Lotte, Binggrae, Haitai, and 3 Others

Suspected of Pre-Agreeing on Discount Rates

Fair Trade Commission to Decide Sanctions Next Month

[Asia Economy Reporter Seungjin Lee] Ice cream companies such as Lotte, Binggrae, and Haitai have come under the Fair Trade Commission's sanctions for suspected price-fixing of ice cream. As the ice cream market has been shrinking for several years, the industry faces a bleak outlook with the possibility of fines.

According to the industry on the 5th, the Fair Trade Commission believes that six ice cream manufacturers?Binggrae, Lotte Confectionery, Lotte Foods, Lotte Holdings, Haitai Ice Cream, and Haitai Confectionery?agreed in advance on discount rates for ice cream products supplied to large marts, corporate supermarkets (SSM), and convenience stores from 2016 to 2019. They aimed to increase operating profit margins by reducing the discount rates for each product.

These companies are also suspected of making agreements not to encroach on each other's clients while maintaining their own sales networks. The Fair Trade Commission plans to hold a plenary session on the 15th of next month to determine the level of sanctions against these companies. In 2007, four companies?Binggrae, Lotte Confectionery, Haitai Confectionery & Foods, and Lotte Samkang?were found guilty of colluding on ice cream prices and were fined approximately 4.6 billion KRW.

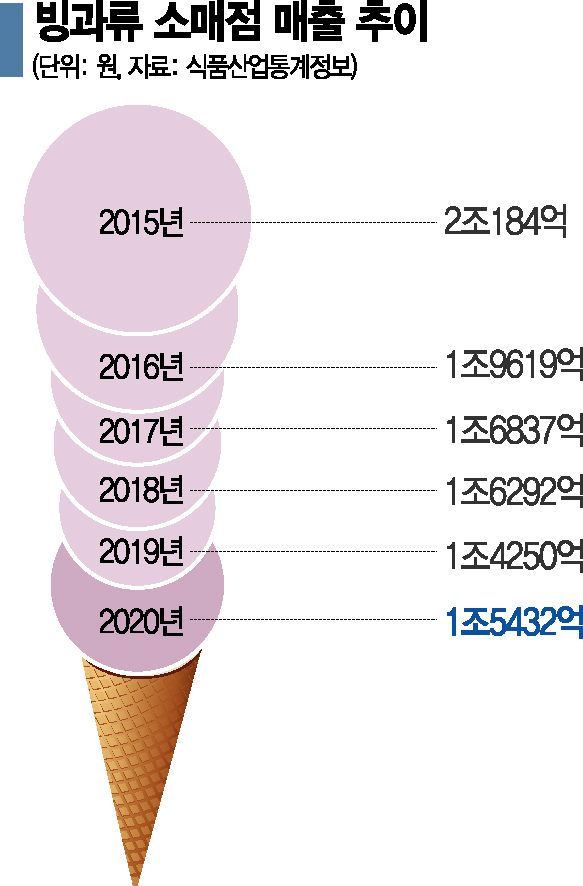

The ice cream industry is struggling to hide its embarrassment as the Fair Trade Commission's sanctions come amid a prolonged market downturn. The ice cream market has significantly shrunk every year due to a decrease in the child population and the emergence of ice cream substitutes. According to Food Industry Statistical Information, the ice cream market size dropped from 2.0184 trillion KRW in 2015 to 1.9619 trillion KRW in 2016, falling into the 1 trillion KRW range. It then sharply declined to 1.425 trillion KRW in 2019. Although it temporarily grew to 1.5432 trillion KRW last year due to the impact of COVID-19, it still remains at about 70% of the 2015 level.

As the ice cream market shrinks, cutthroat competition among companies intensifies. Since the introduction of the open price system in 2010, which allowed the final seller to set ice cream prices, discounts on ice cream became commonplace. Even after the open price system was abolished, distributors continued discounting ice cream products, pressuring manufacturers to lower supply prices, which sharply reduced profitability. While the operating profit margin for general food items is around 5%, ice cream products are known to have a lower margin of 1-3%. Additionally, competition has become fiercer as fast-food outlets have started selling ice cream.

Ice cream companies have attempted to introduce a "price monitoring system" to standardize ice cream prices since 2018, but it has not been established for several years. This is because the system effectively raises prices, which could provoke consumer backlash, making distributors reluctant to adopt it. As a result, ice cream prices still fluctuate by company, prolonging the cutthroat competition among ice cream manufacturers.

An industry insider explained, "The ice cream market faces difficulty in growth due to the declining child population, the main consumer base, and the prolonged discount sales make it hard to establish a price monitoring system. The cutthroat competition among companies is inevitable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)