Will You Ride the Wave of Rivian's IPO or Get Off Midway?

With the news that the U.S. electric vehicle company Rivian is going public through an IPO, domestic Rivian partners and electric vehicle-related companies are also attracting investors' attention. Rivian is an electric vehicle company that has received investments from global companies including Amazon and Ford. Just one week after starting pre-orders for its vehicles at the end of last year, the initial stock was sold out. The market response has been hot, including a contract to supply 100,000 electric vehicles to Amazon by 2030. Expectations are rising that domestic companies related to Rivian will benefit as Rivian grows through its listing and begins full-scale business expansion. However, as seen with Nikola, a U.S. hydrogen truck company that went public earlier, if tangible results fail to meet market expectations after listing, it could negatively impact related stocks. Therefore, analytical investment that carefully examines the competitiveness, financial soundness, and growth potential of beneficiary companies is necessary in preparation.

[Asia Economy Reporter Park Soyeon] Wooshin System is building battery automation facilities for emerging electric vehicle companies such as Rivian. Established in 1984, the company has accumulated over 30 years of expertise in the automotive body equipment field. It assembles hundreds of large and small panels that go into the vehicle body, which can be easily imagined as an automated facility where robots weld while moving along the line. The company handles everything from manufacturing to installation and after-sales management of this equipment. It is a first-tier partner to over 40 major domestic and international automakers and was listed on the Korea Exchange in 2002. Specializing in automated welding line equipment for vehicle bodies, it also operates in automotive plastic interiors and safety belt parts businesses. The automotive safety belts are mainly supplied to General Motors and Hyundai-Kia, and recently have been included in Hyundai's new model Casper. As demand for electric vehicle battery modularization and packaging has exploded, the company is expanding its business area by extending its body assembly know-how to battery automation equipment.

The main customers of the body equipment division, which handles manufacturing of automated welding lines for vehicle bodies and electric vehicle battery equipment, include more than 40 companies such as General Motors, Ford, Volvo, Daimler, Volkswagen, Chrysler, Hyundai, and Kia. Major customers for electric vehicle battery equipment manufacturing include Hyundai Mobis, SK Innovation, HL Green Power, and Rivian. As of June 30, 2021, the sales ratio was 43.7% for the body equipment division and 54.2% for the automotive parts division.

Although the sales ratio of the body equipment division is lower, its growth rate is steep. The annual production performance of the automated welding line in the body equipment division recorded 76.1 billion KRW in 2019, 77.0 billion KRW in 2020, and surged to 62.2 billion KRW in just the first half of this year. The annual operating rate also increased from 62.74% in 2019 and 65.10% in 2020 to 91.56% in the first half of this year.

On the other hand, the operating rate of the automotive parts division, which produces automotive doors, safety belts, and interior parts, showed a declining trend: 73.44% in 2019, 69.87% in 2020, and 66.6% in the first half of 2021. This was due to the impact of COVID-19 and production disruptions caused by semiconductor shortages for vehicles among major customers such as GM and Hyundai. The total order backlog stands at 136.6 billion KRW.

Wooshin System, with its solid existing customer network, is in a favorable position to expand its battery equipment manufacturing business. As global environmental regulations tighten and demand for future vehicles increases, global electric vehicle sales are surging, making electric vehicle battery-related equipment and parts a new business area of focus. Although the share of this segment in total sales is still minimal, electric vehicle battery automation equipment is becoming essential as electric vehicle demand rapidly increases in line with each country's eco-friendly vehicle policies.

However, since these are project-based custom orders, and the scale and price can vary depending on the requirements of battery manufacturers or automakers, the variability in performance impact is significant. A Wooshin System official said, "With domestic battery manufacturers securing global competitiveness, planning and designing the most stable and efficient battery packaging equipment is important," adding, "Based on our know-how in body automation equipment, we are building trust in our equipment not only with battery manufacturers but also with electric vehicle makers."

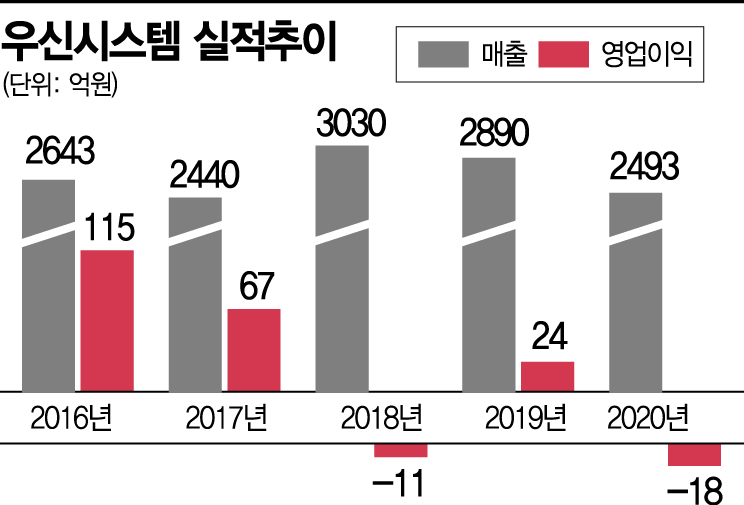

Although order expansion is expected alongside the growth of the electric vehicle market, Wooshin System's financial structure has deteriorated recently due to the impact of COVID-19 and semiconductor shortages for vehicles. Sales over the past five years have ranged between 240 billion and 300 billion KRW. Operating profit sharply declined from about 11.5 billion KRW in 2016 and turned into a loss in 2020. Total liabilities increased from 130.8 billion KRW in 2016 to 223.0 billion KRW in 2020. In particular, interest-bearing debt tripled from 54.1 billion KRW in 2016 to 143.2 billion KRW in 2020. However, CAPEX investment, which is expenditure for generating future profits, has been steady, recorded at 10.8 billion KRW in 2016, 41.7 billion KRW in 2017, 6.1 billion KRW in 2018, 10.3 billion KRW in 2019, and 11.8 billion KRW in 2020.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)