KOSPI Listing in 3 Days... IPO Price 90,000 Won

"Must Overcome Investor Sentiment Weakness and Regulations"

[Asia Economy Reporter Kiho Sung] Kakao Pay, a major "Initial Public Offering (IPO)" that succeeded in attracting general public subscription, will enter the KOSPI market on the 3rd. Investors are keenly watching whether Kakao Pay can achieve a "ttasang" (when the opening price is formed at twice the offering price and then rises to the upper price limit) on its first day of listing. Considering the recent challenging fintech environment, the market evaluates that the key will be how much Kakao Pay can prove its growth potential going forward.

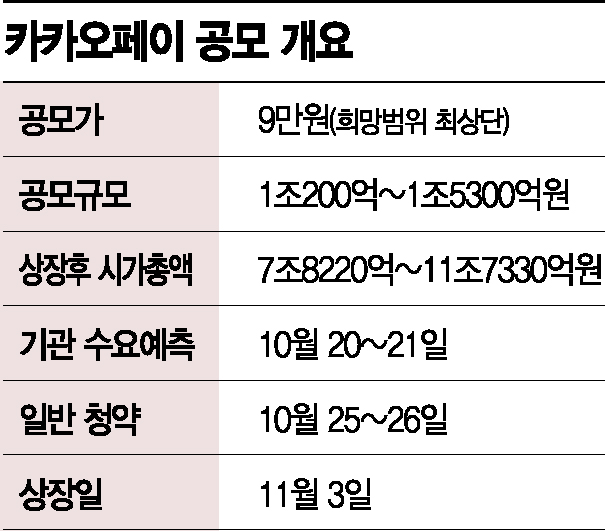

According to the financial sector on the 1st, Kakao Pay, which will be listed on the 3rd, set its offering price at 90,000 KRW (face value 500 KRW), the top end of the desired range in institutional demand forecasting. In the general subscription using the newly attempted "100% equal allocation" method, 1.82 million applications were received, recording a high competition rate of 29.5 to 1.

Although Kakao Pay was expected as a major player in the market, its path to listing was not smooth. Initially scheduled for listing in August, it postponed the listing twice due to controversies over overvaluation of the offering price and the suspension of sales of some products following the enforcement of the Financial Consumer Protection Act.

Despite good results in institutional demand forecasting and general subscription, securities firms have mixed outlooks. Kakao Pay’s market capitalization based on the offering price is 11.733 trillion KRW, which would rise to 30.506 trillion KRW if it achieves ttasang. If successful, it would surpass its sibling company Kakao Bank’s market cap of 29.978 trillion KRW (as of closing price on October 29). It would rank 10th in KOSPI market capitalization, following Kia (34.496 trillion KRW).

The market consensus is that achieving ttasang on the listing day is unlikely, but the stock price trend is expected to be decent at least until December when index inclusion occurs. Meritz Securities set a target price for Kakao Pay at 110,000 KRW, 22% higher than the offering price.

On the other hand, some view the twice-delayed listing, weakened investor sentiment, and concerns over additional regulations as negative factors. KTB Investment & Securities pointed out the possibility of regulatory expansion and considered 57,000 KRW, 37% below the offering price, as the appropriate stock price.

The key issue is how much Kakao Pay can demonstrate its growth potential. Kakao Pay plans to launch Kakao Pay Securities’ mobile trading system (MTS) for stocks as early as this year. Early next year, it is also preparing to launch a digital non-life insurance company. In the loan brokerage sector, it plans to sequentially introduce rental deposit loans, mortgage loans, and card loans following credit loan products.

In line with the full-scale implementation of MyData, asset management services will also be enhanced. By providing users with personalized analysis services and customized options, Kakao Pay aims to serve as a "mobile asset management advisor" through asset status inquiries and in-depth analysis of income and expenditure.

However, financial regulators’ regulations remain a significant concern. The upcoming card fee reform scheduled for this month could bring mixed outcomes. The card industry strongly demands improvements, arguing that merchant fees for Kakao Pay and Naver Pay are up to three times higher than those of the card industry.

Choi Gwansoon, a researcher at SK Securities, said, "Although online-linked investment product services have been suspended, their sales proportion is only 1.2%, so attention should be paid to growth potential rather than traditional valuation indicators in the future," adding, "Through synergy effects with Kakao, it can initially differentiate itself from other operators."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)