[Asia Economy Reporter Ji Yeon-jin] A series of bills aimed at promoting the virtual currency industry, establishing order in virtual currency transactions, and protecting investors are pouring in. With the presidential election next year, both ruling and opposition parties are targeting the younger generation's votes, drawing attention to whether these bills will pass the regular National Assembly session this year. If these bills clear the hurdle of this year's regular session, it will mark the world's first enactment of an industry law encompassing the entire virtual currency market.

According to the National Assembly's legislative information system on the 31st, Representative Yoon Chang-hyun, who serves as the chairman of the People Power Party's Special Committee on Virtual Assets, proposed the "Basic Act on the Virtual Asset Industry" on the 28th.

The bill includes provisions on licensing virtual asset operators, prohibiting unfair practices, methods and procedures for user protection and supervision, as well as the government establishing a basic plan for the development of the virtual asset industry to enhance the soundness and competitiveness of the industry. It also mandates the operation of a Virtual Asset Policy Coordination Committee involving public-private and industry-academia-research participation, and the establishment of a Virtual Asset Industry Development Fund.

Representative Yoon plans to begin consultations with related ministries such as the Financial Services Commission and the Office for Government Policy Coordination to ensure the bill passes during this regular session. He emphasized, "For effective regulation of virtual assets, classification reflecting characteristics such as securities-type or payment-type is very important," adding, "Since there are limitations to what can be addressed in the basic act, a second legislative effort should follow to revise the entire industrial law so that classified virtual assets can be subject to relevant individual industrial laws by function and industry."

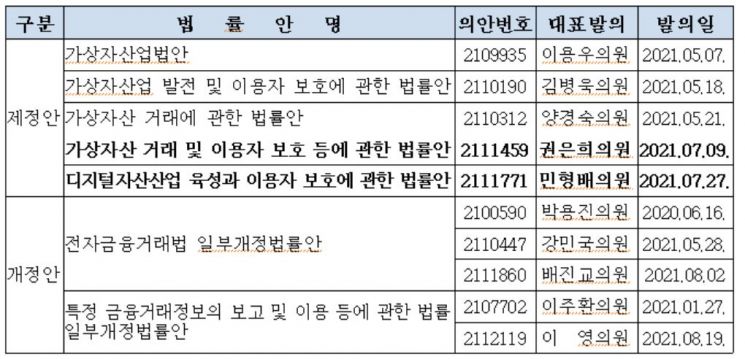

Since the beginning of this year, as price volatility of virtual currencies including Bitcoin has increased, legislation related to virtual assets has been continuously introduced. In particular, bills to establish industry laws that foster the virtual currency market and protect users have already been proposed by the Democratic Party and the People's Party. With Representative Yoon now joining the legislative efforts, both ruling and opposition parties appear to be moving toward enacting virtual currency industry laws.

For this reason, the possibility of the virtual currency industry law passing the regular National Assembly session this year is being anticipated. Given the upcoming presidential election next year, the fact that the 'MZ generation' (referring to those born between 1980 and 2000), who are active investors in virtual currencies, can be targeted increases the likelihood. In fact, although the government has clarified its taxation policy on virtual currencies starting January next year, bills postponing the taxation timing have been continuously proposed across party lines in the National Assembly.

However, the fact that this is the world's first industry law covering the entire virtual currency market could be a burden.

In the United States, there is no separate federal law on virtual assets. Instead, virtual currencies are regarded as financial investment products and regulated by the Securities and Exchange Commission (SEC) according to guidelines. The EU also regulates virtual assets as financial investment products under the Markets in Financial Instruments Directive II (MiFID II), and the Market Abuse Regulation (MAR) applies to unfair trading.

Japan amended its existing "Payment Services Act" in 2016 to legally recognize the property value of virtual currencies but only includes regulations focused on investor protection.

Therefore, the Financial Services Commission holds the position that during institutionalization discussions, international trends should be thoroughly reviewed to prevent speculative demand or market instability caused by excessive expectations. Additionally, since basic institutionalization such as entry regulations for virtual currency operators and user asset protection has been implemented through the Act on Reporting and Use of Certain Financial Transaction Information (Special Financial Information Act) since last month, they plan to first induce a smooth transition through this special act.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)