Overall Housing Prices Still Rising

Too Early to Judge a General Downturn

[Asia Economy Reporters Kim Hyemin, Kim Minyoung] ‘The Power of Loan Regulations?’

Experts attribute the reversal in the sales prices of small apartments, mainly in the southwestern area of Seoul, to the shrinking speculative demand caused by the government's successive high-intensity loan regulations. Since small apartments, primarily for 1-2 person households, have relatively low purchase price burdens, the market had attracted a large number of both actual demand and investment demand. Yeokyeonghee, Senior Researcher at Real Estate R114, said, "Whether it is loans or taxes, overall apartment regulations have clearly slowed the price increase," adding, "As buying demand shrinks, it can also be interpreted that investment demand exited first."

In particular, the notable decline in transactions of ultra-small apartments under 40㎡ (about 10 pyeong in sale area) shows that less-preferred housing types are more vulnerable to a weak market when buying demand weakens. The more the upward trend stalls, the more buying demand inevitably declines. Senior Researcher Ye predicted, "The polarization of house prices between desirable homes like ‘smart one-house’ and less-preferred homes will deepen further."

The buying demand contraction following the additional loan measures announced on the 26th is expected to further accelerate this trend. Although demand to purchase even small apartments has increased recently due to concerns over the rapid rise in Seoul apartment prices, stricter loan regulations make it difficult even for actual buyers to access the market. Ham Youngjin, Head of Zigbang Big Data Lab, said, "It is difficult to discuss the decline in small apartment demand based on just one month’s trend," but added, "From the perspective of potential buyers, considering the interest burden from a possible rate hike in November and vacancy risks due to transaction contraction, the incentive to invest in small apartments may decrease."

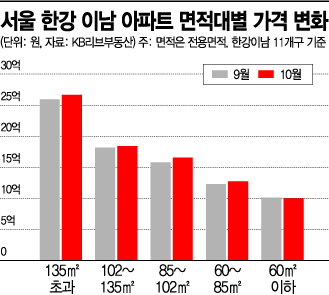

However, the prevailing view is that such cases are not numerous enough to turn the overall market trend into a downward one. It is considered premature to see these as early signs of a price drop. In fact, looking at apartment prices in Seoul this month, the overall trend still maintains an upward curve. Among the 11 districts south of the Han River, only the average price for 60㎡ units fell by 10.73 million KRW, while prices for other size categories showed slight increases.

The presidential election is also a variable. Amid mixed trends, if promises to ease regulations considering voter sentiment pour out, expectations for rising house prices are bound to increase again.

There is also a perspective that loan regulations may actually increase the preference for small apartments, which could lead to buying demand and maintain current prices. Yoon Jihae, Senior Researcher at Real Estate R114, predicted, "If loan regulations are strengthened, preference for small apartments with less financial burden will inevitably increase," and "Prices of small apartments are expected to maintain a firm to slightly firm level going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.