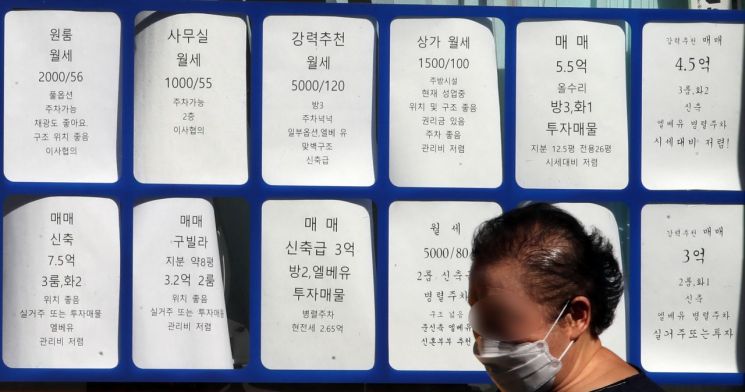

[Asia Economy Reporter Ryu Tae-min] Among all lease transactions in the Seoul area, the proportion of monthly rent (including monthly rent with deposit) accounts for 4 out of 10 cases. Due to the government's successive tightening of household loan regulations in the financial sector, tenants who cannot afford the soaring jeonse prices are being pushed towards monthly rent.

According to the Seoul Real Estate Information Plaza on the 27th, out of 33,435 apartment lease contracts concluded in Seoul from August to the 26th of this month (based on contract date), 13,099 contracts (39.2%) included monthly rent. This proportion is the highest level recorded for the same period since the Moon Jae-in administration took office in 2017.

The proportion of contracts including monthly rent among lease transactions from August to October was 30.4% in 2017, slightly decreased to 26.8% in 2018, then increased to 27.1% in 2019, 32.9% last year, and approached 40% this year.

The increase in the proportion of leases including monthly rent was decisively triggered by the government's introduction of the contract renewal request system and the jeonse/monthly rent cap system in July last year. As jeonse supply became scarce and prices soared, tenants who could not prepare the increased jeonse deposit increasingly entered into contracts involving monthly rent.

With the government's successive announcements of high-intensity loan regulations making sales and jeonse transactions more difficult, the proportion of contracts including monthly rent is expected to increase further. As household debt continues to rise, the government demanded strong total loan volume management from banks, and from August this year until recently, comprehensive loan regulation in the financial sector has been realized. Additionally, the financial authorities announced a plan to strengthen household debt management by advancing the implementation date of the Debt Service Ratio (DSR, the ratio of principal and interest repayment to income) 40% application and expanding it to the secondary financial sector.

Ham Young-jin, head of the Zigbang Big Data Lab, said, “If demand for sales decreases, some demand shifts to leases, which can burden the jeonse market, and this is accompanied by restrictions on jeonse loans. Real demanders who find it difficult to accept restrictions on jeonse loans or landlords' demands for increased jeonse deposits may accelerate the trend of choosing monthly rent with deposit, leading to a monthly rentification phenomenon.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.