Only 3 out of 10 Wage Earners Enrolled

Enrollment Rate Down 1.4%p from 5 Years Ago

Contributions Decrease 12.2% in 6 Years

[Asia Economy Reporter Oh Hyung-gil] It has been revealed that only 3 out of 10 wage earners in South Korea are subscribed to pension savings. By 2025, one in five citizens will be aged 65 or older, entering a 'super-aged society,' but the retirement income security system is heavily reliant on the National Pension. Private retirement security means, such as pension savings, are being neglected by consumers.

According to the insurance industry on the 27th, as of last year, there were 5.9 million pension savings subscribers, accounting for only 30.7% of the total 19.16 million wage earners. The pension savings subscription rate has declined by 1.4 percentage points compared to 32.1% five years ago in 2016.

Even among those who have subscribed to pension savings products, the amount of money accumulated in accounts is also decreasing. The annual contribution to pension savings dropped by 12.2% over six years, from 11.057 trillion won in 2015 to 9.703 trillion won last year.

Due to the low contribution amounts, pension savings are not effectively fulfilling their role for retirement. The average amount received per pension savings contract is 2.93 million won annually, about 240,000 won per month, which is only 20% of the minimum monthly living cost of 1.17 million won for a single-person household.

Pension savings are representative retirement preparation products that individuals can subscribe to on their own, including insurance, funds, and trusts (new sales of which have been discontinued since 2018). The government provides tax deduction benefits during year-end tax settlements to encourage subscription to pension savings, but there are limitations in raising the subscription rate.

Public pensions like the National Pension alone have limitations in preparing for retirement. The income replacement rate, which is the ratio of National Pension payments to average lifetime income, remains at about 40%. The Moon Jae-in administration pledged to raise the income replacement rate to 50%, but an increase in insurance premiums is inevitable.

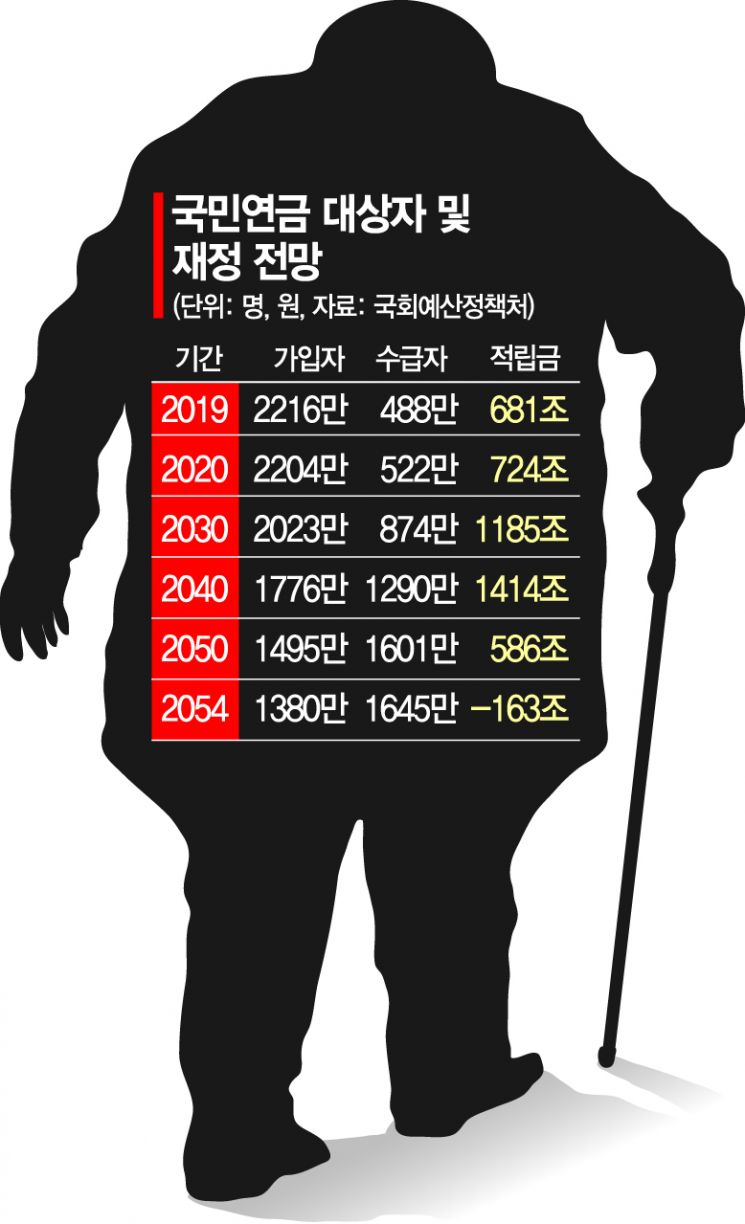

Moreover, the National Pension is expected to run a deficit starting in 2042. Government spending to secure retirement income is also increasing significantly, adding to the fiscal burden. As of last year's settlement, the total expenditure on major retirement income security projects such as the National Pension, retirement pensions, and basic pensions was about 70 trillion won, with an average annual expenditure growth rate of 10% over the past five years, exceeding the overall total expenditure growth rate of 9.3%.

There are calls for tax reform to revitalize private pensions. Lee Tae-seok, a research fellow at the Korea Development Institute (KDI), said, "Various fiscal and tax support measures should be considered to activate private pensions so that they can fulfill their function of securing retirement income."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.