Mirae Asset Life Insurance announced on the 25th that the Variable Insurance Global MVP Fund series has surpassed 4 trillion won in net assets.

Mirae Asset Life Insurance announced on the 25th that the Variable Insurance Global MVP Fund series has surpassed 4 trillion won in net assets.

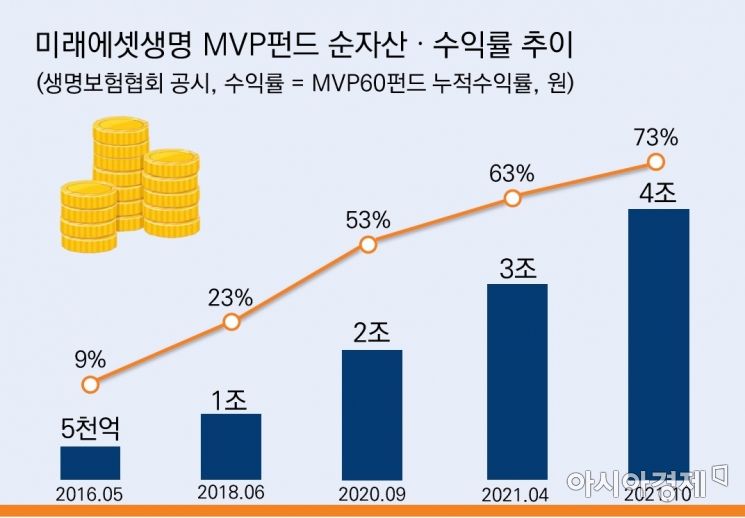

[Asia Economy Reporter Oh Hyung-gil] Mirae Asset Life Insurance announced on the 25th that its variable insurance 'Global MVP Fund Series' has surpassed 4 trillion won in net assets.

Launched in 2014, the Global MVP Fund is the first fund in the insurance industry where asset management experts directly manage the assets of variable insurance subscribers.

Amid the recent overseas investment boom, easy global asset allocation and excellent returns have been proven, achieving 2 trillion won in fund assets last September, and doubling in size within a year.

The MVP Fund Series is divided into eight types according to the ratio and target of investment assets, such as MVP Stock, MVP60, and MVP30. The MVP60 Fund, which invests more than 60% in stocks of world-class companies, led the growth of the MVP Fund Series by increasing assets by more than 1 trillion won in the past year. The cumulative return of the MVP60 Fund reaches 73.3%, boasting a stable annual average return close to 10%.

Mirae Asset Life Insurance plans to integrate the MVP Fund Series into various products to provide more customers with the experience of global asset allocation. Recently, the lineup has been expanded so that online variable savings insurance starting from 10,000 won and retirement pension subscribers can also choose the MVP Fund.

Byun Jae-sang, CEO of Mirae Asset Life Insurance, stated, "Diversified investment is most important to secure steady returns," and added, "We hope that more customers will invest reasonably in global quality assets through the MVP Fund and achieve stable results from a long-term perspective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.