Korea Insurance Research Institute, Report on 'Metaverse and the Insurance Industry'

[Asia Economy Reporter Ki Ha-young] As the metaverse industry rapidly rises, advice has emerged that the domestic insurance industry should also explore various ways to provide new healthcare services utilizing metaverse technology.

According to the recent report "Metaverse and the Insurance Industry" released by the Korea Insurance Research Institute on the 24th, insurance companies are expected to either cover risks arising from the metaverse or enhance efficiency across various sectors by leveraging metaverse technology.

Generally, the metaverse refers to a "virtual world realized through digital technology and connected via the internet, enabling interaction among users." In particular, the metaverse is anticipated to significantly transform sales, marketing, collaborative communication, and training by helping remove physical and geographical barriers.

Currently, domestic insurance companies are using the metaverse to expand customer touchpoints and promote customers' health management. Some companies provide consultation services on metaverse platforms to broaden customer engagement, while others collaborate with startups or independently develop mobile applications (apps) or platforms to incentivize customers' health management and offer insurance premium discounts.

Overseas, the metaverse is utilized in more diverse forms than domestically. In the United States, a nonprofit health insurance company covers remote medical services provided by the healthcare startup XR Health. XR Health, a U.S. startup specializing in remote healthcare, offers various virtual reality remote treatment services such as physical therapy using games within virtual reality, stress and pain management, ADHD, and COVID-19 rehabilitation therapy.

Additionally, the U.S. insurtech company Wingsure is developing a mobile platform that provides customized insurance to small-scale farmers located in regions where accessing insurance services is difficult, using various technologies such as artificial intelligence (AI), machine learning, and augmented reality.

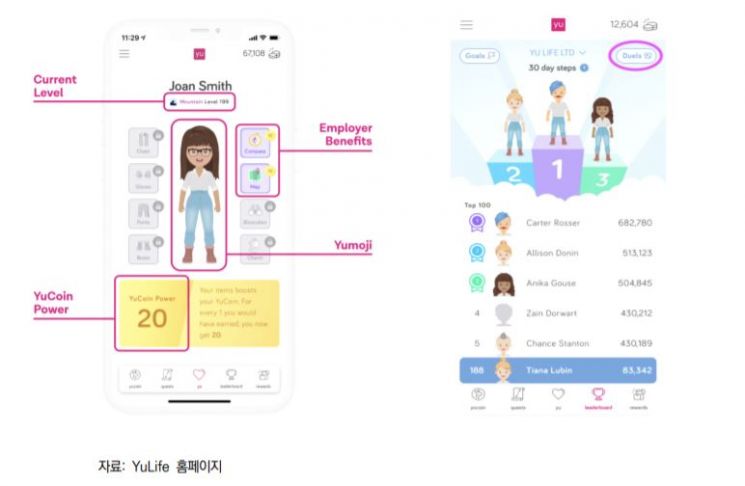

The UK startup YouLife is applying the metaverse to group insurance. They include a gamified app in group insurance that helps users achieve health management goals presented by the app. For example, users create their avatar "Yumoji" in the app's internal world called "Yuniverse," and by completing missions (Quests) such as running or meditation suggested by the app, they receive "YuCoins," which can be exchanged for vouchers at specific brands. In fact, 60% of employees enrolled in group insurance participate in health management through the YouLife app, with 46% of them using the app monthly, showing a high participation rate.

The Korea Insurance Research Institute expects domestic insurance companies to prioritize guaranteeing new healthcare services utilizing startups' metaverse technology, upgrading healthcare apps they provide, and strengthening linkage with insurance products. If possible, it is also suggested to attempt providing games that promote health management within the metaverse platform through collaboration with the platform.

As the utilization and importance of the metaverse are expected to grow further in the future, advice has been given to pursue ways to use the metaverse in developing new products and business models. The Korea Insurance Research Institute stated, "Insurance companies need to study ways to cover new risks arising from the metaverse, such as cybersecurity, identity forgery through avatars, and intellectual property issues," and added, "They should also focus on the expansion and development of the virtual economy and explore service opportunities that insurance companies can offer within the virtual economy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.