Fines Totaling 185.5 Billion KRW Imposed on 493 Individuals

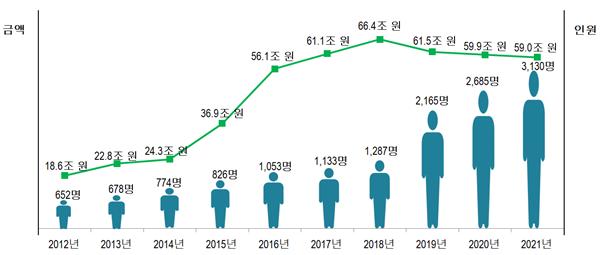

[Sejong=Asia Economy Reporter Kim Hyunjung] The results of overseas financial account reporting showed that 3,130 people reported a total of 59 trillion KRW. The number of people increased by 16.6% compared to last year, while the amount decreased by 1.5%.

On the 24th, the National Tax Service announced that this was confirmed based on the overseas financial account reporting results as of June this year. The overseas financial account reporting system requires domestic residents or domestic corporations to report to the competent tax office by June of the following year if the total balance of overseas financial accounts they hold exceeds 500 million KRW on any day at the end of each month. This system has been in effect since 2011. If the reporting obligation is violated, a fine of up to 20% of the unreported amount must be paid, and if the unreported amount exceeds 5 billion KRW, criminal prosecution may occur along with public disclosure of the list.

As of June, 2,385 individual reporters reported 9.4 trillion KRW, showing an increase of 26.3% in the number of people and 17.5% in the amount compared to the previous year. Corporate reporters numbered 745 corporations reporting 49.6 trillion KRW, with the number of corporations decreasing by 6.4% and the amount by 4.4%. The National Tax Service explained that the number of reporters increased compared to last year due to the expansion of the reporting obligation scope, following the reduction of the reporting threshold from 1 billion KRW to 500 million KRW in 2019 and the requirement from 2020 for individual shareholders to report accounts of foreign corporations established overseas by individuals.

Additionally, with the recent increase in interest in overseas stocks, the number of individual reporters directly investing in overseas stocks increased, resulting in a 61% increase in stock account reporters compared to the previous year.

On the other hand, the National Tax Service analyzed that the reported amount decreased due to the contraction in the issuance scale of securitized products amid a low interest rate environment. Looking at the reported amounts by range, individuals most frequently reported in the 500 million to 1 billion KRW range (1,018 people), and corporations most frequently in the 1 billion to 3 billion KRW range (233 corporations).

By industry of corporate reporters, manufacturing (306 corporations) accounted for 41%, the highest, followed by service industry, construction, and wholesale & retail trade. The reported amount was highest in the service industry (23.7 trillion KRW, 48%), followed by construction, manufacturing, finance & insurance, and electricity & gas industries.

Examining by type of financial account, among the total reported amount of 59 trillion KRW, stock accounts accounted for the largest portion with 29.6 trillion KRW (50.0%). Next were savings and deposit accounts with 22.6 trillion KRW (38.2%), and other accounts such as derivatives and bonds with 6.9 trillion KRW (11.8%).

The balance of savings and deposit accounts sharply declined (23% decrease compared to the previous year) due to the international low interest rate impact, showing a decreasing trend over the past five years, whereas stock account balances steadily increased (18% increase compared to the previous year). The National Tax Service attributed this to expanded global liquidity and increased risk asset preference driven by expectations of economic recovery, resulting in increased overseas stock investment and stock valuation gains.

A total of 20,077 reported accounts this year were located in 142 countries, slightly down from 144 countries last year. In most countries, the proportion of reported amounts in savings and deposit accounts decreased, while the proportion in stock accounts increased. Particularly, in Japan, stock accounts accounted for most of the reported amount (95.7%) and represented 70% of the total stock account reported amount.

Continuing from last year, the number of reported accounts and reported amounts by individual reporters were highest in the United States (4,413 accounts, 3.9 trillion KRW). The number and amount of reported accounts in Hong Kong and Singapore showed high growth rates again this year, and the National Tax Service analyzed that offshore tax bases have been legitimized due to the recent automatic exchange of financial information, effectively dismantling financial secrecy.

For corporate reporters, the number of reported accounts was highest in China (1,608 accounts), and the reported amount was highest in Japan (20.2 trillion KRW). The reported amounts in the United States and Singapore showed high growth rates (23% and 56% respectively), raising their rankings among all reporting countries. Conversely, although China had the second highest reported amount after Japan last year, this year the reported balance sharply decreased (84% decrease) due to the contraction in securitized product issuance amid low interest rates.

Since the first overseas financial account reporting in 2011, fines related to unreported overseas financial accounts have been imposed on 493 people totaling 185.5 billion KRW as of the end of June this year. If the unreported amount exceeds 5 billion KRW, imprisonment of up to two years or fines of 13-20% (which can be combined) may be imposed, and 68 people have been prosecuted from 2014 to the first half of this year. Since the disclosure system for names of unreported persons exceeding 5 billion KRW was first implemented in 2013, a total of seven names have been publicly disclosed to date.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.