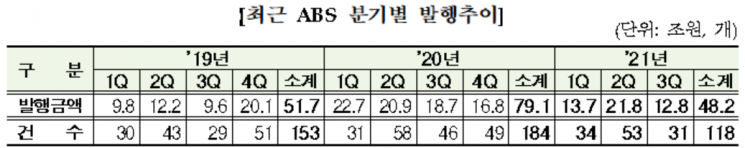

[Asia Economy Reporter Park Jihwan] The total issuance amount of asset-backed securities (ABS) in the third quarter of this year was 12.8 trillion KRW, showing a 31.5% decrease compared to the same period last year. This decline is attributed to the termination of the Saemin-type Anshim Conversion Loan, which led to a reduction in the issuance of mortgage-backed securities (MBS) by the Korea Housing Finance Corporation, and a significant decrease in ABS issuance by companies due to the effects of interest rate hikes.

According to the analysis data on ABS registered issuance performance for the third quarter of 2021 released by the Financial Supervisory Service on the 19th, the issuance by the Korea Housing Finance Corporation, financial companies, and general corporations all decreased compared to the same period last year.

The MBS issued by the Korea Housing Finance Corporation, which are based on mortgage-backed bonds, amounted to 7.4 trillion KRW, down 30.6% from the same period last year. This is interpreted as a result of the termination of the 'Saemin-type Anshim Conversion Loan,' which had a significant impact on the increase in MBS issuance in the previous year.

Financial companies such as banks, specialized credit finance companies, and securities firms issued ABS worth 3.4 trillion KRW based on non-performing loans (NPL), installment finance receivables (card receivables, automobile installment receivables, lease receivables), corporate bonds, etc. This figure represents a 33.3% decrease compared to the same period last year. General corporations issued ABS worth approximately 2 trillion KRW based on terminal installment payment receivables and real estate project financing (PF). This is a 31.7% decrease compared to the same period last year. A Financial Supervisory Service official stated, "In the third quarter of this year, ABS issuance by financial and general corporations decreased compared to the third quarter of last year, when issuance had increased due to reasons such as low interest rates."

Looking at ABS issuance by securitized assets, the issuance amount of loan receivables-based ABS related to MBS and NPL was 8 trillion KRW, a decrease of 3.4 trillion KRW (30.2%) compared to the same period last year. Specifically, this includes 7.4 trillion KRW of MBS by the Korea Housing Finance Corporation, 500 billion KRW of NPL-based ABS, and 100 billion KRW of SOC loan receivables-based ABS.

ABS issuance based on sales receivables such as card receivables and automobile installment receivables recorded 3.5 trillion KRW, down 1.6 trillion KRW (30.8%). This includes 600 billion KRW of card receivables-based ABS, 1 trillion KRW of installment and lease receivables-based ABS, 1.4 trillion KRW of corporate sales receivables-based ABS such as terminal installment payment receivables, and 500 billion KRW of real estate PF-based ABS.

The issuance amount of P-CBOs based on low-credit corporate bonds decreased by 900 billion KRW (40.0%) compared to the same period last year, totaling 1.3 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.