The success of "Squid Game" has increased the value of Korean content production companies. The fact that Korean drama content resonates in the global market was proven through "Squid Game," and it is expected that the scale of investment in domestic content production will also expand. The power of "Hallyu dramas" (Korean dramas), which had been undervalued compared to Western dramas like "Mid" (American dramas) and "Youngde" (British dramas), has been spotlighted through COVID-19 and online video streaming services (OTT platforms). This phenomenon is encouraging as it provides explosive growth opportunities not only to large content producers with content supply channels such as CJ ENM and JTBC affiliates but also to small and medium-sized production companies like NEW, AStory, and Samhwa Networks. However, investors should carefully examine the financial structure, which is weak due to accumulated deficits and debts over several years.

[Asia Economy Reporter Park So-yeon] NEW is a company gaining attention ahead of Disney Plus's launch in Korea. NEW entered the drama production market in 2016 with "Descendants of the Sun." Since then, it has produced an average of 1.6 dramas per year and has recently been increasing the number of productions.

NEW headquarters is engaged in film investment and distribution, and through its subsidiaries operates eight business sectors including drama, music, and visual effects (VFX). Major subsidiaries include drama and film production company "Studio&New," VFX planning company "Engine Visual Wave," content planning and distribution company "Content Panda," music investment and distribution company "Music&New," new media company "New ID," cinema operator "Cine Q," and sports marketing and management business "Bravo&New."

Previously, NEW headquarters' film distribution performance played a central role in consolidated results, but from this year, its subsidiary Studio&New is expected to lead a turnaround in performance.

◆ Disney Plus Domestic Launch: Spotlight on 'Moving' Supply= NEW is set to soon release a drama called "Moving" through its content production subsidiary Studio&New. Based on a webtoon by Kang Full and directed by Park In-je, famous for "Kingdom Season 2," the drama stars Jo In-sung, Han Hyo-joo, and Ryu Seung-ryong. "Moving" will be presented as an original drama on the new OTT platform Disney Plus, which is entering the Korean market next month. The financial investment industry expects NEW to earn over 10 billion KRW in profits from "Moving" alone.

Studio&New signed an exclusive supply contract with Disney Plus to provide at least one drama per year for five years. Disney Plus, preparing to enter Korea, announced plans to supply about 50 original contents worldwide every year until 2024, in addition to its own content. It chose to partner first with production company NEW to secure Hallyu content.

Considering the long-term contract with Disney Plus, it is expected that the risk of NEW's performance decline will be low. There is also anticipation that the drama division's strong performance will continue for the time being. Lee Min-hee, a researcher at IBK Investment & Securities, said, "Including drama production in the first half, sales of 60 billion KRW are expected this year," adding, "Profitability is also expected to be favorable."

The forecast that the number of content orders will surge due to competition among OTT companies is also positive news for NEW. In the long term, many OTTs such as Apple TV Plus and HBO Max are expected to enter the market and compete to secure Korean content. This expectation has grown even more after the success of "Squid Game." In fact, Netflix's investment in Korean content this year reached about 550 billion KRW, a 65% increase from last year.

If OTT companies accelerate their entry into the domestic market, it is expected that small and medium-sized production companies similar in scale to NEW will grow faster. This is because they can negotiate more flexibly as they have not signed long-term partnership contracts with existing operators.

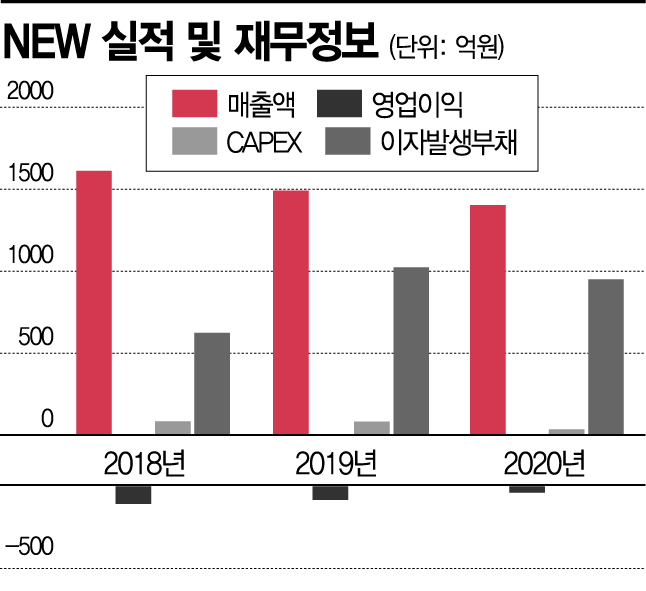

◆ Film Production Hit Hard by COVID-19 Remains a Challenge= NEW has not yet recovered from the impact of COVID-19 in its core business of film production and distribution. In the second quarter of this year, due to the absence of film releases caused by COVID-19, NEW's sales plummeted about 87% compared to the previous quarter, and operating losses widened. Sales, which had increased to about 160 billion KRW in 2018, dropped to about 140 billion KRW in 2019 and 2020.

From 2017 to the recent four years, it recorded continuous operating losses ranging from 3.8 billion KRW to 10.6 billion KRW. Capital expenditures (CAPEX), costs spent to generate future profits, decreased from about 22.2 billion KRW in 2016 and 12.3 billion KRW in 2017 to about 1 billion KRW in 2020.

On the other hand, interest-bearing debt increased sharply from about 23.5 billion KRW in 2016 to 102.3 billion KRW in 2019 and 95 billion KRW in 2020.

The securities firms' consensus is not bad. They expect a turnaround starting this year, with operating profits of 22.8 billion KRW in 2022 and 28.7 billion KRW in 2023. Especially, the growth potential of subsidiaries is highly evaluated.

Lee Nam-soo, a researcher at Kiwoom Securities, said, "We should pay attention to the growth of Studio&New, which was valued at about 200 billion KRW and raised 24 billion KRW in new funds, and the VFX subsidiary Engine Visual Wave, which successfully raised 12 billion KRW."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)