[Asia Economy Reporter Lee Seon-ae] "From archrival to savior."

This year, a change has been detected in the movement of pension funds, which had been the archrival of the rising market due to mechanical selling. Recently, they have stepped up as saviors of the unstable domestic stock market, helping to defend against the downturn. Now, the market's attention is focused on whether they will stop "mechanical selling" and switch to "buying for a rising market."

According to the Korea Exchange on the 15th, pension funds have net sold a total of 22.7694 trillion KRW in the KOSPI market from the beginning of this year until the 12th. This was because the National Pension Service (NPS) took a mechanical selling position as its target stock ratio exceeded 20%. The assets under management of the four major pension funds?NPS, Government Employees Pension Service, Private School Teachers’ Pension, and Military Mutual Aid Association?amount to 944 trillion KRW, with the NPS accounting for 96% (908 trillion KRW) of that.

However, they recently turned to net buying amid the sharp market decline. On the 12th, when concerns over rising oil prices and interest rates led to concentrated foreign selling and the domestic stock market fell more than 1%, pension funds net bought about 42.1 billion KRW in the KOSPI market. On the 13th, they continued net buying with 79.5 billion KRW in the KOSPI market, and on the 14th, although somewhat reduced, they net bought about 3.4 billion KRW. The relatively weak net buying on the 14th is interpreted as reflecting the strong rebound of the index on that day.

Looking at their recent moves, it appears to be a signal that pension funds can step in as saviors when the stock market undergoes strong corrections. Experts first note that mechanical selling has stopped. At the end of July, the NPS’s domestic stock ratio was 19.5%, entering the target range for the first time since the end of November last year (19.6%). Considering that the NPS has been selling stocks additionally for about two months since August and that stock prices have fallen, the current domestic stock ratio is likely lower than at the end of July. KB Securities researcher Ha In-hwan emphasized, "It is clear that pension funds are no longer in a situation where they must mechanically sell to adjust their domestic stock ratio."

Pension funds are nicknamed the "pension army" because they focus on net buying when the market undergoes strong corrections, helping to prevent further declines and the collapse of investor sentiment. Although this year they earned the nickname "archrival" due to mechanical selling, experts believe that if the KOSPI falls below the 2800 level, pension funds will again engage in strong net buying, as they did during the 2008 global financial crisis. Researcher Ha said, "In the past, whenever the KOSPI fell about 10% or more from its previous high, pension funds switched to net buying."

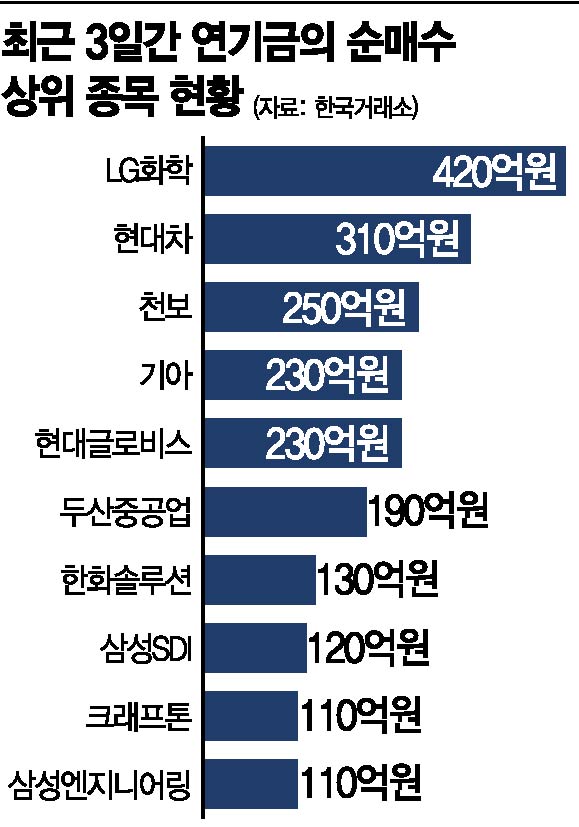

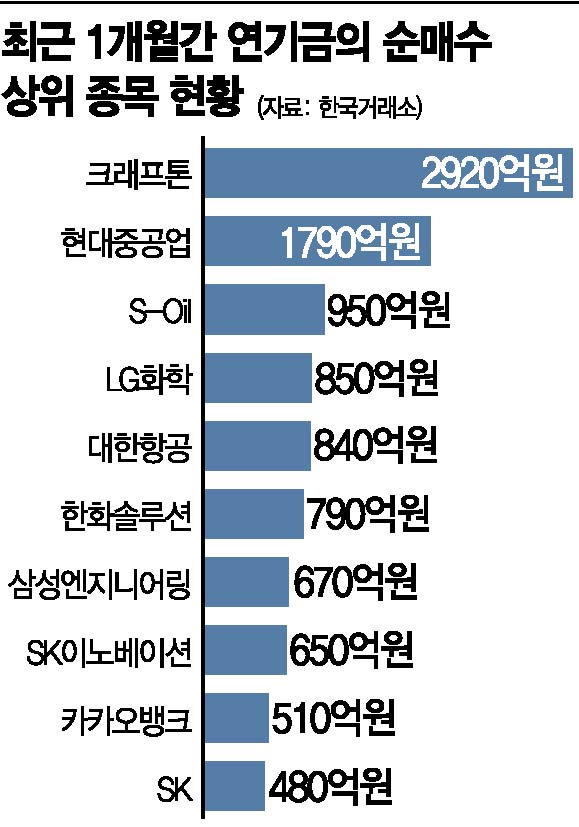

Accordingly, attention is focused on the stocks pension funds have been net buying. From the 12th to the 14th, the top net bought stocks by pension funds were LG Chem (42 billion KRW), Hyundai Motor (31 billion KRW), Cheonbo (25 billion KRW), Kia (23 billion KRW), Hyundai Glovis (23 billion KRW), Doosan Heavy Industries & Construction (19 billion KRW), Hanwha Solutions (13 billion KRW), Samsung SDI (12 billion KRW), Krafton (11 billion KRW), Samsung Engineering (11 billion KRW), Korea Zinc (11 billion KRW), SK IE Technology (10 billion KRW), Iljin Materials (9 billion KRW), and S-Oil (9 billion KRW). Looking at the past month, the order is Krafton (292 billion KRW), Hyundai Heavy Industries (179 billion KRW), S-Oil (95 billion KRW), LG Chem (85 billion KRW), Korean Air (84 billion KRW), Hanwha Solutions (79 billion KRW), Samsung Engineering (67 billion KRW), SK Innovation (65 billion KRW), KakaoBank (51 billion KRW), and SK (48 billion KRW).

However, there is also a cautious view that continuous inflow of pension fund money within the year will be difficult. Pension fund assets tend to move long-term, reducing their weight when valuations are high and re-entering at favorable price levels. DB Financial Investment researcher Kang Hyun-ki said, "Although the KOSPI has fallen significantly recently, the 12-month forward price-to-earnings ratio (PER) is about 11 times, higher than the long-term average of 10 times, so it is likely that the strategy will continue to be selling rather than buying," adding, "Pension funds are expected to move only when prices become attractive, so inflows within the year are unlikely."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.