The success of ‘Squid Game’ has increased the value of Korean content production companies. The fact that Korean drama content resonates in the global market was proven through ‘Squid Game,’ and it is expected that the scale of investment in domestic content production will also expand. The power of ‘K-dramas,’ which had been undervalued compared to Western dramas like ‘Mid’ and ‘Yongde,’ has been spotlighted through the COVID-19 pandemic and online video streaming services (OTT) platforms. This phenomenon is encouraging as it provides explosive growth opportunities not only to large content producers with content supply channels such as CJ ENM and JTBC affiliates but also to small and medium-sized production companies like NEW, AStory, and Samhwa Networks. However, investors should carefully examine the financial structure, which is weak due to accumulated deficits and debts over several years.

[Asia Economy Reporter Jang Hyowon] As the online video streaming service (OTT) market rapidly grows, drama production company AStory is gaining attention. AStory is the first domestic production company to supply the original drama series ‘Kingdom’ to the global OTT platform Netflix. AStory is producing tentpole projects based on strong creators (PDs and writers).

Performance Boosted by ‘Jirisan’ Production

AStory is a company engaged in drama content production business, producing dramas and supplying them to broadcasters and overseas markets, as well as conducting ancillary businesses such as intellectual property (IP) sales, OSTs, and games. Major works include Korea’s first Netflix original drama ‘Kingdom Season 1 and 2,’ ‘Signal,’ and ‘100 Days My Prince.’ Writers Kim Eun-hee, Park Jae-beom, and the duo Jang Young-chul & Jung Kyung-soon belong to AStory.

Revenue types are broadly divided into two categories: drama works and copyrights. Drama works revenue comes from drama production income, including production fees received from broadcasters and OTT platforms, product placements (PPL), and sponsorship support. Copyright revenue is income from selling overseas rights, cable and VOD broadcasting rights, and OTT transmission rights.

As of the end of the first half of this year, drama works accounted for 46.55% of revenue, and copyrights accounted for 53.45%. In 2018, drama works revenue accounted for over 91%, but as IP accumulated, copyright-related revenue increased. Copyright revenue in the first half of this year alone reached about ten times the total copyright revenue of 2018.

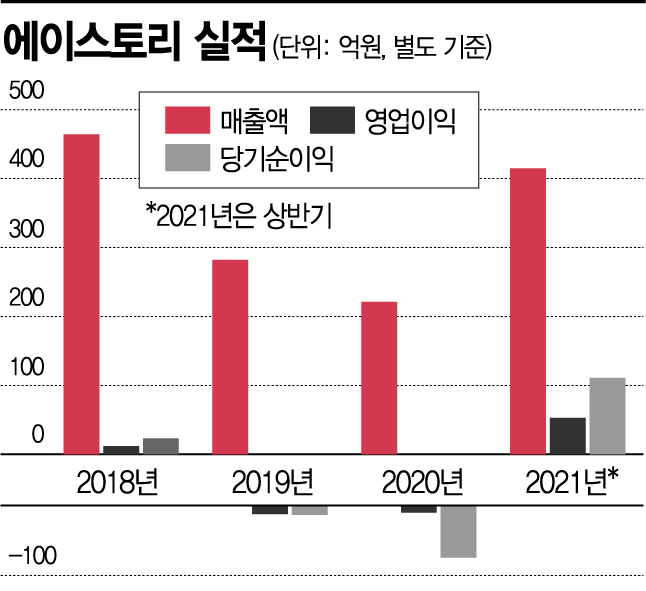

AStory’s performance is also at an all-time high. As of the end of the first half of this year, cumulative sales reached 41.5 billion KRW, operating profit was 5.2 billion KRW, and net profit was 11 billion KRW. Compared to the same period last year, sales increased by 841.8%, and operating and net profits turned positive. The production revenue progress rate of the drama ‘Jirisan’ was reflected by about 45% in the second quarter alone, driving the performance. ‘Jirisan,’ starring Jeon Ji-hyun and Ju Ji-hoon, is a mystery drama written by Kim Eun-hee and directed by Lee Eung-bok.

The outlook for future performance is also bright. In the third quarter of this year, the remaining production revenue of ‘Jirisan,’ which is scheduled to premiere on the 23rd, will be fully reflected. The cumulative production revenue progress rate of ‘Jirisan’ until the second quarter is 91%, leaving 9% of production revenue remaining.

Additionally, secondary rights of the drama have almost no cost, so additional profits are expected. According to Hana Financial Investment’s analysis, ‘Jirisan’ is expected to generate operating profits of 10 to 15 billion KRW per episode. This is the highest profit ever among mid-sized production companies.

Furthermore, revenue from the currently popular Coupang original variety show ‘SNL Korea’ and production revenue from works such as ‘Big Mouth’ and ‘Extraordinary Attorney Woo’ will also be reflected in the second half of the year. Next year, the mega tentpole seasonal drama ‘Mudang,’ written by Park Jae-beom, the writer of ‘Vincenzo,’ will be produced.

Focus on CB Call Option Outlook

AStory’s financial condition is also relatively sound. As of the end of the first half of this year, AStory’s total assets were 98.5 billion KRW, total liabilities 52.4 billion KRW, and total equity 46.1 billion KRW. Cash equivalents exceed total borrowings, resulting in negative net borrowings.

The debt ratio rose slightly to 113.5% from 79% at the end of last year, due to the issuance of convertible bonds (CB). In April, AStory issued CBs worth 33 billion KRW to KOSDAQ venture funds and others. The nominal and maturity interest rates are 0%, so the company has no interest burden.

By the end of the first half of this year, about 6 billion KRW of the CB investment funds were used, and the remaining 27 billion KRW is held in deposits and other forms. AStory stated that these funds will be used for production costs of upcoming dramas.

The conversion price of this CB was initially 43,372 KRW but was adjusted downward once to 33,834 KRW. The number of convertible shares is 975,350, accounting for 10.23% of the total shares outstanding. Notably, this CB includes a call option (put right) allowing the company or a third party designated by the company to purchase 50%, so it is important to monitor who will exercise the CB in the future.

Meanwhile, AStory already recorded a full loss of 9 billion KRW last year on its investment in Optimus Asset Management’s fund, which was an issue last year. Subsequently, it received 2.7 billion KRW from the seller as liquidity support funds and holds it as an asset. If additional losses are recovered in the future, they are expected to be recorded as gains.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.