Seongnam Urban Development Corporation Does Not Even Request Shareholding Ratio Change

Park Soo-young, a member of the People Power Party, is questioning the 'Daejang-dong Development Suspicion' during the audit of the Office for Government Policy Coordination at the Political Affairs Committee held at the National Assembly in Yeouido, Seoul on October 1, 2021. Photo by Yonhap News.

Park Soo-young, a member of the People Power Party, is questioning the 'Daejang-dong Development Suspicion' during the audit of the Office for Government Policy Coordination at the Political Affairs Committee held at the National Assembly in Yeouido, Seoul on October 1, 2021. Photo by Yonhap News.

[Asia Economy Reporter Lee Hyun-joo] An analysis has emerged that the enormous profit of 404 billion KRW going to a few individuals such as Hwacheon Daeyu Asset Management and Cheonhwa Dongin during the Daejang-dong development was possible due to an abnormal shareholding structure of Seongnam Neutteul.

On the 14th, Park Soo-young, a member of the People Power Party's Daejang-dong Task Force, analyzed everything from the private project bidding guidelines to Hana Bank consortium's business plan, business agreement, and shareholder agreement, confirming that there was a structure that concentrated profits to private operators.

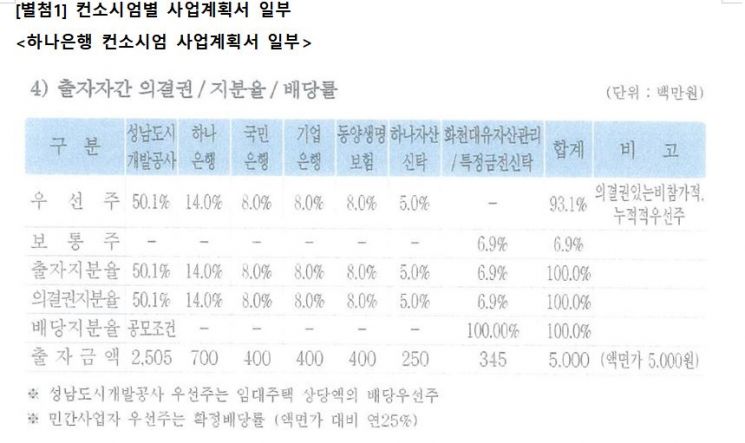

According to Park's office, on March 26, 2015, the consortium of Hana Bank, Meritz Securities, and the Korea Development Bank submitted their respective Daejang-dong development business plans and disclosed their dividend rate plans. Only the Hana Bank consortium specifically mentioned how to divide preferred and common shares, stating that Hwacheon Daeyu and a specific money trust (Cheonhwa Dongin) would receive 6.9% common shares, while Seongnam Urban Development Corporation and financial companies would be allocated non-participating preferred shares. They also specified a fixed dividend rate of 25% per annum based on the face value (5,000 KRW).

Non-participating preferred shares are preferred shares that cannot receive dividends exceeding the predetermined dividend rate, so Seongnam Urban Development Corporation and the other financial companies could not take more than the set dividend amount regardless of how much profit was made. It appears that the Hana Bank consortium created this structure from the business planning stage.

Consortium Business Plan of Hana Bank Related to Daejang-dong Development (Provided by Office of Park Soo-young, People Power Party)

Consortium Business Plan of Hana Bank Related to Daejang-dong Development (Provided by Office of Park Soo-young, People Power Party)

Although Seongnam Urban Development Corporation had the authority to request changes in shareholding ratios and approve them through negotiations, this investment share ratio was reflected as is (June 15, the first business agreement between Seongnam Urban Development Corporation and Seongnam Neutteul). There was an opportunity to correct this in the shareholder agreement, but the result did not change. Seongnam Urban Development Corporation merely classified that it would take Type 1 preferred shares (non-participating) and financial companies would take Type 2 preferred shares (non-participating), but maintained the original proposal where Hwacheon Daeyu and Cheonhwa Dongin monopolized the common shares.

According to materials analyzed by the People Power Party's Daejang-dong Task Force, assuming both Type 1 and Type 2 were participating preferred shares that could receive dividends exceeding the set dividend rate, Seongnam Urban Development Corporation and financial companies would have received about 375.7 billion KRW, and Hwacheon Daeyu and Cheonhwa Dongin about 28.2 billion KRW. The People Power Party believes that more profit recovery was possible depending on the shareholding structure but it was tacitly approved.

Park argued that from the bidding stage to the shareholder agreement, Seongnam Urban Development Corporation and financial companies conspired to concentrate dividends to a few individuals. He said, "It is not reasonable that in the Daejang-dong development project, which all consortia evaluated as low risk and high business feasibility, Seongnam Urban Development Corporation and financial companies did not choose common shares with large dividends," adding, "A national audit and special prosecutor are necessary to reveal everything in detail."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)