Still High Growth Compared to Pre-COVID-19

Financial Authorities to Prepare and Announce Additional Management Measures This Month

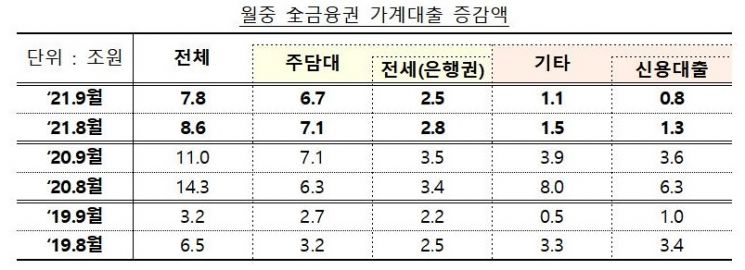

[Asia Economy Reporter Kwangho Lee] Last month, household loans across all financial sectors increased by 7.8 trillion KRW, showing a reduced growth compared to the previous month (8.6 trillion KRW). However, the high growth rate continues compared to the pre-COVID-19 period.

On the 13th, the Financial Services Commission and the Financial Supervisory Service announced in the 'September 2021 Household Loan Trends (Preliminary)' report that "the year-on-year household loan growth rate was 9.2%, indicating a slight slowdown in the increase."

Last month, mortgage loans increased by 6.7 trillion KRW, a smaller increase compared to the previous month (7.1 trillion KRW).

The banking sector accounted for 5.7 trillion KRW and the secondary financial sector for 1.1 trillion KRW, both decreasing by 100 billion KRW and 200 billion KRW respectively compared to the previous month (5.8 trillion KRW and 1.3 trillion KRW).

In the banking sector, mortgage loans increased mainly through jeonse loans (2.5 trillion KRW) and group loans (1.5 trillion KRW), maintaining a similar level to the previous month.

Other loans such as credit loans increased by 1.1 trillion KRW, showing a slowdown following last month's 1.5 trillion KRW increase. This reduction in growth is attributed to a decrease in credit loans due to the inflow of Chuseok bonuses and a decline in card loans from credit finance companies.

A financial authority official explained, "Although the increase in household loans across all financial sectors in September slightly decreased compared to the previous month, the growth rate remains high compared to the pre-COVID-19 period. We are currently preparing additional management measures for the soft landing of household debt, which will be announced in October."

Ko Seung-beom, Chairman of the Financial Services Commission, emphasized, "We will carefully devise measures to ensure that there is no inconvenience to low-income real demand borrowers who genuinely need funds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.