Most Commercial Banks Do Not Operate Internships

Rarely Offered Internships Mostly Focus on Digital and IT

Financial Firms Cite Changes in Hiring Methods and Workforce Demand

[Asia Economy Reporter Song Seung-seop] The private financial companies' internship program, known as "Geumteon," is disappearing. Opportunities to gain field experience at central headquarters or branches have virtually vanished. Especially with downsizing and a preference for digital talent, humanities graduates preparing for employment are lamenting that they have lost their place.

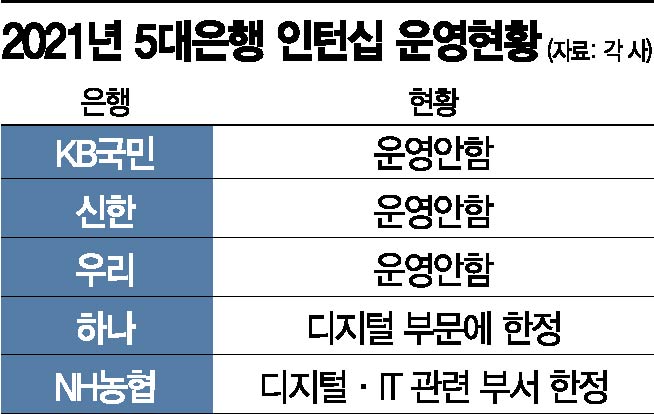

According to the financial sector on the 14th, among KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup Banks, only Hana Bank and Nonghyup Bank officially operate internship programs. The other financial companies have not operated internship screenings for years or have replaced them with external activities in the form of supporter groups.

Financial companies that selected interns this year limited the application fields to digital and IT sectors. Hana Bank, which recruited university student interns in August, restricted the positions to the digital field. Initially, Hana Bank recruited interns in a common division supporting branch and headquarters tasks without any major restrictions.

Last year, along with the digital field, interns were selected in fund/trust, corporate finance, and investment banking (IB) sectors, introducing major restrictions. Applicants had to hold degrees in engineering or natural sciences for broad categories, or in business/economics for corporate finance and IB sectors. This time, there were no separate major restrictions, but possessing digital expertise was preferred. Those holding high-level certifications such as Information Security Engineer or Advanced Data Analytics Professional (ADP), or those majoring in engineering or natural sciences, were given preference.

Even when internship postings are rare, most focus on digital and IT

Nonghyup Bank, which issued appointment letters to 5th-grade new employees in an internship format the day before, also limited recruitment to digital, IT, and card sectors. The card sector involved data and system development roles such as artificial intelligence (AI) or simple payment systems. There were no restrictions on education or major, but a bachelor's degree in science and engineering and related certifications were preferred. The document screening included an online coding test, making it difficult for most humanities graduates preparing for employment to apply.

In financial employment communities, voices are emerging that internships are mainly conducted for science and engineering majors or involve simple tasks, making it difficult to build experience. Kim Sang-hyun (28, pseudonym) said, "I don't know where to gain the job competencies and experience that banks highly evaluate," adding, "Written exams in coding or AI fields are difficult even for majors, so there is practically nowhere to apply."

In response, the IBK Industrial Bank of Korea's internship program is gaining popularity among job seekers. It consistently operates a systematic internship program and, despite being a policy bank, offers opportunities to learn general financial tasks similar to private banks. When it recruited 250 experiential interns on the 20th of last month, 4,707 people applied, resulting in a high competition ratio of 18.83 to 1.

Financial companies explain that changes in recruitment methods and manpower demand have led to changes in internship operations. A representative from a commercial bank said, "Internship programs were largely established to give job seekers opportunities when banks recruited hundreds of people through open recruitment," adding, "As open recruitment has decreased and irregular hiring methods have taken hold, internship programs have also disappeared."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.