US AI Expert Workforce Only 4% of South Korea's Size... China Accounts for Just 10% of Research Papers

[Asia Economy Reporter Yu Je-hoon] As the United States and China fiercely compete for dominance in the autonomous vehicle market, an analysis has emerged that urgent improvements in laws and systems are needed domestically to foster talent and expand investment for securing artificial intelligence (AI) technology, as well as to accumulate autonomous driving big data.

The Korea Industrial Alliance Forum (KIAF) held an online seminar on the morning of the 13th under the theme "Comparison of the Current Status of US-China Autonomous Driving Competition and Implications." KIAF includes 15 industry organizations from sectors such as automobiles, semiconductors, batteries, and electronic information and communications.

The global autonomous vehicle market, expected to grow significantly around 2025, is projected to reach approximately KRW 1,070 trillion (according to McKinsey Consulting estimates) in new car sales by 2040. The technology can be applied beyond automobiles to robots, heavy equipment, agricultural machinery, and urban air mobility (UAM). This is why not only traditional automakers like Hyundai Motor Group and General Motors (GM) but also big tech companies such as Google and Baidu have entered the market.

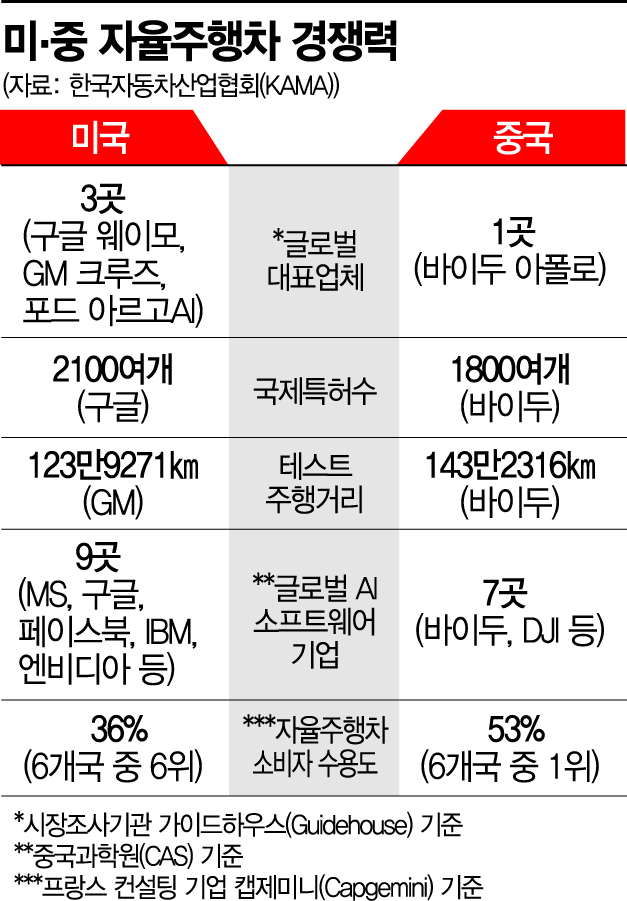

The US and China, locked in a global power struggle, are competing most intensely in this future industry. Nearly half of the world’s research and development (R&D) investment in autonomous driving is concentrated in companies like Google (Waymo), GM (Cruise), and Baidu (Apollo). In the US, a variety of companies including big tech, automakers, and AI startups participate in development based on a flexible regulatory framework, whereas in China, big tech companies lead autonomous driving technology development under intensive government policy support. The industry views China’s rapid pursuit, driven by high consumer acceptance and a massive market, as steep, but expects the US to maintain its lead for the time being.

The problem is that compared to these two countries competing for dominance, South Korea’s human and physical infrastructure related to autonomous vehicles remains insufficient. For example, the number of AI professionals with master's or doctoral degrees in Korea is 405, which is only 3.9% of the US’s 10,295, and the number of academic papers is 6,940, about 10% of China’s 70,199.

The same applies to the accumulation of big data, which is core to autonomous driving. US-based Tesla is expected to have accumulated 5 billion miles (approximately 8 billion km) of real-road Autopilot driving records by the end of this year, and Korea’s top company Hyundai Motor Group is currently conducting autonomous driving tests through its joint venture Motional in the US. China’s Baidu also operates robo-taxis covering the entire Beijing area, achieving a cumulative accident-free record of 500,000 km. In contrast, such attempts are limited domestically due to legal and institutional constraints.

At the seminar, there was a call for urgent policies to foster talent and accumulate big data. Jeong Man-ki, chairman of KIAF, stated, "It is necessary to include autonomous vehicles as a national strategic technology to promote corporate technology development," and added, "The tax credit for R&D investment and related facility investment by large companies should be increased from the current 0-2% to over 30%, which is the level of advanced countries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.