RPS Mandatory Supply Ratio Increase Doubles Net Profit of KHNP and Five Power Companies Over 4 Years with Higher Costs

Debt Ratio Soars from 125.2% to 161.3% Under Moon Administration

KEPCO's Compensation Burden Grows... Electricity Rate Hike May Impact Citizens

[Sejong=Asia Economy Reporter Kwon Haeyoung] The increase in renewable energy purchase costs by major power generation public enterprises is interpreted as the result of the Moon Jae-in administration's persistent push for nuclear phase-out, coal phase-out, and accelerated renewable energy expansion policies. Although the government introduced the Renewable Portfolio Standard (RPS) in 2012, the mandatory supply ratio under the RPS has rapidly increased as solar and wind power deployment accelerated under the current administration. There is growing concern that these costs will snowball in the future, increasing the financial burden on Korea Electric Power Corporation (KEPCO) and eventually leading to a domino effect of electricity rate hikes.

◆ Renewable Energy Mandatory Supply Ratio Doubled= According to the Ministry of Trade, Industry and Energy on the 12th, the mandatory supply ratio under the RPS rose from 2% in 2012, when the system was introduced, to 4% in 2017, increasing by 2 percentage points over five years. However, since the current administration took office, the ratio has risen from 4% in 2017 to 9% this year, an increase of 5 percentage points, more than doubling the mandatory supply ratio in the same period.

The RPS requires public and private power generation companies with facilities of 500 MW or more to supply a certain portion of their total power generation from renewable energy sources each year. To fulfill this obligation, power generators purchase Renewable Energy Certificates (RECs) from private operators in addition to their own power production. Private solar power operators and others generate revenue by selling RECs to power generators.

This is closely related to the current administration's accelerated renewable energy deployment policy. The rapid increase in solar power generation facilities has led to oversupply, creating a vicious cycle of raising the mandatory supply ratio under the RPS. The government continues to promote renewable energy expansion policies. According to the 9th Basic Plan for Electricity Supply and Demand announced by the Ministry of Industry last year, the government plans to reduce the share of nuclear and coal power from 46.3% in 2020 to 25.1% in 2034 based on installed capacity, while significantly increasing the share of renewable energy from 15.8% to 40.3%. To achieve the government's enhanced Nationally Determined Contribution (NDC) target of a 40% reduction in greenhouse gas emissions and the 2050 carbon neutrality goal, renewable energy purchase costs are expected to rise further. Following a legal amendment in April, the government plans to gradually increase the mandatory supply ratio under the RPS from 9% of total power generation this year to 12.5% next year and 25% in five years.

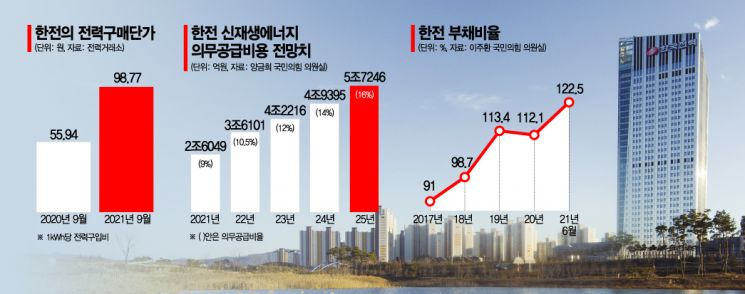

The financial burden on power generators is increasing. The average debt ratio of five power generation companies under KEPCO and Korea Hydro & Nuclear Power (KHNP) rose from 125.2% in 2016, before the current administration, to 161.3% last year. This is due to the government's coal phase-out policy lowering coal-fired power plant operation rates and the nuclear phase-out policy increasing the operation of relatively expensive liquefied natural gas (LNG) plants. The increase in renewable energy-related costs and investments is also a significant factor.

An official from a power public enterprise said, "The law only sets an upper limit for the mandatory supply ratio under the RPS and does not specify a concrete deadline, but the government is raising it too rapidly."

◆ Electricity Rate Hikes Are Inevitable= The increase in renewable energy purchase costs for power generators ultimately translates into a burden on KEPCO. The government sets the renewable energy purchase ratio for power generators under the RPS, but KEPCO, as the parent company, compensates for all these costs. KEPCO's RPS compliance costs increased from 1.612 trillion won in 2017 to 2.247 trillion won last year and 1.677 trillion won in the first half of this year. KEPCO expects to spend a total of 2.6049 trillion won on RPS costs this year.

The future outlook is even more concerning. According to the '2021-2025 Mid-to-Long-Term Financial Management Plan' submitted by KEPCO to Rep. Yang Geum-hee of the People Power Party, RPS costs are expected to rise to 3.6101 trillion won next year, 4.2216 trillion won in 2023, and 5.7246 trillion won in 2025. These figures are based on an RPS ratio of 10.5% to 16%. However, considering the government's amendment to the RPS mandatory supply ratio enforcement decree, which raises the ratio to 12.5% starting next year, KEPCO's RPS costs are expected to exceed 4 trillion won within a year.

This will act as a pressure factor for electricity rate hikes. The cost for KEPCO to purchase electricity from power generators was 98.77 won per kWh as of last month, nearly double the 55.94 won per kWh in the same month last year. With recent global energy price increases, KEPCO faces cost pressure, and the government's rapid renewable energy policy could ultimately result in an electricity bill shock.

An energy expert said, "It is necessary to thoroughly examine the factors causing electricity rate increases due to the rapid renewable energy generation policy, adjust the policy speed accordingly, and expand the share of nuclear power, which is a base load and low-cost power source."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.