Government Proposes Additional Increase in NDC

44.4% Reduction in Greenhouse Gas Emissions Required in the Energy Transition Sector

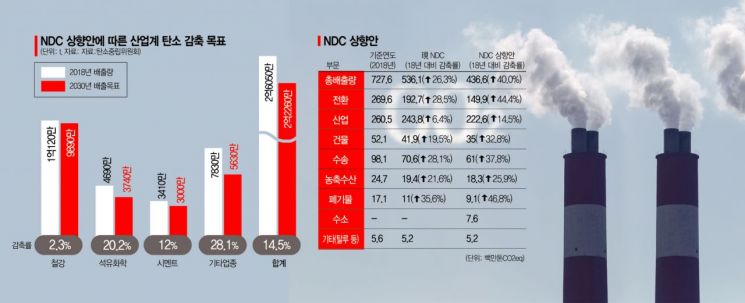

[Asia Economy Reporter Joo Sang-don] The government recently set a 40% target for the '2030 National Greenhouse Gas Reduction Goal (NDC)' and proposed a higher target for the energy transition sector. This reflects the judgment that reducing emissions in the energy transition sector, which has the highest greenhouse gas emissions, is crucial to achieving the overall target. However, with recent energy price increases and the tightening of eco-friendly regulations causing a contraction in existing energy production and triggering sharp price hikes?known as the so-called 'greenflation' phenomenon?there is a high possibility that further raising the NDC will exacerbate this situation.

On the 8th, relevant ministries and the 2050 Carbon Neutrality Committee proposed an upward revision to reduce greenhouse gas emissions in the energy transition sector by 44.4% by 2030. This figure is 4.4 percentage points higher than the total reduction target of 40%. Excluding waste, which had the lowest greenhouse gas emissions in 2018 (17.1 million CO2 equivalent tons), the energy transition sector must undertake the most intensive reductions.

In 2018, greenhouse gas emissions in the energy transition sector were 269.6 million tons. The existing NDC aimed to reduce this to 192.7 million tons, a 28.5% reduction, but with the NDC revision, the target is 149.9 million tons, requiring an additional reduction of 42.8 million tons compared to the previous goal.

The government’s reduction plan for the energy transition sector includes reducing the share of coal power and expanding renewable energy. Specifically, the 2030 power generation mix by energy source is proposed as △Nuclear 23.9% △Coal 21.8% △Liquefied Natural Gas (LNG) 19.5% △Renewables 30.2%. Professor Jeong Dong-wook of the Department of Energy Systems Engineering at Chung-Ang University commented, "The nuclear power share appears to follow the existing nuclear phase-out roadmap. To shift energy sources in each sector from fossil fuels to electricity, power demand will inevitably increase, and it is questionable whether this can be met solely by renewable energy. Even if possible, a sharp rise in electricity rates is unavoidable."

The surge in energy prices due to eco-friendly policies is already evident. Dubai crude oil reached $80.55 per barrel on the 6th, marking a yearly high. LNG futures on the New York Mercantile Exchange (NYMEX) jumped to $6.31 per 1 MMBtu (1 MMBtu = gas producing 250,000 kcal) on the 5th, nearly tripling from $2.33 on December 28 last year. Additionally, the price of coal for power generation, which was around $54.4 per ton in October last year, soared to $206.3 per ton earlier this month.

This is a factor driving electricity rate hikes. Earlier, the government and Korea Electric Power Corporation raised electricity rates in the fourth quarter for the first time in eight years since November 2013, due to soaring fuel costs continuing from early this year. The average post-tax prices of bituminous coal, LNG, and BC oil reflected in the fourth quarter electricity rates for June to August this year were 151.13 KRW/kg, 601.54 KRW/kg, and 574.4 KRW/kg respectively, representing a 10.2% to 22.6% increase compared to the previous three months. This has increased the burden on the public.

Joo Won, head of the Economic Research Office at Hyundai Research Institute, said, "When energy prices rise, companies inevitably pass these costs onto services and goods, which ultimately causes inflation. Especially in South Korea, where the industrial structure is centered on heavy chemical industries with high energy consumption, the impact of energy prices on inflation is greater than in Europe and other regions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)