[Asia Economy Reporter Ji Yeon-jin] The recent approval by the U.S. Securities and Exchange Commission (SEC) of an exchange-traded fund (ETF) composed of companies that have invested in Bitcoin, such as Tesla and Twitter, is being seen as a sign that Bitcoin's integration into the institutional framework is becoming more tangible.

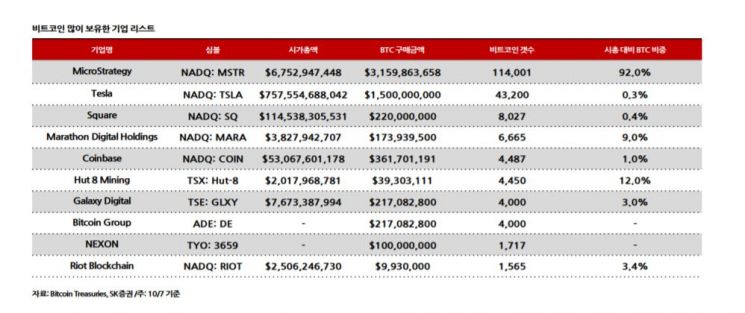

According to the financial investment industry on the 11th, the SEC-approved fund is the "Volt Bitcoin Revolution ETF," which invests one-quarter of its portfolio in companies holding cryptocurrencies. The fund was applied for by Volt Equity, a startup ETF issuer based in San Francisco, USA. It is expected to include companies with significant Bitcoin holdings such as MicroStrategy and Tesla, as well as mining companies like Marathon Digital, Coinbase?the largest exchange in the U.S.?and payment-enabled platforms like Twitter, Square, and PayPal.

Until last year, the SEC held a negative stance on Bitcoin ETF applications. However, with the appointment of Chairman Gary Gensler, the situation has gradually changed. Chairman Gensler is known for his high level of understanding of the related industry, having taught cryptocurrency courses at university, and is praised for focusing on establishing regulations for the proper market settlement rather than outright bans like in China. Currently, the SEC is reviewing the listing applications of more than 20 Bitcoin and Ethereum ETFs, including those from ARK, Fidelity, and VanEck.

Han Dae-hoon, a researcher at SK Securities, said, "It is uncertain whether a Bitcoin ETF will be approved this year," but added, "The approval of an ETF that includes companies investing in or operating businesses related to Bitcoin indicates that the SEC's stance has softened considerably. The institutional integration, which was unimaginable just one or two years ago, is gradually becoming visible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.