Hana Financial Research Institute 'Economic and Financial Outlook' Report

Possibility of Additional Hikes Amid Real Estate and Household Debt Concerns

[Asia Economy Reporter Kiho Sung] It is forecasted that next year the Bank of Korea’s base interest rate will rise to 1.25%, the level before the COVID-19 crisis. Although one rate hike is expected after the new government is formed following the presidential election, additional hikes cannot be ruled out if the real estate market and the rapid increase in household debt do not stabilize.

Concerns are rising that borrowers who took out loans at historically low interest rates amid last year’s frenzy of “Yeongkkeul” (borrowing to the limit) and “Bittou” (investing with borrowed money), as well as low-income and vulnerable borrowers, will face increased interest burdens. Especially since financial authorities have announced that loan regulations will continue until next year, making it difficult to roll over debt, the combination with rising interest rates could cause household interest burdens to snowball, highlighting the urgency of countermeasures.

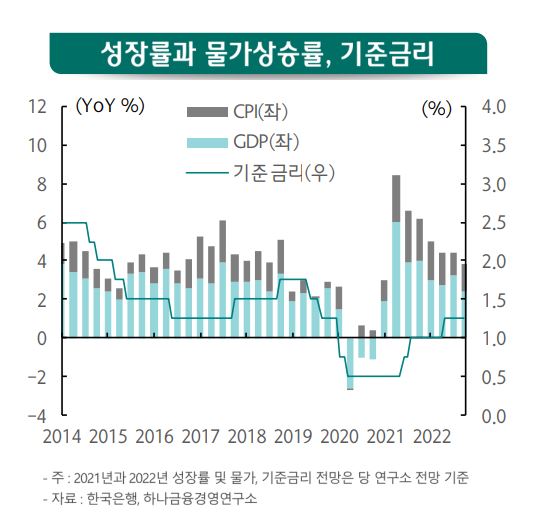

According to the “2022 Economic and Financial Market Outlook” report released on the 7th by Hana Financial Management Research Institute, the base interest rate is expected to be raised additionally in the fourth quarter of this year and the third quarter of next year, considering economic recovery and the accumulation of financial imbalances.

Regarding the timing of the hike in the third quarter of next year, the report took into account the need for policy review by the new government, the appointment of a new Bank of Korea governor, and the expiration of terms for some Monetary Policy Committee members. Accordingly, it is expected that the rate will return to 1.25%, the pre-COVID-19 crisis level, next year.

Furthermore, as the U.S. Federal Reserve (Fed) proceeds with monetary policy normalization, market interest rates are also expected to continue rising. The yield on 3-year government bonds is predicted to increase from 1.65% in the fourth quarter of this year to 1.80% in the fourth quarter of next year.

However, the report conditions the single rate hike next year on the easing of financial imbalances due to two rate hikes this year and strengthened household debt regulations. If housing prices and household debt continue to surge until next year, two rate hikes cannot be ruled out.

Kim Sujeong, senior researcher at Hana Financial Management Research Institute, emphasized, “The domestic authorities’ determination to ease financial imbalances and concerns over early tightening by the Fed due to prolonged inflation could lead to a steep rise in interest rates, which should be kept in mind.”

With a sharp interest rate hike expected next year, borrowers vulnerable to interest rate fluctuations, such as those who engaged in “Yeongkkeul” and “Bittou,” are anticipated to be directly hit. According to the “Analysis of Household Debt Interest Repayment Burden Due to Interest Rate Hikes” recently released by the National Assembly Budget Office, as of July, 73.5% of household loans were variable-rate loans. Due to low interest rates and other factors, banks have preferred variable rates, increasing the share of variable-rate loans in household lending from 65.6% in March last year to 73.5% this year. This means that when interest rates rise, the household interest repayment burden also increases.

The Budget Office analyzed that if household loan interest rates rise by 1 percentage point, the interest burden on Korean households will increase by 12.5 trillion won. It diagnosed, “If the Bank of Korea raises the base interest rate further, causing loan interest rates to rise, the increase in household interest repayment burdens could raise credit risks and negatively impact consumption.”

Meanwhile, Hana Financial Management Research Institute expects the economy next year to maintain a favorable growth trend due to improving COVID-19 conditions and expanded domestic demand recovery. However, following this year’s V-shaped rebound and the fading of the base effect, along with reduced policy support and slowing export conditions, economic growth momentum is expected to gradually weaken, with a forecasted growth rate of 2.8%, lower than this year’s estimated 3.9%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)