KIRI CEO Survey

"Gradual Interest Rate Increase Improves Profitability"

Main Product Identified as Individual Protection Insurance

[Asia Economy Reporter Oh Hyung-gil] Insurance company CEOs predicted that the COVID-19 pandemic would end in 2023 and the economy would normalize. They identified individual protection insurance as their main product going forward and focused on health-related businesses such as health management, caregiving, and nursing as new business areas.

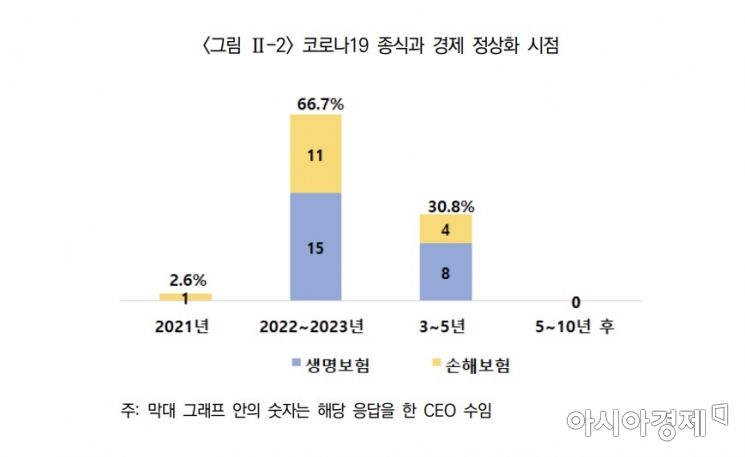

According to a survey report conducted by the Korea Insurance Research Institute on domestic insurance company CEOs on the 6th, 66.7% of respondents predicted a short-term end to COVID-19 between 2022 and 2023.

However, 30.8% of respondents answered that the impact of COVID-19 would last for a long period of about 3 to 5 years.

Most CEOs also responded that the insurance industry would benefit positively once the economy normalizes after COVID-19.

CEOs evaluated that the upward trend in market interest rates would continue for a considerable period but expected the increase to be slight. They responded that the rise in interest rates would be positive more in terms of profitability than growth. This is interpreted as interest rate increases generally affecting investment business profit growth and a decrease in the secondary spread margin.

Regarding digitalization, 41.0% responded that they would shift to a new business model within the insurance industry, which was the highest, and 28.2% said they would shift to a new business model beyond the insurance industry.

Concerns about the entry of digital platforms into the insurance market were highest regarding abuse of market dominance and data/technology monopolies, with high concerns also about excessive competition and blind spots in consumer protection.

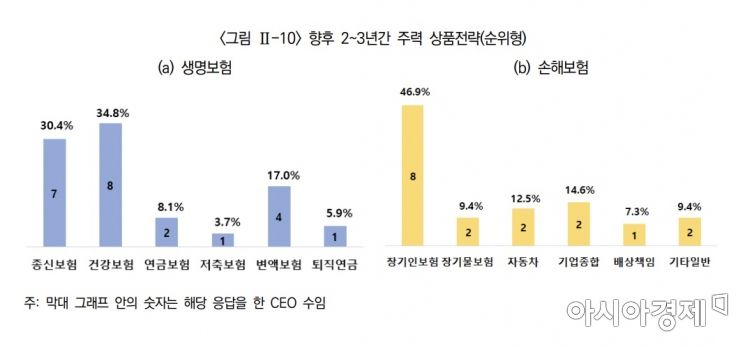

The main product strategies of life insurance companies were health insurance (34.8%), whole life insurance (30.4%), variable insurance (17.0%), and pension insurance (8.1%), while non-life insurance companies most frequently selected long-term personal insurance (46.9%), followed by comprehensive corporate insurance (14.6%) and automobile insurance (12.5%).

As for new business areas of focus, health management services (38.6%) and caregiving/nursing services (20.9%) were chosen as health-related businesses, followed by MyData business (14.1%), micro short-term insurance (12.3%), and comprehensive financial services (10.9%).

Among sales strategies prioritized within the next 1 to 2 years, digital transformation (26.1%), securing competitiveness of sales channels (24.8%), proactive response to IFRS17 and K-ICS (17.5%), and new product development (14.5%) were cited.

Regarding the preparation level for the new international accounting standards (IFRS17) and the new solvency regime (K-ICS) scheduled to be implemented in 2023, 77.0% generally evaluated that preparations were well underway.

Kim Se-jung, a research fellow at the Korea Insurance Research Institute, analyzed, "Insurance companies are expanding new business areas using digitalization as a weapon while showing great interest in expanding health coverage within traditional business areas. They also appear to be very interested in enhancing the positive perception of the insurance industry through fulfilling social responsibilities."

He added, "Since they must respond to various current issues along with long-term survival strategies, it is necessary to maintain an appropriate balance between establishing a long-term growth foundation and addressing current issues."

Meanwhile, this survey was conducted over 16 days from July 12 to July 27, 2021, with 39 out of 42 CEOs (23 from life insurance, 16 from non-life insurance) responding, resulting in a response rate of 93%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.