Is Household Debt the Only Time Bomb? Corporate Loans Also at Risk Level

[Asia Economy Reporter Park Sun-mi] Despite the financial authorities' comprehensive tightening of household loans, the increase in loans within the banking sector shows little sign of slowing down. Amid the shock of loan regulations and the announcement of additional measures, real demand borrowers are facing an emergency in securing funds, raising concerns that the domino effect of defaults could be highly likely depending on market volatility.

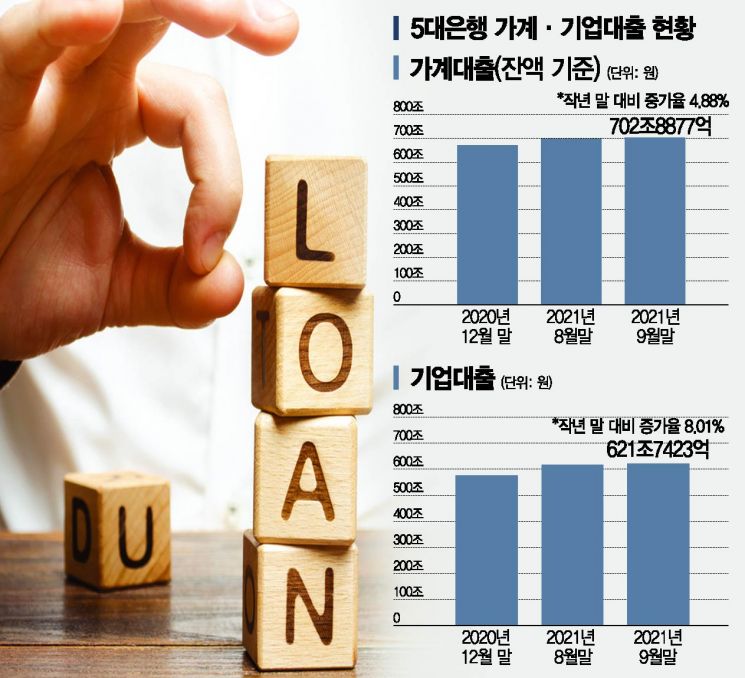

According to the financial sector on the 5th, the outstanding household loans of the five major banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?reached 702.8877 trillion won at the end of last month, surpassing the 700 trillion won mark for the first time. This figure increased by 4.0728 trillion won compared to 698.8149 trillion won in the previous month, with the increase also exceeding August's 3.5067 trillion won. Although Nonghyup Bank was the first among commercial banks to implement high-intensity measures such as suspending new mortgage loans, the balloon effect of loan demand shifting to other banks prevented the reduction of the increase.

The year-on-year household loan growth rate for these banks was 4.88%. This signals a red light for the authorities' goal of managing the growth rate at around 5-6% annually.

Corporate Loans Increase by Over 8%... "Possibility of Increased Loan Defaults in Banks"

Corporate loans have also surged significantly.

At the end of last month, the outstanding corporate loans (including large and small-to-medium enterprises and SOHO loans) of the five major banks totaled 621.7423 trillion won, an increase of more than 5.7 trillion won compared to 616.0192 trillion won at the end of the previous month. Compared to 575.6283 trillion won at the end of last year, this represents an 8% increase. While loans to large corporations increased by 3.5%, loans to small and medium-sized enterprises, which are more vulnerable to COVID-19 impacts, jumped by 8.7%.

Not only is the household loan growth rate not slowing down, but banks' significant increase in corporate loans as an alternative means is also pointed out as a factor that raises the risk of future defaults.

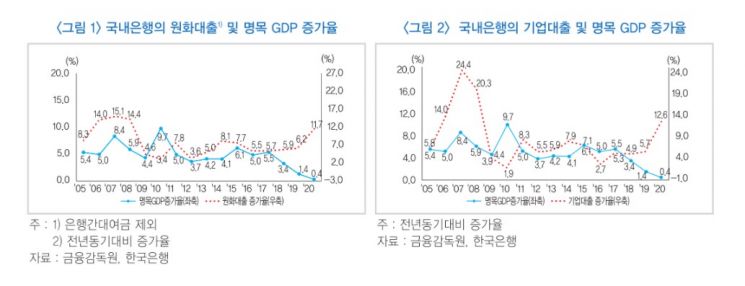

Experts express concern that if the real economy does not recover, even a small market shock could cause collapse. According to the Korea Institute of Finance, until 2017, the growth rates of household and corporate loans by domestic banks moved almost in line with the nominal Gross Domestic Product (GDP) growth rate. From 2018, loan growth rates accelerated sharply while GDP growth rates declined, widening the gap. In particular, last year, the nominal GDP growth rate was 0.4%, whereas the corporate loan growth rate in the domestic banking sector reached 12.6%.

Bank Non-Performing Loan Ratio Decreased but

Possibility of Deferred Defaults Due to COVID-19 Policies

However, due to loan maturity extensions and principal and interest payment deferral programs for small and medium-sized enterprises and small business owners to protect vulnerable groups amid the spread of COVID-19, the apparent level of bank risk remains low. As of the first half of the year, the non-performing loan ratio in the banking sector was 0.54%, significantly lower than 0.71% during the same period last year.

Experts warn that the number of marginal companies with an interest coverage ratio below 100% is increasing, and once the loan maturity extension and principal and interest payment deferral programs end, the side effects of deferred defaults could erupt all at once.

Lee Byung-yoon, Senior Research Fellow at the Korea Institute of Finance, diagnosed, "Despite the recession in the real economy, companies are covering essential costs through loans as sales continue to decline," adding, "If the sales slump persists, the increased loans by banks could become non-performing." He advised, "Individual banks and financial authorities need to estimate the potential scale of latent non-performing assets in bank assets and conduct stress tests on the possibility of defaults due to changes in economic conditions to prepare in advance for risks that may arise in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.