Price Decline Expected in 4Q Mainly for PC DRAM

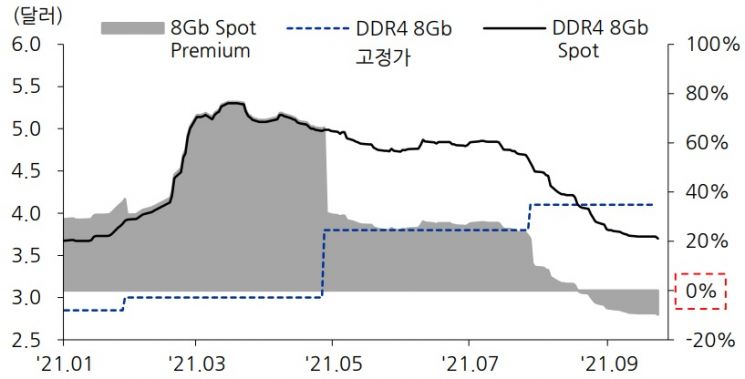

PC DRAM Spot Prices Below Fixed Prices Since August

Server and Mobile Demand Driving Rebound in Second Half of Next Year

[Asia Economy Reporter Su-yeon Woo] Amid prevailing short-term price decline forecasts across the DRAM market, there is a growing expectation that DRAM prices will turn around starting from the second quarter of next year and rebound again from the second half. While PC DRAM prices are expected to continue declining in the short term until the first quarter of next year, demand for server and mobile DRAM is anticipated to support prices and bring about a recovery opportunity.

According to DRAMeXchange, on the 5th, the spot price for PC DRAM (DDR 8Gb) was $3.64, falling below the fixed price of $4.1 in September. The spot price, which had consistently exceeded the fixed price since the beginning of this year, surged to the $5 range around March but dropped below the fixed price after mid-August.

This sharp decline in spot prices has also darkened the short-term outlook for the DRAM market in the fourth quarter of this year. TrendForce forecasted that PC DRAM prices will fall by 5-10% quarter-on-quarter in the upcoming fourth quarter. This is due to high inventory levels among PC manufacturers and the gradual decrease in non-face-to-face demand driven by the "COVID-19 effect," which had led market demand, as vaccination rates increase.

However, even if the market remains weak through the fourth quarter of this year and at least until the first quarter of next year, there is growing confidence in an industry rebound centered on server and mobile DRAM from the second half of next year. Although short-term price declines due to inventory and supply imbalances are expected, demand next year is still seen as solid, supported by the expansion of 5G smartphone adoption and server expansions by large cloud providers. Considering the overall market share, PC DRAM accounts for only about 15%, while 75%, which largely drives overall prices, is concentrated in mobile and server DRAM.

Park Yu-ak, a researcher at Kiwoom Securities, analyzed, "The inventory reduction of PC DRAM is not significant enough to affect the overall industry trend next year," adding, "Recovery in server and mobile DRAM demand and supply reduction due to DDR5 mass production will lead to a DRAM industry recovery from mid-second quarter next year."

Micron, which forms the "big three" alongside Samsung Electronics and SK Hynix in the global DRAM market, also maintained this view in its recent earnings announcement. Sanjay Mehrotra, CEO of Micron, stated, "The DRAM industry is expected to see demand growth in the mid-to-high teens percentage next year," adding, "Basic demand will be sustained by data center growth, server deployments, increased 5G mobile shipments, and growth in the automotive industry, leading to continued strength."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)