Netflix Hits All-Time High Stock Price

Hit Guarantee Sequel to Follow Squid Game Awaited

Drama IP-Based Game Market Entry Sparks Stock Price Surge Expectations↑

[Asia Economy Reporter Minji Lee] As the Korean Netflix original series "Squid Game" sweeps the globe, the stock price of Netflix, the global OTT (online video service) company holding the intellectual property (IP), is fluctuating. Expectations for an increase in subscribers, which is closely related to the stock price, have risen, and the securities industry predicts that the subscriber growth trend may continue as popular content is scheduled to be released within the year.

According to the financial investment industry on the 2nd, Netflix closed the market on the 1st (local time) at $613.15, up 0.46% from the previous trading day, setting a new all-time high closing price. Over the past month, it rose more than 5% from $582.07 to $613.15, contrasting with the Nasdaq index, which fell about 4.85% during the same period. As Squid Game held the number one spot in the global popularity rankings for nine consecutive days, expectations have increased that the "hit content" could continuously boost subscriber numbers.

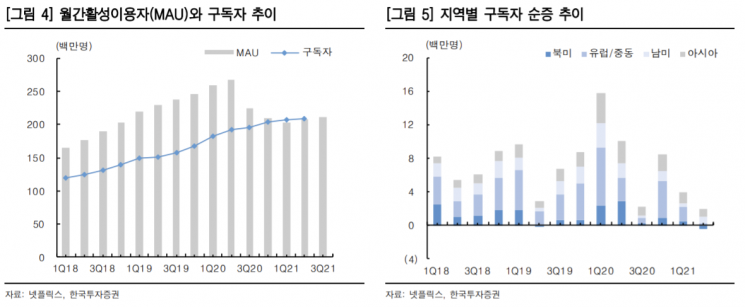

The strengthening of Netflix's subscriber loyalty is also analyzed to have drawn positive investor sentiment. Despite a decline in monthly active users (MAU) due to the worsening impact of COVID-19 starting from the second quarter of last year, subscriber growth continued. Taewan Oh, a researcher at Korea Investment & Securities, explained, "This means that subscribers paid the subscription fee even while watching less content than before on Netflix," adding, "Netflix is employing a strategy to attract new subscribers in emerging markets through original content and to increase the average revenue per user (ARPU) in developed countries by expanding the variety of content available to subscribers."

Following Squid Game, Netflix plans to release a series of anticipated works within the year. These include "You Season 3," "Red Notice," "The Witcher Season 2," and "Cobra Kai Season 4." The market evaluates that all these contents are sequels and blockbusters with proven success, sufficient to seek a stock price rebound. Researcher Taewan Oh stated, "The net increase in subscribers, which was previously a concern, will expand again as popular content is released consecutively," recommending "a buying approach until the end of the year."

In the long term, expectations for the gaming business are also expected to rise. Netflix announced its entry into the mobile gaming market during its second-quarter earnings report. In August, it launched five mobile games for testing purposes in some European countries, including Spain and Italy, and in September, it acquired the U.S. game developer Night School Studio. Night School Studio is known for developing the thriller game "Oxenfree," which received praise for its sound design. Netflix plans to develop various games based on drama IPs and distribute them free of charge to subscribers. Minha Choi, a researcher at Samsung Securities, said, "The full-scale gaming business aligns with Netflix's previous expansion of its own IP utilization and is seen as an attempt to provide users with diverse enjoyment within the Netflix screen as a new form of entertainment, encouraging them to spend more time consuming content."

Besides gaming, the company plans to enhance IP value by entering various businesses such as webtoon releases and merchandise sales. Accordingly, operating profit margins are expected to increase, reducing multiple burdens. Researcher Taewan Oh said, "Netflix's price-to-earnings ratio (PER) is expected to decrease from 100 times in 2019 to 46 times in 2022," adding, "As it enters a full-scale profit recovery phase, operating profit margins during this period are expected to rise significantly from 12.9% to 22.5%."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.