Real Demanders' Financing Plans Disrupted... Authorities Likely to Maintain Strict Regulations

[Asia Economy Reporter Kwangho Lee] Due to financial regulations imposed by financial authorities to manage household loans, many genuine homebuyers preparing to purchase their own homes are facing disruptions in their funding plans, leading to a flood of complaints on the Blue House's public petition website.

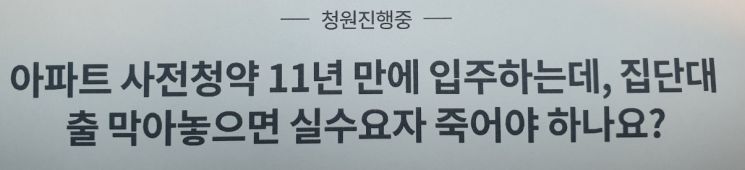

According to the Blue House public petition website on the 29th, a post titled "After 11 years of pre-sale for an apartment, if group loans are blocked, do genuine buyers have to die?" was uploaded on the 27th. As of 9:15 a.m. that day, the petition had 2,311 participants.

The petitioner, Mr. A, who identified himself as a head of household in his late 40s with two children, began by saying, "In October 2010, I applied for a pre-sale as a first-time buyer for an apartment in the OO district of Hanam, Gyeonggi Province, promoted by LH (Korea Land and Housing Corporation), and was selected in December 2010." He explained, "At the time of the pre-sale announcement, Hanam's OO district was a non-regulated area with no residency obligation or resale restrictions, and bank loans such as Loan-to-Value (LTV), Debt-to-Income (DTI), and Debt Service Ratio (DSR) were allowed up to 80% without restrictions." Mr. A appealed, "After nearly 11 years, the apartment is newly built and the first move-in will start on the 27th of next month, but the Financial Services Commission has reduced the loan limits. For ordinary citizens who are only now able to get loans to pay the balance, it sounds like they are being told not to move in and to die homeless on the streets."

Like Mr. A, many complaints have been posted on the public petition board. Mr. B, who won a pre-sale and is scheduled to move in around mid-next year, posted on the same day, "Please lift the group loan restrictions." Mr. B lamented, "After reading the shocking news about blocking group loans, my heart feels heavy, and I cannot sleep because there is no solution, wondering if I should give up my pre-sale rights." He reflected, "Seeing the current regulations, instead of happily preparing for the upcoming move-in, I am worried and stressed depending on loan trends, which feels like looking at my own future."

Other posts include titles such as "My dream of buying a first home is shattered. Crying because group loans are blocked," "Request to lift mortgage loan restrictions for single-home residents," and "Mortgage loans! What are you doing?"

Despite these appeals from genuine buyers, financial authorities maintain their stance to continue strong and phased measures until the effects of the policies become evident, suggesting that the damage will likely increase.

Following NH Nonghyup Bank, KB Kookmin Bank also reduced loan limits starting today. As of the 23rd, Kookmin Bank's household loan balance was 168.8297 trillion won, a 4.31% increase from the end of last year. After Nonghyup Bank (7.33%) already exceeded the financial authorities' household loan management target for this year (an annual increase rate of 5-6%), even Kookmin Bank, which has the largest loan scale, has reached its limit.

Professor Sung Tae-yoon of Yonsei University's Department of Economics advised, "From the perspective of genuine buyers, blocking bank loans could push them toward secondary financial institutions or private loans, so loans should not be blocked. Low-credit borrowers should be supported through fiscal aid in the form of policy funds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.