SK·Ford, Background of Increased Large-Scale Investment

Market Expansion Following US Policies

Sense of Crisis as Latecomer Also Plays a Role

Factory Sites Confirmed in Tennessee and Kentucky

[Asia Economy Reporter Choi Dae-yeol] The electric vehicle model of Ford's pickup truck F-150, a symbol of the American automotive industry, has received over 150,000 pre-orders. The existing internal combustion engine model is also a popular vehicle, selling about 800,000 to 900,000 units annually, and this figure far exceeded initial expectations even considering the substantial demand for pickup trucks in the U.S. market.

This is the reason why Ford increased the scale of investment to build battery and electric vehicle factories in the U.S. together with SK Innovation, which supplies electric vehicle batteries. When the two companies announced the formation of a joint venture earlier, the investment was expected to be around 6 trillion won. Ford and SK have now decided to invest $11.4 billion (13.102 trillion won), twice as much as initially planned over the next 4 to 5 years, as the market is rapidly expanding in line with the U.S. government's policy to promote electric vehicle adoption.

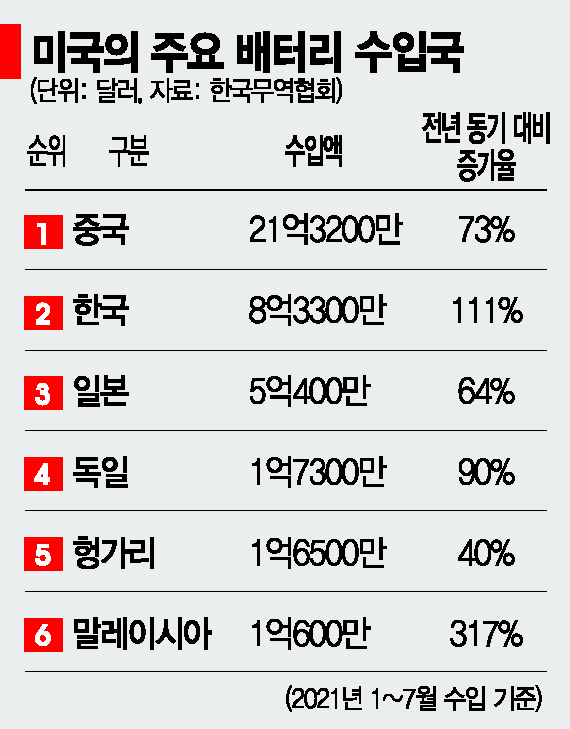

The U.S. has fewer battery factories compared to Europe and China, so it is meeting the increasing local demand for electric vehicle batteries through imports. According to data from the Korea International Trade Association on the 28th, the U.S. imported lithium-ion batteries worth $4.3 billion from January to July this year, nearly matching last year's total annual import value of $4.7 billion. China, South Korea, and Japan, which account for more than 95% of the global battery supply, have all shifted their largest battery export destinations to the U.S. this year.

Since U.S. President Joe Biden has driven the promotion of electric vehicles after taking office, and major electric vehicle makers have been releasing new models one after another, the market is rapidly growing. Bill Ford, Chairman of Ford, said, "This is a moment of change leading the transition to electric vehicles and opening a new era of 'carbon-neutral manufacturing.' Through innovation and investment, we will produce electric vehicles that Americans cheer for while protecting the planet and contributing to national prosperity."

Battery Production Capacity Increased from 60 to 129 GWh Annually, More Than Doubled

"U.S. Largest Investment in Electric Vehicle Batteries"

Tennessee and Kentucky Expected to Become Electric Vehicle Ecosystem Hubs

For SK and Ford, who are relatively late in expanding their electric vehicle business, a sense of urgency to take a more aggressive approach likely influenced this decision. Ford's rival General Motors (GM) has been strengthening its electrification strategy for years by launching models like the Bolt, and LG Energy Solution, which had past legal disputes with SK Innovation, has also secured joint factories with GM early on to strengthen its local battery business. In this situation, since GM's flagship Bolt, which uses LG batteries, has recently faced a series of fires and is focused on managing that issue, Ford and SK appear to be expanding their presence together.

On the same day as announcing the investment plan, the two companies also confirmed and disclosed the factory sites. Glendale, Kentucky, where the joint factory will be located, had previously seen federal and state government efforts to develop the battery industry that did not succeed as planned. However, with the large-scale battery factory and cooperating companies related to battery materials and raw materials moving in, it is expected to become a major hub for the local battery ecosystem.

The Kentucky factory is planned to have a capacity of 86 GWh (two units of 43 GWh each), making it the largest among local battery factories. The Tennessee factory will have a capacity of 43 GWh and will include Ford's electric vehicle assembly plant. Ford mainly has finished vehicle factories in the northeastern U.S., but with this decision, it will also have a production base in the central U.S.

SK's battery business in the U.S. is also expected to elevate its status. The joint factory with Ford will have an annual battery production capacity of 129 GWh, and separately, SK's independently operated Georgia plants 1 and 2 have a capacity of 21.5 GWh, so in 4 to 5 years, the total capacity will exceed 150 GWh.

This is comparable to the scale of LG's currently operating or joint venture factories. LG Energy Solution operates a Michigan plant (5 GWh) and has secured two joint factories with GM (each 35 GWh). Additionally, LG is reviewing an individual battery factory with an annual capacity of 70 GWh, having decided on the investment scale but not yet finalized the specific site. SK has also secured the site for a third Georgia plant, so the ranking of production scale within the U.S. may change.

Ji Dong-seop, head of SK Innovation's battery business, emphasized, "We are cooperating with Ford, which is opening a new chapter in automotive industry history through bold eco-friendly electric vehicle transition," and added, "Through the joint venture with Ford, we will leap forward together and realize a shared vision to create a cleaner planet."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.