Concerns Over 'Loan Cliff' Domino Effect... What Will Real Buyers Facing Wedding and Moving Seasons Do?

Go Seung-beom: "Total Volume Control to Expand Until Next Year... High-Intensity Measures Will Continue"

[Asia Economy Reporter Kwangho Lee] It has been revealed that the additional loan capacity of the five major banks until the end of the year is less than 3 trillion KRW. In the worst-case scenario, following NH Nonghyup Bank, a domino effect of new loan suspensions could occur, raising concerns about damage to actual borrowers.

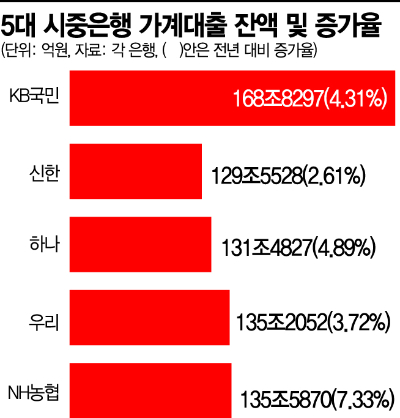

According to the financial sector on the 28th, as of the 23rd, the outstanding household loans of the five major banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?amounted to 700.6574 trillion KRW, an increase of 4.57% compared to the end of last year.

Although the increase rate did not exceed the target set by financial authorities for this year, it has reached its limit. The authorities plan to manage the household loan growth rate at 5-6% annually this year and around 4% next year.

By bank, Nonghyup Bank had the highest growth rate at 7.33% (125.587 trillion KRW), followed by Hana Bank at 4.89% (131.4827 trillion KRW), Kookmin Bank at 4.31% (168.8297 trillion KRW), Woori Bank at 3.72% (135.2052 trillion KRW), and Shinhan Bank at 2.61% (129.5528 trillion KRW).

Nonghyup Bank has already exceeded its target and has suspended handling mortgage loans and other products. As loan demand concentration becomes a reality, other banks are also gradually implementing loan restriction measures.

Hana Bank will temporarily restrict some mortgage credit insurance (MCI) and mortgage credit guarantee (MCG) loan products starting from the 1st of next month. Kookmin Bank will also significantly reduce limits on jeonse deposit loans and group loans starting from the 29th.

Shinhan Bank and Woori Bank still have some leeway, but as other banks tighten loans, there is a considerable possibility of demand concentrating on these banks.

The problem is that if the household loan growth does not slow down even after measures such as loan limit reductions, in the worst case, some loan products may have to be suspended. In this case, there is a high likelihood that the domino effect will spread throughout the entire financial sector.

Voices expressing frustration over the government's loan regulations are rising in online real estate communities. A community member, Choi Woonsan (46, pseudonym), said, "The government is trying to curb the rapid rise in real estate prices caused by policy failures such as the three lease laws with uniform total volume regulations," criticizing the approach.

A bank official explained, "The financial authorities are strongly committed to managing household loans, so they have no choice but to tighten lending," adding, "We are considering various measures to prevent damage to borrowers."

Although dissatisfaction and concerns among actual borrowers are increasing and voices of concern are emerging mainly from the banking sector, the financial authorities intend to continue implementing strong measures continuously and step-by-step until the effects of the measures become apparent.

Financial Services Commission Chairman Ko Seung-beom stated at a meeting with economic and financial market experts the previous day, "We will extend the timeline for managing the total volume of household loans beyond next year." He added, "The most important criterion for loan decisions should be whether the borrower can handle the loan and repay it stably even if circumstances change in the future," and "The core of the household loan measures to be announced by the government in October will focus on enhancing the effectiveness of repayment ability assessments."

The financial authorities are considering additional household loan management measures, including advancing the schedule for phased implementation of the Debt Service Ratio (DSR) regulations by borrower and strengthening DSR regulations on the secondary financial sector.

Experts point out that fundamental solutions, not just tightening regulations unconditionally, are necessary. Woo Seok-jin, a professor of economics at Myongji University, emphasized, "If household loans are a problem, the straightforward approach is for the central bank to raise interest rates, and if the rapid rise in housing prices is the problem, it should be solved through supply."

Ahn Jin-geol, director of the People's Economy Research Institute, warned, "If loans are blocked indiscriminately without distinguishing between good and bad borrowers, there is a risk of pushing actual homebuyers without homes into monthly rent," urging, "Sufficient housing stability support measures such as protecting actual borrowers and supporting monthly rent funds should precede."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.