[Asia Economy Reporter Ji Yeon-jin] Since the massive stock market crash due to COVID-19 last March, a stock investment craze has surged, leading to a sharp increase in stock margin trading, known as 'debt investment.' Last month, as stock market volatility increased, the average daily scale of forced liquidation doubled, resulting in significantly higher investor losses.

The Financial Supervisory Service (FSS) issued a consumer alert, emphasizing that there have been complaints arising from investors not fully understanding the risks of stock margin trading, urging investors to exercise special caution.

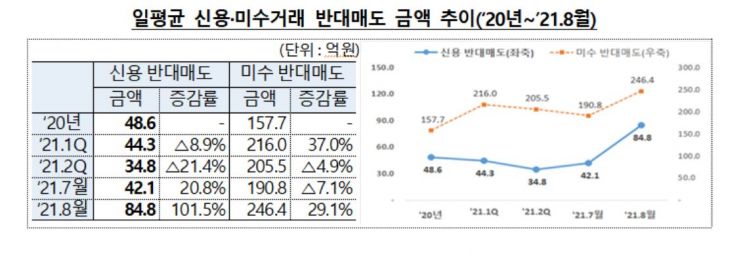

According to the FSS, stock margin trading soared from 6.6 trillion KRW in March last year to 25.7 trillion KRW as of the 13th of this month. In particular, forced liquidation?where securities firms forcibly sell stocks if individuals fail to repay borrowed funds within the deadline?jumped from an average of 4.2 billion KRW per day in July to 8.48 trillion KRW last month, doubling in just one month. Forced liquidation of the shortest-term loans, known as unsettled trades, also sharply increased from 19 billion KRW in July to 24.6 billion KRW.

The FSS explained that in leveraged investments through margin trading, when stock prices plunge sharply, the margin maintenance ratio falls below the required level, increasing forced liquidation volumes, which in turn leads to further stock price declines, thereby amplifying investment losses.

If the price of the invested stock falls below the margin maintenance ratio (typically 140% of the margin loan balance), investors must deposit additional collateral in cash by the next business day. If additional collateral is not provided within the deadline, the securities firm places a sell order at a price discounted by a certain rate (usually 15% to 20%) from the previous day's closing price. At this time, the amount sold through forced liquidation can be much greater than the collateral shortfall.

For example, if an investor purchases 1,000 shares priced at 10,000 KRW each with a total of 10 million KRW?comprising 4.5 million KRW of personal funds and 5.5 million KRW of margin loan?and the stock price falls below 7,300 KRW (the margin maintenance ratio of 140%), the securities firm will demand approximately 700,000 KRW in additional collateral. If the investor fails to provide this, forced liquidation will be calculated based on 5,600 KRW, which is 80% of the previous day's closing price (7,000 KRW). The forced liquidation amount will be about 4.75 million KRW, which is 6.8 times the collateral shortfall of 700,000 KRW.

Moreover, if the price of held stocks plummets rapidly in a short period, all held stocks may be forcibly liquidated. If the sale amount is less than the margin loan balance, so-called "empty account" losses exceeding the principal can occur.

The FSS expressed concern, stating, "As financial companies tighten loan limit management to properly control the recent rise in household loans and market interest rates are also trending upward, securing funds for additional collateral deposits in the event of a sudden stock price drop may not be easy."

The FSS urged investors to first confirm whether they can bear the risk of investment losses, then explore financial products with more favorable conditions than margin trading, and carefully review the margin trading explanation and terms provided by the brokerage firm. Additionally, investors should check the collateral ratio for margin loans and keep in mind sources of funds to cover additional collateral if there is a collateral shortfall.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.