'China Money' Floods Domestic Real Estate

Heightened Alert on Ripple Effects from Evergrande Group Default Crisis

Rising Trend of Real Estate Purchases by Chinese and Other Foreigners

Government Lacks Proper Statistics... Measures Needed

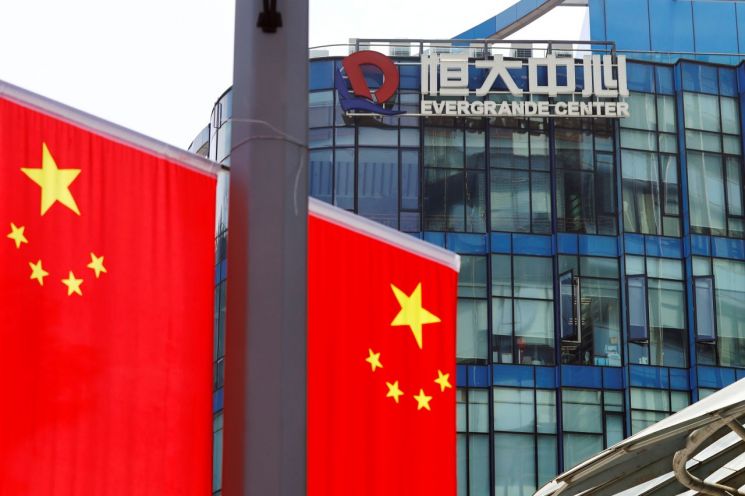

As the likelihood of default by China’s major real estate developer Evergrande Group increases, concerns are emerging that the domestic real estate market, which has seen a large influx of 'China money,' could also be adversely affected. However, the government is criticized for being vulnerable to crisis response as it has failed to properly grasp the current status of foreign real estate holdings, let alone implement measures to prevent speculation.

According to the real estate industry and major foreign media on the 27th, as Evergrande Group’s liquidity crisis continues, there is analysis that it could shock not only China but also the economies of neighboring countries. Although the risk posed by Evergrande is unlikely to escalate into a global financial crisis like the Lehman Brothers incident, the debt scale is enormous, reaching about 355 trillion won, making short-term shocks to adjacent countries inevitable.

In particular, the domestic real estate market, which has seen a massive inflow of Chinese capital, is on high alert regarding this situation. If the risk in the Chinese real estate market expands and the liquidity crisis caused by default overlap, Chinese investors may prioritize selling overseas assets, which could impact our market.

Looking at data submitted by the Ministry of Land, Infrastructure and Transport to the National Assembly, the influence of Chinese nationals on the domestic housing and land market is growing day by day. This year, there were a total of 2,778 apartment transactions by foreigners in Korea, of which 1,952 cases (70.3%) were purchases by Chinese nationals. Among the 2,394 foreign private rental business operators registered in Korea, 885 (37.0%) are Chinese, accounting for more than one-third. This indicates that the Chinese risk could affect not only land and housing but also the rental market for ordinary citizens.

Although the bankruptcy threat of Evergrande Group is increasing the crisis over Chinese real estate capital, the government has not even properly grasped the current status. The Ministry of Land, Infrastructure and Transport, the relevant department, tracks foreign housing ownership through the Building Administration System, but this statistic does not allow for detailed identification of nationality. Annual foreign land and property purchases are aggregated by nationality in different departments, but the information is rough and insufficient for countering speculation.

The National Assembly Legislative Research Office stated in a report on national audit issues released last month, "It is currently difficult to accurately grasp the status of foreign real estate acquisitions through the national statistics portal," and added, "To properly respond to speculative real estate acquisitions by foreigners, detailed surveys and data construction on regional and building use status are necessary." This issue is a recurring point of criticism from the National Assembly every year, but improvement efforts have been delayed amid government indifference.

Low regulation on foreign real estate purchases is also cited as a problem. While domestic residents face increasing difficulties in transactions due to various loan regulations and actual transaction investigations, foreigners are relatively advantaged in financing and face weaker surveillance, resulting in significant reverse discrimination. Former Minister of Land, Infrastructure and Transport Kim Hyun-mi acknowledged the seriousness of foreign real estate speculation at the Land, Infrastructure and Transport Committee plenary meeting in August last year and stated, "We will consider obligations such as actual residence," but no discussions have taken place so far.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.