Dispute Management Tasks in Financial Consumer Protection Act Improvements

Including Authority for On-Site Investigations and Data Submission Requests

[Asia Economy Reporter Oh Hyung-gil] Samsung Fire & Marine Insurance is operating an organization directly under the Chief Executive Officer (CEO) that oversees consumer protection. This organization is responsible for overall management tasks including education and system improvements related to consumer protection, as well as monitoring product development and sales, and handling complaints and dispute resolution outcomes.

Following the enactment of the Financial Consumer Protection Act (FCPA) on the 25th, the company is interpreted to be establishing an internal control system and actively reflecting consumer protection principles in its management strategy. With the end of the FCPA grace period, other insurance companies are also expected to revise or establish their own guidelines.

According to the insurance industry on the 27th, Samsung Fire & Marine Insurance decided to establish and operate a consumer protection oversight body directly under the CEO to independently perform internal control tasks related to consumer protection. The existing Consumer Policy Team will be converted into this oversight body, and Choi Sung-yeon, Executive Director and head of the Consumer Policy Team, is expected to be appointed as the chief officer responsible for consumer protection.

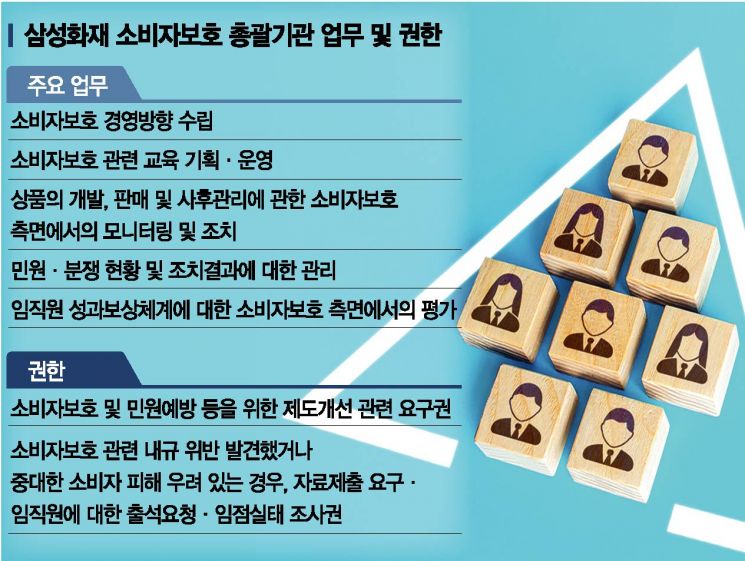

The oversight body’s main duties include establishing management directions related to consumer protection and planning and operating related education. It will also monitor consumer protection aspects throughout the entire process of insurance product development, sales, and post-management. Additionally, it will manage the status and resolution results of complaints and disputes raised by consumers.

In particular, the organization has been granted strong authority over internal departments. It can request system improvements from relevant departments to prevent consumer issues or complaints. Departments receiving such requests must promptly carry out the improvements, and if unable to do so, must explain the reasons through a committee process.

If violations of consumer protection internal regulations are discovered, or if there is concern about significant consumer harm or complaint handling, the organization can request submission of materials, summon employees, conduct on-site investigations, and if necessary, request audits from the audit team.

It can also directly take actions such as consumer protection education for employees and requests for document submission, or request cooperation from related departments, which are generally required to comply unless there are special circumstances.

Departments responsible for product development or sales must consult with the consumer protection oversight body in advance regarding product development or changes, sales suspension, and the creation or modification of important documents such as product brochures, terms and conditions, and subscription application forms. If consumer protection issues are identified, the oversight body can demand the relevant departments to halt product launches, suspend marketing, or submit improvement plans.

Samsung Fire & Marine Insurance plans for the CEO to directly conduct regular inspections at least once a year to ensure that this internal control system for consumer protection is maintained and properly operated.

The evaluation and reward system for sales employees and related departments has also been improved. In addition to sales performance, customer satisfaction and internal control items are now included. This encompasses the number of incomplete sales, customer profitability, consumer satisfaction survey results, completeness of contract-related documents, and the appropriateness of sales procedures. Measures have also been established to prevent the sales performance of specific products from being reflected in performance evaluation indicators.

An insurance industry official said, "With the full enforcement of the FCPA, insurance companies are establishing internal standards for consumer protection," adding, "Since the financial sector has historically had the highest number of consumer complaints, this is interpreted as a strong commitment to thoroughly comply with the FCPA."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.