First Foreign Company to Secure 100% Stake in China

Hana Securities "Different Approach from Other Banks,

Hengda Group Crisis Has Little Impact"

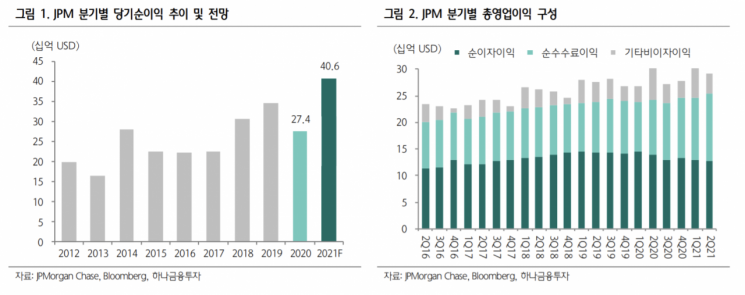

[Asia Economy Reporter Minji Lee] JP Morgan Chase is expected to improve its performance through expanded operations in China and increased interest income in the second half of the year.

According to the financial investment industry on the 25th, JP Morgan closed at 163.04 on the 24th (local time), up 1.15% from the previous trading day. Over the past three months, it has risen 5.8%, and since the beginning of the year, it has increased by about 29%.

In August, JP Morgan became the first foreign company to receive approval from the China Securities Regulatory Commission to acquire 100% ownership of its Chinese subsidiary. Following China's removal of foreign capital ownership restrictions, JP Morgan Securities expanded its stake in the Chinese subsidiary to 71% last November and has now acquired the remaining shares in full.

Jungwook Choi, a researcher at Hana Financial Investment, said, "This is expected to be a turning point for full-scale investment in China," adding, "Unlike other global banks such as Citigroup and HSBC that are withdrawing from various countries due to profitability or cost issues, JP Morgan is expanding its overseas investments."

Although there are concerns that bank stocks could be hit due to the recent default crisis of Evergrande Group, it is predicted that JP Morgan's entry into China will not be significantly affected. This is because Evergrande's debt, approximately 1.9 trillion yuan, is considered small compared to the total assets of Chinese financial institutions at 365 trillion yuan and total liabilities of about 332 trillion yuan.

JP Morgan's commercial bank, Chase Bank, announced in 2018 that it would invest $20 billion over the next five years to open 400 new branches and hire an additional 3,000 employees. So far, 230 branches have been established, and in August, branches were opened in all 48 states on the U.S. mainland.

Researcher Choi said, "Unlike other banks that are reducing the number of branches, JP Morgan is strengthening retail banking based on its branch network," adding, "As a result of branch expansion, deposits increased by $7 billion in the second quarter, which will ultimately lead to loan growth and contribute to improved profitability."

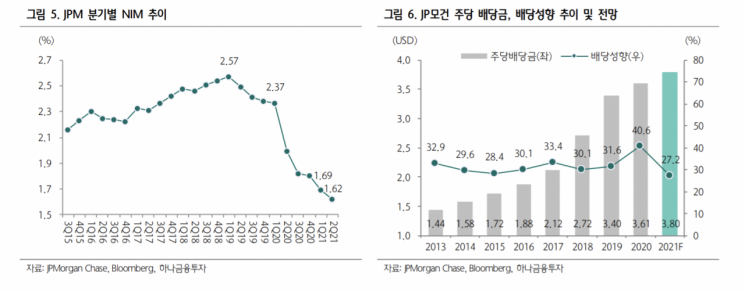

As market interest rates are expected to trend upward, JP Morgan's interest income is predicted to increase further. Since JP Morgan's loan volume surpassed $1 trillion in the second quarter and continues to show a steady upward trend, interest income is expected to rise significantly due to a rebound in net interest margin (NIM) following the interest rate hike.

Researcher Jungwook Choi said, "The U.S. CPI inflation rate in August recorded 5.3% compared to the same period last year, indicating a sharp rise in prices, and signals suggest that tapering could begin in November," adding, "JP Morgan is positioned as a representative beneficiary amid increasing tapering and interest rate pressure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)