Apple's Supply Market Share Expected to Increase... XR and Automotive Electronics Future Business Potential Also Abundant

[Asia Economy Reporter Minwoo Lee] LG Innotek is expected to deliver solid earnings in the third quarter of this year, surpassing market consensus. It is also analyzed that the company will benefit from the growth of future front-end businesses in the long term.

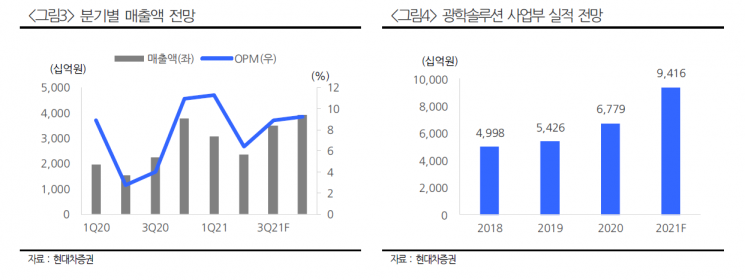

On the 25th, Hyundai Motor Securities forecast that LG Innotek will record consolidated sales of 3.4851 trillion KRW and operating profit of 309.2 billion KRW in the third quarter of this year. This represents growth of 56.3% and 245.8%, respectively, compared to the same period last year. It is also expected to exceed the market consensus of sales of 3.3941 trillion KRW and operating profit of 297.9 billion KRW.

Performance growth is expected mainly in the optical solutions business segment by supplying Apple, a major client, with second-half new product cameras, front structured light (SL) cameras, and rear time-of-flight (ToF) 3D cameras. The expansion of supply of antenna-in-package (AiP) substrates for 5G is also expected to contribute to earnings growth. Park Chan-ho, a researcher at Hyundai Motor Securities, explained, "Especially since competitors are experiencing production disruptions due to the COVID-19 situation, LG Innotek’s supply share is expected to increase."

With this trend, it is projected that LG Innotek will achieve record-high annual results with sales of 12.806 trillion KRW and operating profit of 1.166 trillion KRW this year. Researcher Park said, "Apple’s supply performance last year benefited in the first half of this year due to delayed new product launches, but this year, with normal launches, supply performance has been reflected since the third quarter." He added, "Apple plans to release mid-range models in the first half of next year, and new products in the second half of next year will stimulate demand again due to form factor changes, so profits next year are not expected to decline."

Long-term momentum is also considered solid. As a leading supplier of Apple’s optical components, growth drivers for future businesses such as increased camera pixel counts, extended reality (XR) device launches, camera modules employing folded zoom, and automotive cameras are expected to positively influence future earnings and stock price revaluation.

Against this background, Hyundai Motor Securities maintained its 'Buy' rating on LG Innotek and raised the target price by 3.6% to 290,000 KRW. The closing price the previous day was 217,000 KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)