Youth DSR Exceeds Average at 37%

Credit Loan Growth Rate 20% in Q2

Higher Proportion of Vulnerable Borrowers Than Other Age Groups

25% of Savings Bank Credit Loans via Mobile

Bank of Korea "Need to Verify Proper Screening"

[Asia Economy Reporters Eunbyeol Kim, Sehee Jang] Since the COVID-19 pandemic, household debt has surged to 1,805 trillion won, leading to an increasing number of citizens who must cut back on consumption. In particular, the burden is growing for young people in their 20s and 30s who took out loans amid the craze for ‘debt investment (Debt-tu)’ and ‘pulling together all resources (Yeongkkeul),’ as well as for low-income groups who were forced to borrow due to the pandemic. If young people, who are typically active consumers expecting steady future income, reduce spending because of debt burdens, the vitality of our economy is bound to decline. Although the Bank of Korea shifted away from its ultra-low interest rate policy early last month and financial authorities have begun tightening loan regulations to manage debt, there is growing consensus that it will not be easy to slow the pace of debt increase.

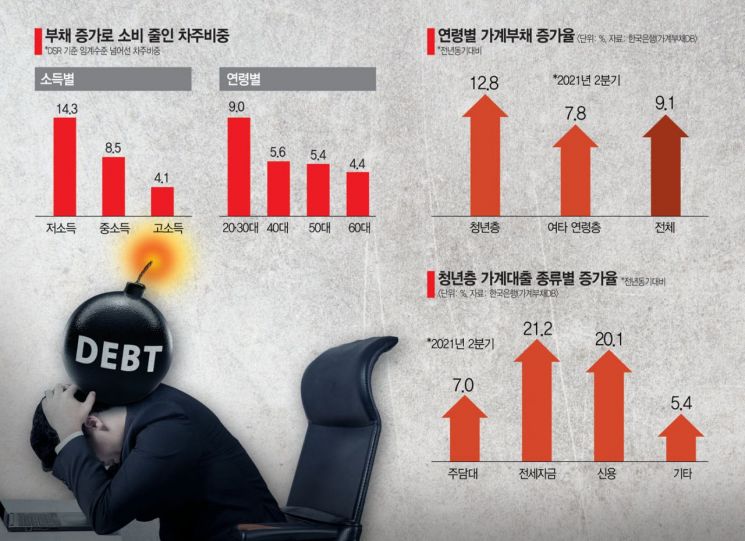

◆ Debt Hurting Consumption, Up to 72 Trillion Won = On the 24th, the Bank of Korea pointed out in its ‘Financial Stability Report’ that the proportion of domestic households able to manage debt without reducing consumption is gradually decreasing. Measuring the critical level of household debt in Korea, the total debt service ratio (DSR) and loan-to-income ratio (LTI), which restrict consumption, were 45.9% and 382.7%, respectively. Although the average DSR and LTI were somewhat comfortable at 36.1% and 231.9%, the proportion of borrowers exceeding the critical level has steadily increased to 6.6% based on LTI, up from 4% in 2017. The amount of debt these borrowers must repay to meet the critical level reaches up to 72 trillion won.

Already, among low-income and young groups, there has been an increase in cases where consumption has been reduced due to surging debt. Among low-income households, 14.3%, and among young people, 9.0% have cut back on consumption because of debt burdens. Young people, who mainly took out jeonse (key money deposit) loans due to the high proportion of rental housing, have recently increased both mortgage loans and unsecured loans. Accordingly, the DSR for young people stood at 37.1%, exceeding the average (mid-30% range). The growth rate of young people’s unsecured loans, which was around 5.0% before COVID-19, surged to 20.1% in the second quarter, and the proportion of vulnerable borrowers was 6.8%, higher than other age groups. This means that with lower income than other age groups and higher debt burdens, young people are more likely to face difficulties repaying their debts.

A Bank of Korea official said, "The contribution rate of young people to the overall increase in household debt has risen significantly," adding, "Debt burdens can also hinder healthy consumption activities." The official further noted, "Low-income groups, young people, and small businesses with limited assets or sales may face restrictions on consumption or investment due to excessive debt," warning, "These groups are likely to be the most vulnerable when a shock occurs."

Professor Jun Kyung Ha of Hanyang University’s Department of Economics also said, "Low-income and young groups are relatively highly exposed to risks because they are vulnerable to future income reductions and asset market shocks," advising, "While it is difficult to artificially protect people involved in debt investment, policy financing should be more broadly utilized for loans taken out for living expenses due to COVID-19."

◆ Savings Bank Loans Up 27% = The Bank of Korea also expressed concerns that the increase in debt burdens not only suppresses consumption and corporate investment but could also shake the financial sector if a market shock occurs. In the second quarter, the loan growth rate at savings banks was 27.1%, far exceeding that of banks (9.0%) and non-bank financial institutions (14.0%). This surge in savings bank loans was driven not only by investment demand linked to real estate development but also by increased demand for living expenses due to the impact of COVID-19. As of the end of June, the outstanding project financing (PF) loans at savings banks reached 7.8 trillion won, the highest in 10 years since September 2011 (8.8 trillion won). This was the result of borrowers rushing to savings banks as COVID-19 severely affected companies in sensitive industries, low-income households, and as bank loan regulations tightened.

The Bank of Korea also pointed out the need to pay attention to loans made through non-face-to-face channels, which have become active since COVID-19. In the second quarter, 24.5% of newly issued household credit loans at savings banks were executed via mobile loan platforms.

A Bank of Korea official said, "It is necessary to verify whether non-face-to-face loans undergo credit screening as thoroughly as face-to-face transactions," adding, "Since many savings banks are subsidiaries of financial holding companies, these connections should also be examined." The Bank of Korea also warned that delinquency rates at internet-only banks, which are expanding unsecured loans, could rise. It estimated that if loans to middle- and low-credit borrowers increase, the delinquency rate on unsecured loans at internet-only banks could rise to 2.2% in 2023. These specialized banks plan to expand the proportion of unsecured loans to middle- and low-credit borrowers to over 30% by 2023.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.