LG Display Recovers Double-Digit Operating Margin After 4 Years

Surpasses LG Electronics HE Division Profitability

Annual Operating Margin Expected to Exceed This Year

OLED Transition Accelerates Starting Q3 This Year

[Asia Economy Reporter Su-yeon Woo] LG Display has surpassed the profitability of LG Electronics, a TV set (finished product) manufacturer, for the first time in four years, thanks to the expansion of the OLED TV panel market. It is encouraging that LG Display, which supplies display panel components, is recovering profitability faster than set manufacturers by benefiting first from the 'global OLED mainstreaming.'

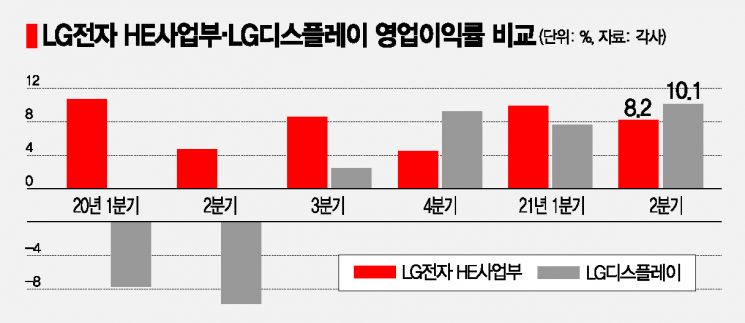

According to the industry on the 24th, LG Display's operating profit margin in the second quarter of this year recovered to double digits at 10.1% for the first time in four years, surpassing LG Electronics' Home Entertainment (HE) division's operating profit margin of 8.2%. Until the second quarter of 2017, LG Display recorded an operating profit margin exceeding 12%, but from the second half of 2017, when the LCD price decline began in earnest, it failed to defend profitability and recorded a negative operating profit margin close to -10% (-9.7%) in the second quarter of 2020.

However, from the second half of last year, as LCD panel prices began to rise sharply and the trend of expanding OLED panel adoption continued, LG Display recovered to the 9% range in the fourth quarter of 2020, surpassing LG Electronics' HE division's operating profit margin for the first time in three and a half years. Since the beginning of this year, LG Electronics has also been increasing the proportion of premium products focused on OLED TVs, showing a simultaneous rise in profitability for both companies.

Furthermore, driven by the expansion of OLED lineups by global TV manufacturers and strong worldwide OLED TV sales, there is a forecast that LG Display will surpass LG Electronics' HE division's profitability for the first time in four years on an annual basis this year. This is because LG Display's OLED transition work is expected to accelerate from the second half of this year, leading to a significant recovery in profitability.

The industry expects LG Display's large OLED business division to turn profitable in the third quarter, marking eight years since entering this business in 2013. The small and medium-sized OLED business, mainly for smartphones, is also expected to perform well as shipments of panels for Apple's new iPhone models are anticipated to increase.

Meanwhile, LCD prices, which had been soaring since the second half of last year, have turned downward starting from the third quarter of this year. The price of LCD TV panels (43-inch standard) in the first half of September fell by 5.3% compared to the previous half-month period, marking an overall downward trend. From LG Display's perspective, it is crucial to defend profitability against falling LCD prices and to enter a virtuous cycle through the expansion of OLED adoption. The need to expand the overall OLED business is emphasized, including not only large W-OLED panels supplied for TVs but also small and medium-sized OLEDs applied to smartphones and plastic OLEDs (P-OLED) for vehicles.

LG Display's recent investment strategy worth 5 trillion won is also interpreted as a foundation expansion for full-scale OLED transition. Last month, LG Display announced plans to invest 3.3 trillion won over the next three years in 6th-generation small and medium-sized OLED facilities, and this month, it decided to invest 1.4 billion dollars (1.6 trillion won) to expand the OLED module line located in Haiphong, Vietnam.

Researcher Kim Cheol-jung of Mirae Asset Securities said, "It is a time when strategic judgment on OLED transition investments by domestic display companies is necessary," adding, "Starting from the third quarter of this year, LCD is expected to enter a profit decline cycle due to continued cost burdens, whereas OLED is expected to enter a profit increase cycle."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.