Korea Investment & Securities "Not a Hindrance to Bank Industry Improvement Trend... Mid- to Long-Term Growth Potential Remains Valid"

The counter of a commercial bank in Seoul on the afternoon of the 30th of last month [Image source=Yonhap News]

The counter of a commercial bank in Seoul on the afternoon of the 30th of last month [Image source=Yonhap News]

[Asia Economy Reporter Minwoo Lee] There is an analysis that the government's household debt management measures are not a particular negative factor for bank stocks. It is explained that these measures do not reverse the short-term improvement trend in the banking industry and are rather positive for sustainable growth in the mid to long term.

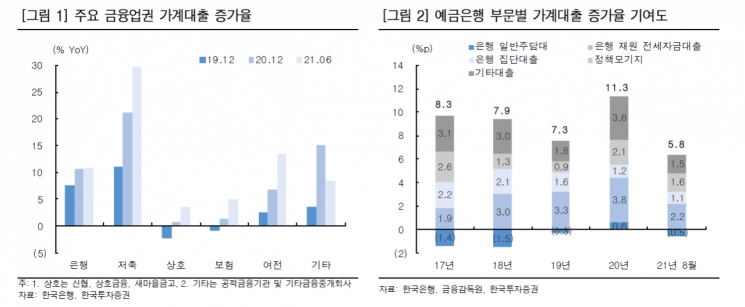

On the 20th, Korea Investment & Securities made this forecast regarding bank stocks. Despite the government's tightening loan policies, the rise in net interest margin (NIM), improvement in asset quality, and increase in total assets are effective, indicating a steady growth in profits. In particular, concerns about a sharp drop in the household loan growth rate are considered excessive. The current annual growth rate of 10.3% is expected to slow to 7% next year, indicating a soft landing rather than a hard landing.

After NongHyup Bank announced on the 20th of last month that it would stop new real estate loans, the banking industry index increased by only 1.9%. Despite the base interest rate hikes, it has not significantly outperformed the KOSPI, which rose by 1.0%. This is because several banks and non-bank institutions have recently reduced limits or temporarily suspended new issuance of credit loans (including limit loans) and jeonse (key money) loans, starting with NongHyup. Additionally, the upcoming announcement of household loan management measures by financial authorities after the Chuseok holiday has also been a burden.

Household loan management measures under consideration include the early introduction of 2-3 stages of borrower-level total debt service ratio (DSR), strengthening DSR limits for the secondary financial sector, and including card loans under DSR regulations. However, these policies are expected to focus only on bank credit loans and non-bank household loans. Non-bank household loans surged by 9.8% year-on-year as of June. Baek Doosan, a researcher at Korea Investment & Securities, stated, "Policy efforts to block the balloon effect need to be proactively focused on non-banks," adding, "Especially since DSR is a management indicator based on the combined financial sector, strengthening DSR will act as a suppressive effect on non-bank loans."

The year-on-year growth rate of other bank loans, which reached 11.8% as of last month, is expected to stabilize downward to around 6-7% annually. This is attributed to the preemptive restrictions on high-value credit loans implemented last November and the DSR strengthening applied since July. In particular, it is anticipated that the growth rate of other loans will not easily fall to the low single digits, as loans continue to be used in asset markets such as real estate and stock investments. According to a full survey of funding plans, approximately 9.4 trillion KRW of credit loans were used for real estate acquisition funds from March last year to July this year. This accounts for about 22% of the 43 trillion KRW increase in other bank loans during the same period.

Researcher Baek analyzed, "Considering credit loans used for real estate transaction costs such as acquisition tax and jeonse deposit coverage, more than 30% of the increase in bank credit loans was likely used for real estate-related funds," adding, "Therefore, considering funds for living stabilization and capital market utilization, it is unlikely that the annual growth rate of other bank loans will fall below 6% in the future."

Furthermore, even when considering the contribution of each sector's household loan growth rate in deposit banks, it is structurally difficult for the overall bank household loan growth rate to fall below 7%. This is because jeonse loans, group loans, and policy mortgages require a soft landing approach rather than abrupt regulatory tightening, in line with the government's principle of supporting real demand. In particular, jeonse loans require detailed policy responses, considering that nationwide jeonse prices increased by 11% year-on-year in August this year due to the Lease Protection Act and the increase in the number of households.

Researcher Baek emphasized, "In the short term, these policies are not factors that reverse the improvement trend in the banking industry, but in the mid to long term, they are rather positive for sustainable growth," adding, "Essential household debt measures do not diminish the attractiveness of bank investments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.