[Asia Economy Reporter Kiho Sung] Fintech companies such as KakaoPay Securities and Toss Securities are actively working on 'fractional stock trading.' Although recently impacted by the Financial Consumer Protection Act (FCPA), fractional trading has been a long-cherished goal for fintech firms. Therefore, they are expected to launch aggressive marketing campaigns to attract MZ generation customers.

According to the financial sector on the 19th, the Financial Services Commission recently improved the system to allow fractional trading of domestic and foreign stocks. It plans to designate innovative financial services for securities companies that wish to provide fractional trading services through the Korea Securities Depository between October and November.

So far, only two securities companies?Korea Investment & Securities and Shinhan Financial Investment?have offered fractional stock trading, limited to foreign stocks. As of the end of June, the cumulative trading scale was 140,000 users and 315.9 billion KRW for Shinhan Financial Investment, and 510,000 users and 877.5 billion USD for Korea Investment & Securities. The financial authorities intend to improve the system to allow fractional trading not only for foreign stocks but also for domestic stocks.

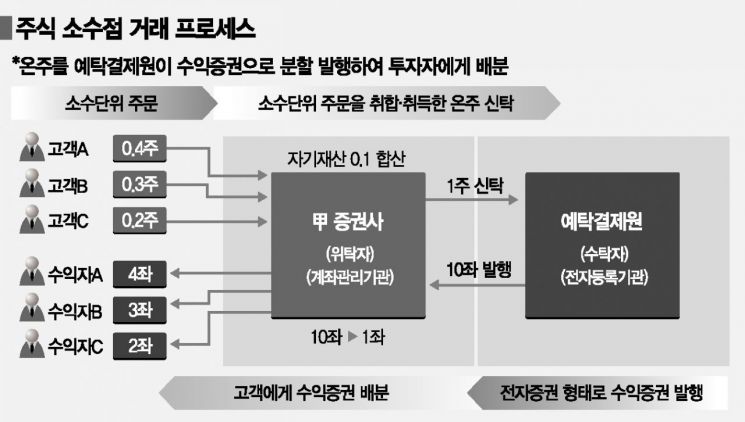

Fintech companies have consistently emphasized the need for fractional trading. Fractional trading allows expensive stocks to be divided and bought or sold in fractional units such as 0.1 shares or 0.01 shares. For example, a stock worth 1 million KRW can be divided into fractional units and purchased for 10,000 KRW (0.01 shares). This enables investment in blue-chip stocks with a small amount of money. Until now, domestic stocks have been difficult to introduce fractional trading due to infrastructure issues designed around the indivisibility principle of stocks, which requires trading in whole shares (1 share).

Fintech companies have begun full-scale preparations in line with government policies. Securities companies wishing to provide the service must apply for innovative financial service designation with the Korea Securities Depository between October and November this year and receive approval from the Financial Services Commission. Toss Securities plans to participate in the application process starting next month. KakaoPay Securities has not set a specific date yet but plans to join fractional trading in line with the launch of its mobile trading system (MTS) scheduled for the end of this year.

In particular, both companies target customers in their 20s and 30s, making them the securities firms expected to benefit the most from the introduction of fractional trading for domestic and foreign stocks.

A Toss Securities official said, "Fractional trading will lower the entry barrier for novice investors starting their investment journey and provide an opportunity to access blue-chip stocks more easily with small amounts."

Kim Daehong, CEO of KakaoPay Securities, stated, “We warmly welcome the Financial Services Commission’s announcement allowing fractional trading of domestic and foreign stocks. We will leverage this system improvement as a stepping stone to promote a new culture where anyone can invest steadily with small amounts. We will expedite the related procedures for fractional stock trading and strive to provide a service that allows investors to conveniently and safely make small investments in line with the MTS launch within this year.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)