Naver Financial Rebuts Claims of Unfair Comparison with Credit Cards and Equity Issues

[Asia Economy Reporter Ki Ha-young] As concerns arose that big tech (large information and communication companies) fees are up to three times higher than credit card fees, Naver Financial rebutted that the comparison is not between the same subjects. The actual fee rate is only 0.2~0.3% because it includes fees paid to credit card companies and order management fees.

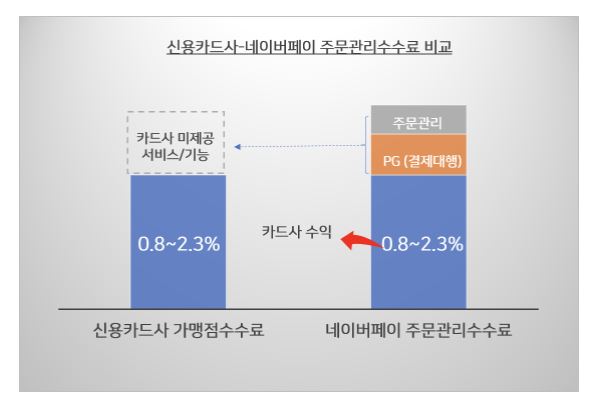

According to Naver Financial on the 16th, Naver Pay fees consist of merchant fees paid to credit card companies and fees related to the role of payment gateway (PG) companies, which bear the risk of losses due to defaults by online shopping malls with low credit.

In particular, the order-based payment fee (order management fee) applies to order-based merchants among Smart Store and external independent shopping malls. It includes not only the PG role but also order management services such as sales management including shipping, exchanges, and returns, delivery tracking, fast settlement support, fraud detection system (FDS), inquiry and membership management, and customer center operation.

For payment-type merchants that provide simple payment without order management functions, the payment fee rate is said to be around 1.1~2.5%, according to the company. Considering the fee of 0.8~2.3% paid to credit card companies, Naver Pay’s actual fee rate is claimed to be only 0.2~0.3%. This includes risk burden costs (escrow) and system operation costs incurred by acting as a representative merchant for credit cards on behalf of small business owners.

Naver Financial stated, "Naver Pay’s payment fees and order management fees are both at the lowest level in the industry," and added, "Especially, Naver Smart Store’s order management fee is the lowest in the e-commerce industry."

They also emphasized, "Since the end of July, Naver Pay has unified fees by removing distinctions by payment method for all fees including order management fees and payment fees, and applied a single fee based on sales grades such as small, medium, and general sales. For all payment methods other than credit cards, preferential fees for small and medium-sized merchants are applied equally as with credit cards."

Meanwhile, Kim Han-jung, a member of the National Assembly’s Political Affairs Committee from the Democratic Party, criticized the day before that big tech payment fees for small merchants with annual sales under 300 million KRW are up to three times higher than credit card fees. As of the end of last month, the merchant fee for credit card preferred merchants with annual sales under 3 billion KRW ranged from 0.8% to 1.6%, while big tech payment fees ranged from 2.0% to 3.08%. In particular, for small merchants with annual sales under 300 million KRW, the credit card fee was 0.8%, whereas Naver Pay’s order-based payment fee was 2.2%, nearly three times higher. For the sales bracket exceeding 3 billion KRW, credit card fees were 2.3%, and big tech fees were recorded at 3.2% to 3.63%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.