Card Companies Halt New Card Issuance Citing Cost Reduction

130 Card Types Discontinued by July

Portfolio Adjusted Due to Changing Consumer Patterns

Consumers Complain About Reduced Benefits

Industry Warns Further Merchant Fee Cuts This Year Will Make Benefit Reductions Inevitable

[Asia Economy Reporter Ki Ha-young] Card companies facing profitability deterioration are consecutively stopping the issuance of existing cards, citing cost reduction and other reasons. There are concerns that consumer benefits are gradually decreasing as not only simple partnership cards but also steady sellers are being discontinued.

According to the industry on the 16th, Lotte Card stopped issuing new cards such as Happy Point Lotte Card and Kyobo Bookstore Hottracks Lotte Card starting from the previous day. This month, partnership cards like Marine Corps Veterans Daily, I Love Seoul Management Corporation, and Jigeum Shop were also discontinued.

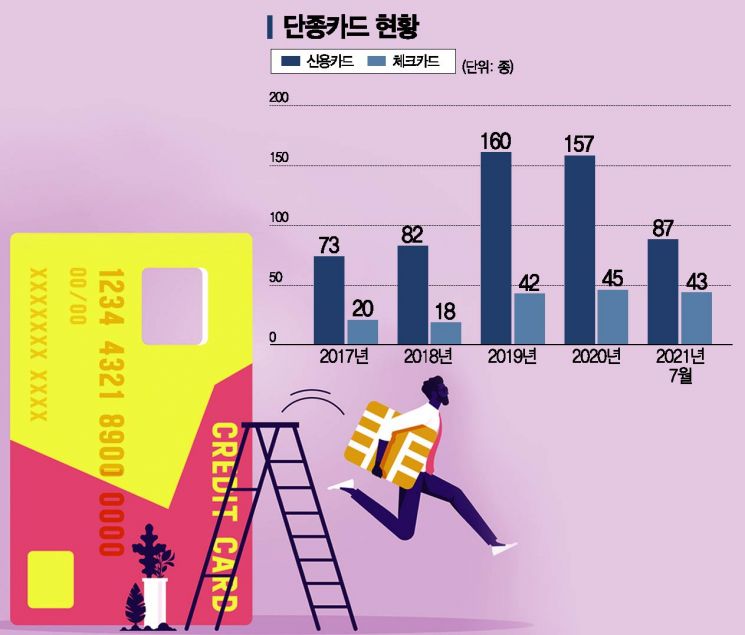

By July, the number of discontinued credit and check cards has already exceeded half of the cards discontinued last year. The total number of discontinued credit and check cards by the seven major card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Woori, Hana) as of the end of July this year reached 130 types (87 credit cards and 43 check cards). This figure is close to 65% of last year's 202 types (157 credit cards and 45 check cards).

This includes steady sellers that have been loved for a long time. Shinhan Card stopped selling the 'Lady Card,' which was launched in 1999 during the LG Card era and had been popular for 20 years, in July. Among the cards discontinued by Lotte Card was the so-called 'All My Shopping Card,' which could be used for asset management, causing disappointment among consumers. Hana Card attracted attention by stopping the issuance of 89 types of cards at once in June, including 49 credit cards and 40 check cards.

The industry explains that the cards recently discontinued were products launched more than 10 years ago and no longer in demand due to changes in customer consumption patterns. They say this is part of launching alternative products following the latest trends such as Private Label Credit Cards (PLCC) and reorganizing product portfolios. However, consumers have expressed dissatisfaction that the revamped cards offer fewer benefits compared to before. Some even conduct marketing encouraging the cancellation of already discontinued cards. Kim Seong-mi (pseudonym, 36), a housewife, said, "I recently received a call from a card company recommending the cancellation of a card that had already been discontinued," adding, "They said they would give me a department store gift certificate worth 180,000 won if I canceled the card, but since the card still had one year of benefits left with three years remaining on its validity, I declined."

The discontinuation of these cards is rooted in the deterioration of card companies' profitability. In fact, the merchant fee revenue, which was the main source of income for card companies, is steadily decreasing. According to the Financial Supervisory Service's Financial Statistics Information System, the merchant fee revenue of the seven major card companies in the first quarter of this year was 1.1468 trillion won, nearly half of the 2.2436 trillion won recorded in the first quarter of 2018 before the merchant fee adjustment. Additionally, since last year, the introduction of the 'Profitability Analysis System Guideline,' which allows card companies to release only products that can generate profits over the next five years based on profitability analysis, has made it difficult to launch cards with high-cost benefits.

An industry official said, "Card companies, which have cut costs due to the reduction of merchant fees, have no choice but to discontinue products that are not profitable," adding, "If the atmosphere for fee reduction continues in the fee reassessment scheduled for this year, the benefits returned to consumers, such as card benefits, will inevitably decrease."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)