[Asia Economy Reporter Park Sun-mi] The COFIX (Cost of Funds Index), which serves as the benchmark for variable interest rates on mortgage loans in the banking sector, rose by 0.07 percentage points.

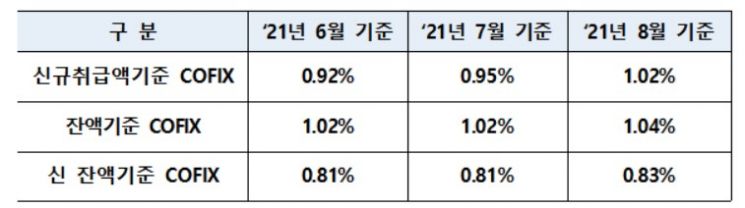

On the 15th, the Korea Federation of Banks announced that the August COFIX based on new loan amounts recorded 1.02%, an increase of 0.07 percentage points compared to the previous month. This marks the third consecutive month of increase since June. The outstanding balance-based COFIX also rose by 0.02 percentage points to 1.04%, and the new outstanding balance-based COFIX increased by 0.02 percentage points to 0.83%.

COFIX is the weighted average interest rate of funds raised by eight domestic banks. It reflects changes when banks raise or lower interest rates on deposit products such as actual deposits, savings, and bank bonds. While the outstanding balance-based and new outstanding balance-based COFIX generally reflect market interest rate changes gradually, the new loan amount-based COFIX is calculated based on funds newly raised during the month, so it tends to reflect market interest rate changes more quickly.

Commercial banks will apply the August COFIX rate level disclosed on this day to new variable-rate mortgage loans starting from the 16th.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)