Google Under Investigation for 'Forced OS Pre-installation' and Three Other Cases Including App Market

Kakao and Coupang Also Likely to Face Sanctions

Platforms Remain a Key Topic in National Assembly Audit

Strict Regulations Expected to Continue

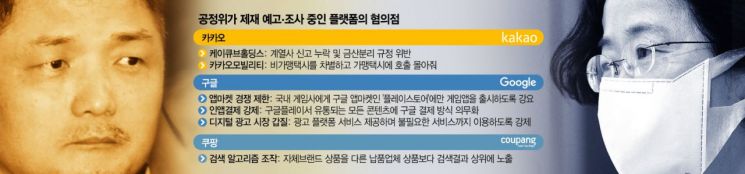

[Sejong=Asia Economy Reporter Joo Sang-don] The Fair Trade Commission (FTC), the main regulatory authority for platforms, is expected to increase the severity of sanctions against tech companies such as Google, Kakao, and Coupang. The top officials of the agency have unusually mentioned ongoing investigations directly, leading to interpretations that the FTC is effectively moving toward imposing sanctions. Some insiders have even said, "The FTC's sanctions are just beginning."

An FTC official stated on the 15th, "In addition to the already announced case regarding Google's forced operating system (OS) pre-installation, we are currently investigating three other cases related to Google," adding, "Regarding the case where Google allegedly obstructed game companies from launching services on competing app markets, we sent a review report (equivalent to a prosecutor's indictment) in January this year and are currently coordinating the schedule for a plenary meeting to make a final determination on the legality."

Previously, the FTC imposed corrective orders and a fine of 207.4 billion KRW on Google for forcing smartphone manufacturers such as Samsung and LG to pre-install its Android OS. Chairman Cho Sung-wook announced the sanction results and revealed, "The ICT dedicated team is investigating a total of three cases including app market competition restrictions, forced in-app payments, and the advertising market," signaling additional sanctions against Google.

◆Next Target: App Market Competition Restrictions= Among the Google-related issues under investigation, the case most likely to reach a conclusion first is the restriction of competition in the app market. Since 2018, the FTC has been investigating allegations that Google forced domestic game companies such as Nexon, NCSoft, and Netmarble to release their apps exclusively on its app market, the Play Store. The FTC sent a review report to Google in January this year.

The FTC is also investigating the forced in-app payment case, which was reported. In-app payment refers to the practice where apps listed on a company's app market are required to use only the payment system created by that company when selling digital goods and services. Last year, Google announced that it would mandate Play Store in-app payments, previously applied only to mobile games, for all apps and impose a 30% commission. However, since the amendment to the Telecommunications Business Act, known as the 'Google Gapjil Prevention Act,' has passed the National Assembly and is now in effect, the FTC is seeking ways to avoid overlapping regulations. Additionally, the FTC is investigating allegations of 'digital advertising market gapjil,' where Google allegedly forced the use of unnecessary services while providing advertising platform services.

Kakao and Coupang are also expected to be included among the sanction targets. Recently, FTC Vice Chairman Kim Jae-shin pointed out, "There is an ongoing investigation following reports that major domestic mobility platforms discriminated against non-affiliated taxis and favored affiliated taxis in dispatching," adding, "There are also ongoing concerns that major online shopping platforms displayed their private brand (PB) products in prominent positions while relegating products from tenant companies to lower positions."

◆Kakao Accounts for 80% of Nationwide Branded Taxis= According to data on affiliated (branded) taxis received by Representative Kim Sang-hoon (People Power Party) from the Ministry of Land, Infrastructure and Transport and Kakao Mobility, as of the end of June, out of 29,820 affiliated taxis nationwide, 23,271 (78.0%) were KakaoT Blue. This means that about 8 out of 10 branded taxis nationwide are KakaoT Blue.

The FTC is also considering prosecuting Kim Beom-su, Chairman of Kakao's Board of Directors, for failing to properly report designated data of the holding company K Cube Holdings. Designated data refers to the status of affiliated companies, relatives, and shareholders submitted annually by the controlling shareholder (head) of a corporate group to the FTC for designating publicly disclosed corporate groups. If this data is falsified or intentionally omitted, fines may be imposed or prosecution may follow. The FTC is also examining possible violations of the 'separation of finance and industry' regulations.

Inside and outside the government, there is a growing expectation that the FTC's platform regulations are still in the early stages. A National Assembly official familiar with the FTC's affairs said, "The FTC will take a strong stance to reinforce its role as the main regulatory authority for platforms."

Chairman Cho has previously expressed concerns, stating, "The platform sector is structurally difficult for latecomers to enter the market due to the 'network effect' and 'concentration phenomenon,' where utility increases as more users join," and added, "Platform operators who have secured market dominance may engage in anti-competitive behaviors such as demanding exclusive dealing to exclude competitors or transferring their dominance to other markets to maintain and strengthen their monopolistic position."

Platforms are expected to remain a major topic in the upcoming National Assembly audit next month. An opposition party official said, "As issues such as protection for platform workers and small business owners who are tenants arise, both ruling and opposition parties are preparing to strongly criticize various problems of platform companies," adding, "There is a high possibility that negative sentiment toward platform companies will spread."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)