[Asia Economy Reporter Park Byung-hee] Concerns are mounting that Evergrande Group (Hengda Group), China's largest private real estate developer, may go bankrupt. Although Hengda Group denied market rumors on the 13th that it would file for bankruptcy protection, credit rating agency Fitch warned that Hengda might fail to pay bond interest due on the 23rd. Last week, Fitch downgraded Evergrande's bond credit rating to junk (non-investment grade).

Evergrande Group's bankruptcy would significantly impact China's financial market and could damage international credibility, prompting the Chinese government to consider countermeasures.

Bloomberg reported on the 14th (local time), citing sources, that the Chinese government is assembling accounting and legal experts to review Evergrande Group's asset status. Analysts suggest that the Chinese government is conducting preliminary work for restructuring Evergrande Group, which is facing a liquidity crisis. Bloomberg analyzed that Evergrande Group's restructuring would be one of the largest in China's history.

According to sources, the Guangdong provincial government, where Evergrande Group's headquarters is located, entrusted one of China's largest restructuring law firms, King & Wood Mallesons, with the Evergrande issue last month. Additionally, financial advisors were dispatched to Evergrande Group under orders from the central government. Currently, Evergrande Group's debt is estimated at about $300 billion (approximately 352 trillion KRW).

In a report submitted to the stock exchange on the same day, Evergrande Group acknowledged that it is facing a severe liquidity crisis. It stated that there has been no progress in asset sales plans to overcome the liquidity crisis. The sale of stakes in the electric vehicle business and real estate services business has not progressed, and the sale of the Hong Kong headquarters building has not proceeded as planned. Founded in 1997 in Guangdong Province by Chairman Xu Jiayin (63), Evergrande Group started in real estate and expanded into finance, healthcare, travel, sports, and electric vehicles.

Evergrande Group also stated that although September is usually an active month for home purchases, housing sales are expected to decline due to decreased buyer confidence. Bloomberg explained that the situation is unlikely to improve without government intervention.

To resolve the issues, Evergrande Group announced that it has independently hired U.S. investment bank Houlihan Lokey and other financial advisors. Houlihan Lokey has advised on over 1,400 restructuring cases totaling more than $3 trillion since 1988 and participated in the Lehman Brothers restructuring. Evergrande said it will work with Houlihan Lokey and others to review group assets and devise solutions for all stakeholders.

Daniel Pan, an analyst at Bloomberg Intelligence, said, "It appears they have started bond restructuring after asset sales failed to produce results," adding, "Especially the issue of asset management products could become a social issue, so it will be a top priority to resolve."

Investors and product buyers who suffered losses due to Evergrande Group protested in front of Evergrande Group's headquarters in Shenzhen, Guangdong Province, China, on the 14th (local time), despite the rain.

Investors and product buyers who suffered losses due to Evergrande Group protested in front of Evergrande Group's headquarters in Shenzhen, Guangdong Province, China, on the 14th (local time), despite the rain. [Image source= Bloomberg AFP]

Protests by investors and product buyers who suffered losses due to Evergrande Group continue at Evergrande offices across China. In front of the headquarters building in Shenzhen, Guangdong Province, protests have continued for three consecutive days until the 14th.

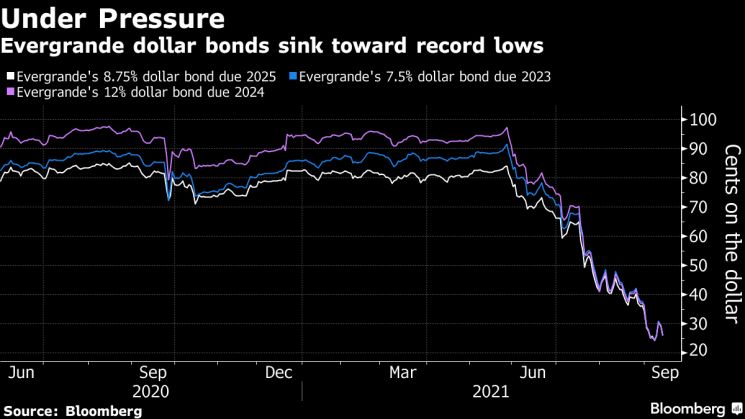

On the same day, Evergrande's stock price fell 12% in the Hong Kong stock market. The annual decline rate expanded to 80%, and the current stock price is the lowest since November 2014. The price of Evergrande bonds maturing next year also plunged 5.5 cents to 27 cents.

None of Evergrande's bonds mature this year. However, it must pay $669 million in interest this year. It must pay $83.5 million in interest on the 23rd, as Fitch warned.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.