The heads of 15 major domestic conglomerates have united to form the K-Hydrogen Alliance. They plan to invest a staggering 43.4 trillion KRW by 2030 to develop the hydrogen industry. The alliance will promote cooperation among companies in the hydrogen sector and propose policies to the government, playing a consultative role in leading the hydrogen economy. This alliance is expected to invigorate hydrogen industries such as automotive, petrochemicals, and materials. Stock prices of hydrogen-related companies are also fluctuating, with material companies experiencing particularly steep rises. Reflecting market interest, Asia Economy examines the current status and growth potential of Hyosung Advanced Materials, which produces the core material 'carbon fiber' for hydrogen tanks, and Kolon Industries, which manufactures hydrogen vehicle parts and materials.

[Asia Economy Reporter Park So-yeon] Kolon Industries is a chemical materials company engaged in various industries including industrial materials, films and electronic materials, and fashion. The recent market attention on Kolon Industries stems from its success in domestic production and mass production of core materials for hydrogen fuel cells. Interest in Kolon Industries has increased further following Hyundai Motor Company's announcement to expand hydrogen vehicles, as Kolon Industries has secured key material technologies used in the hydrogen value chain. Kolon Industries is considered an undervalued hydrogen-related stock.

◆ Expectations for 'Cash Cow' Hydrogen Vehicle Core Parts and Materials = Since beginning research on membrane technology for hydrogen fuel cells in 2006, Kolon Industries has continuously expanded its business based on its technological capabilities in the hydrogen fuel cell field. Kolon Industries' main hydrogen business products include moisture control devices for hydrogen fuel cells, polymer electrolyte membranes (PEM), and membrane electrode assemblies (MEA). The moisture control device is a core component that maintains internal humidity at a constant level to ensure efficient electricity generation within hydrogen fuel cells. PEM is one of the essential components of hydrogen fuel cells, serving as a selectively permeable membrane. MEA is a film-type assembly that facilitates the chemical reaction between oxygen and hydrogen in hydrogen fuel cells, converting it into electrical energy.

These materials and parts had not received much commercial attention until recently, but with Hyundai Motor Company leading visible hydrogen projects, there is widespread expectation that Kolon Industries will significantly contribute to increasing corporate value.

Kolon Industries is the first in Korea to begin mass production of moisture control devices and currently holds the global market share number one in this product category. The reason Kolon Industries' moisture control device is particularly notable is that it manages water and temperature in the stack (electricity generation device) and also reduces hydrogen concentration in exhaust gases. It is supplied to Hyundai Motor Company's hydrogen electric vehicle Nexo, and large-scale expansion is underway. In June, Kolon Industries secured a large-scale contract to supply upgraded moisture control devices for the new Nexo model scheduled for release in 2023. Based on this, the company is actively developing overseas markets with a goal of achieving over 50% market share globally after 2025.

Core materials for hydrogen fuel cells such as PEM and MEA are also accelerating efforts to penetrate the global market. PEM and MEA account for 40% of the cost of the electricity generation device in hydrogen fuel cells, with market sizes estimated at 1 trillion KRW and 3 trillion KRW respectively by 2025. Kolon Industries is establishing a PEM mass production line at its Gumi plant and plans to expand supply by leveraging its in-house MEA production capabilities to optimally meet customer demand.

A Kolon Industries representative stated, "As the global number one company in moisture control devices, we have established a full production system from PEM material production to module assembly, leading the global market. We are currently collaborating with various global customers and are considering expansion investments to prepare for rapidly increasing demand and market activation."

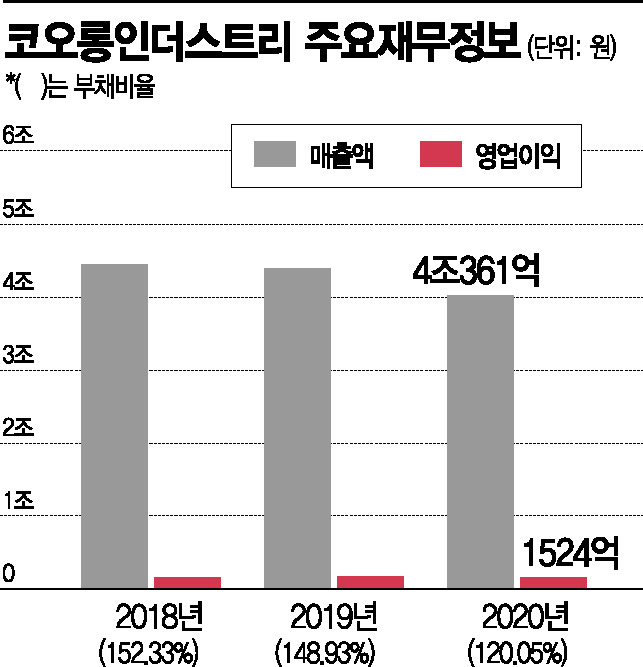

◆ Balanced Portfolio Beyond Hydrogen Vehicle Business = Kolon Industries has consistently maintained sales in the 4 trillion KRW range over the past three years: 4.4598 trillion KRW in 2018, 4.4072 trillion KRW in 2019, and 4.0361 trillion KRW in 2020. Operating profits during the same period were 166.9 billion KRW, 172.9 billion KRW, and 152.4 billion KRW, with operating profit margins of 3.74%, 3.92%, and 3.78%, respectively.

This year, the company achieved a strong performance by surpassing 100 billion KRW in operating profit on a quarterly basis for the first time in 10 years. In Q2 of this year, consolidated sales reached 1.1841 trillion KRW, with operating profit of 103.6 billion KRW. Operating profit for the first half of the year was 172.7 billion KRW. Recording over 100 billion KRW in operating profit on a quarterly basis is the first time since Q2 2011. Securities firms expect Kolon Industries' operating profit for the year to return to the 300 billion KRW level for the first time in 10 years since 2011 (402.1 billion KRW).

The strong Q2 performance was driven by sales of the 'three major materials'?aramid, polyimide, and tire cords?all chemical materials related to new industries. Aramid, known as a 'super fiber,' serves as a reinforcing material supporting 5th generation (5G) communication optical cables internally. Transparent polyimide film, which does not scratch even after hundreds of thousands of folds, is essential for foldable phone production. High value-added tire cords, which shape tires and enhance durability, are used in electric vehicles. In the fashion sector, sales of golf wear and outdoor products increased due to COVID-19, contributing to improved performance. This balanced portfolio is regarded as a solid pillar even amid global economic conditions.

Kolon Industries' debt ratio improved from 152.33% at the end of 2018 to 120.05% at the end of 2020. Interest-bearing debt also decreased by about 18%, from 2.2672 trillion KRW at the end of 2018 to 1.8576 trillion KRW at the end of 2020. Baek Young-chan, a researcher at KB Securities, said, "Corporate value is expected to rise through active expansion and commercialization of hydrogen fuel cell materials. With expanding demand for 5G cables and electric vehicle tire cords, the high profitability of aramid is expected to continue until 2025."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.