Scheduled Display Industry Report

China Narrows Quality Gap and Rapidly Catches Up... "Government Support Needed for Cooperation Between Large Corporations and SMEs and Expansion of R&D"

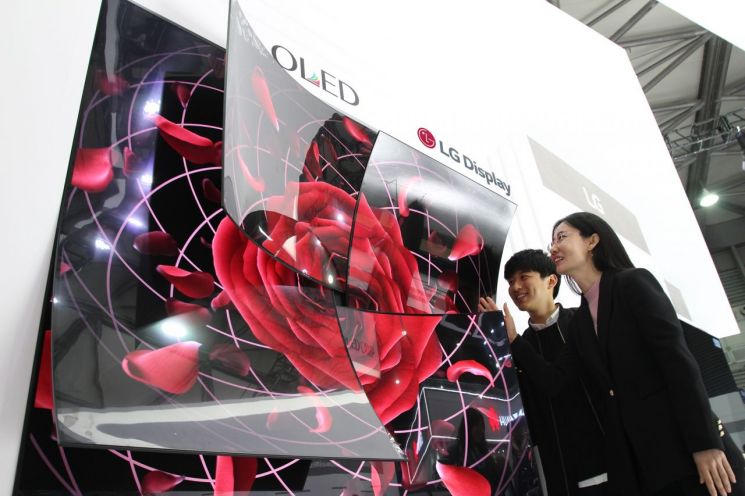

[Sejong=Asia Economy Reporter Kwon Haeyoung] A survey has revealed that South Korea's organic light-emitting diode (OLED) industry, ranked number one globally, generates an annual production value of 27 trillion won and employment for 100,000 people through exports. However, as China narrows the quality gap with South Korea and aggressively pursues the OLED market following the liquid crystal display (LCD) sector, concerns have been raised that government-level measures are necessary to prevent losing leadership in the OLED market.

According to the report titled "Analysis of Export Fluctuation Factors and Economic Effects of the Display Industry" released by the National Assembly Budget Office on the 13th, the production inducement effect of exports in the OLED and other electronic display device sectors last year amounted to 26.8318 trillion won, and the value-added inducement effect generated 9.5029 trillion won. These figures represent 70.5% and 68.8%, respectively, of the total display export effects.

The employment inducement effect of OLED and other exports last year reached 103,687 people, accounting for 76.2% of the total employment created by display exports. This indicates the significant ripple effect OLED has on the domestic economy and employment.

The trade specialization index of the domestic OLED industry against the world was calculated at 0.77. Based on zero, a value closer to 1 indicates specialization in exports, while closer to -1 indicates specialization in imports. The trade specialization index against China was also high at 0.73, indicating a strong export orientation.

The problem is that South Korea's competitive advantage in the global OLED market is gradually being threatened. In particular, the overwhelming quality advantage over China has been diminishing. The export-import unit price ratio with China dropped from 5.8 in 2017 to 2.3 in 2020. A ratio exceeding 1.25 indicates a quality advantage; although South Korea still maintains higher quality competitiveness compared to China, this figure is steadily decreasing.

In fact, China is rapidly catching up to South Korea in the OLED market, supported by government backing and price competitiveness. While the global OLED sales growth rate declined from 42.2% in 2017 to 7.4% in 2019, China's OLED market share increased from 1% to 9.8% during the same period.

Choi Sejung, an economic analyst at the National Assembly Budget Office, stated, "Although the domestic OLED industry maintains the world's number one market share and quality advantage over China, China is rapidly closing the gap and the quality advantage is weakening. The government should actively support cooperation between large corporations and small and medium enterprises to reduce external dependence on materials, parts, and equipment industries, and create new added value by expanding research and development (R&D) investment to secure next-generation display technologies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)