Operating Profit Estimates for 94 Stocks Revised Upward Compared to a Month Ago

Korean Air Tops with 97.2% Increase

Cargo Sector Outperforms Market Expectations

Significant Consensus Upgrades for Nepes, Samsung Life, Dongkuk Steel, and Others

[Asia Economy Reporter Song Hwajeong] As the stock market continues to show sluggish trends, attention is focusing on third-quarter earnings. In a situation where concerns about a peak-out (passing the high point) in the economy are growing, stocks that demonstrate clear earnings growth are expected to show differentiated stock price movements.

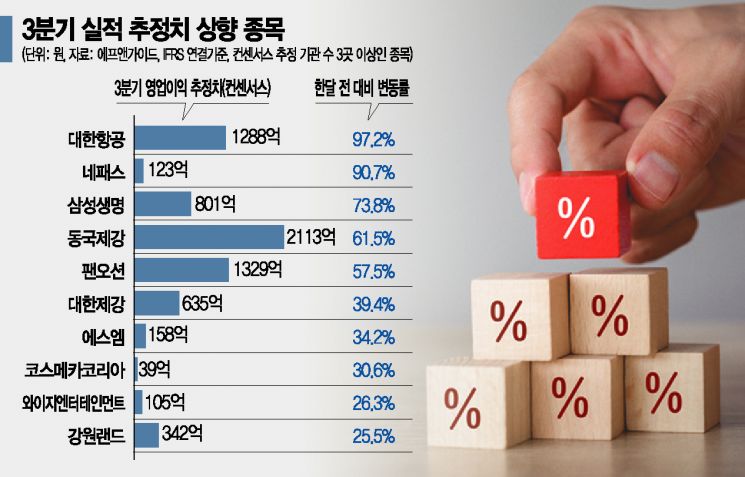

According to financial information provider FnGuide on the 10th, among 236 stocks with earnings estimates from three or more institutions, 94 stocks had their operating profit estimates (consensus) revised upward compared to a month ago.

The stock with the largest upward revision was Korean Air. The third-quarter operating profit consensus for Korean Air is 128.8 billion KRW, which is a 97.2% increase from 65.3 billion KRW a month ago. Despite passenger demand not recovering due to the spread of the Delta variant, strong performance in the cargo sector is expected to result in earnings exceeding market expectations. Yang Jihwan, a researcher at Daishin Securities, said, "Traditionally, the third quarter is the off-season for cargo, but due to the special circumstances caused by COVID-19, the strong performance in the air cargo sector is continuing," adding, "Korean Air's third-quarter operating profit is expected to exceed market expectations with 190 billion KRW on a consolidated basis and 193.6 billion KRW on a separate basis."

Next, Nepes (90.7%), Samsung Life Insurance (73.8%), Dongkuk Steel (61.5%), and Pan Ocean (57.5%) also saw significant upward revisions in consensus. Nepes, which recorded profit margins below market consensus in the second quarter, is expected to enter a recovery and growth cycle starting in the third quarter. Park Chanho, a researcher at Hyundai Motor Securities, forecasted, "The semiconductor industry's production disruption issues have been resolved, and with the expansion of AP production by major clients, earnings recovery will begin in the second half of the year and growth will continue into next year."

In particular, entertainment stocks showed notable upward revisions. Earnings forecasts for SM Entertainment and YG Entertainment were revised up by 34.2% and 26.3%, respectively, compared to a month ago, while JYP Entertainment and HYBE also rose by 14.7% and 6.7%, respectively. This is interpreted as increased earnings expectations due to a significant rise in album sales as major artists make comebacks starting in the third quarter. Kim Hyonyong, a researcher at Hyundai Motor Securities, said, "Major comeback groups in September include BLACKPINK's Lisa, NCT, and ITZY, and K-pop album sales in September are expected to increase by 80% year-on-year to 5.88 million copies," adding, "Even in August, when the Big 4 agencies had a weaker lineup, strong sales growth was recorded, so third-quarter K-pop album sales are expected to easily exceed 17 million copies, an 84% increase." He continued, "We have revised the annual sales estimate upward by about 4 million copies to 62.4 million copies, and the upward trend in entertainment stocks will remain valid until third-quarter earnings become visible."

On the other hand, consensus was revised downward for 91 stocks. Hwaseung Enterprise saw the largest decline with a 63.5% downward revision compared to a month ago, followed by Korea Electric Power Corporation (-59.6%). Additionally, Pearl Abyss (-58.4%), NCSoft (-43.4%), and Com2uS (-41.2%) saw significant downward revisions, highlighting the notable downward adjustment in gaming stocks.

Lee Kyungsoo, a researcher at Hana Financial Investment, said, "The year-on-year growth rates of operating profit for domestic companies in the first and second quarters were 119% and 83%, respectively, but from the third quarter, it is expected to drop to about 27%," adding, "The number of stocks with upward revisions for third-quarter and next year's estimates is rapidly decreasing, so earnings differentiation will gradually appear."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.