Authorities "Stick to Principles... Will Hear Industry Opinions but No Change in Position"

[Asia Economy Reporter Park Sun-mi] On the afternoon of the 9th, an emergency meeting will be held between financial authorities and the fintech industry regarding the controversy over financial platform regulations. While the financial authorities maintain their existing principle of sanctioning financial platforms such as KakaoPay for violating the Financial Consumer Protection Act (FCPA) if they engage in financial product brokerage, the fintech industry argues that innovation finance will regress and that the platform financial industry could shrink.

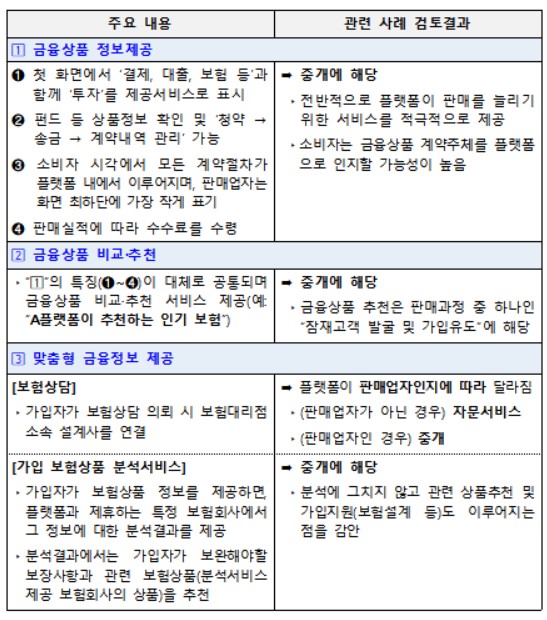

According to the financial authorities on the 9th, the Financial Services Commission, Financial Supervisory Service, Fintech Industry Association, and big tech and fintech companies will gather for an emergency closed-door meeting in the afternoon. This meeting was arranged as industry dissatisfaction grew after the financial authorities judged that recommending financial products on platforms is not mere advertising but sales brokerage, and that brokering financial products without a license violates the FCPA and is subject to sanctions.

A financial authority official said, "Although we have sufficiently explained and given prior notice, the fintech industry has shown a surprised reaction, so we arranged this opportunity to provide further explanation," adding, "If the industry has anything to say about the financial platform regulation issue, we plan to listen and discuss areas for improvement as well."

However, while the financial authorities are holding a meeting to hear the fintech industry's voice, they maintain a strong stance on applying the same regulatory principles to fintech companies for the same financial functions.

The financial authorities have judged that financial platforms’ brokerage services were merely 'simple advertising agency' and thus not subject to the FCPA, allowing them to operate. However, since the purpose of financial platform services is not just providing information but sales, it is generally considered brokerage. Therefore, if existing activities continue without a license, they plan to strictly enforce regulations and impose sanctions starting from the 25th, when the FCPA grace period ends.

On the other hand, the fintech industry plans to use this meeting to demand improvements and point out unreasonable aspects of the financial authorities’ financial platform regulations, and request an extension of the grace period since it is difficult to obtain a license by the 24th, when the FCPA grace period ends. The authorities also have plans to revitalize the fintech ecosystem, so the industry fears that imposing regulations now after growing their businesses will cause innovation finance to regress and shrink the platform financial industry again.

Regarding this, a financial authority official stated, "We have already judged some online financial platform services as unregistered brokerage activities and requested corrections," adding, "There is no room for reversal. We believe we have already given sufficient grace period. Extension of the grace period is not under consideration."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)