With Rising Skill Levels of Chinese Developers

and Tremendous Capital Power, Offensive

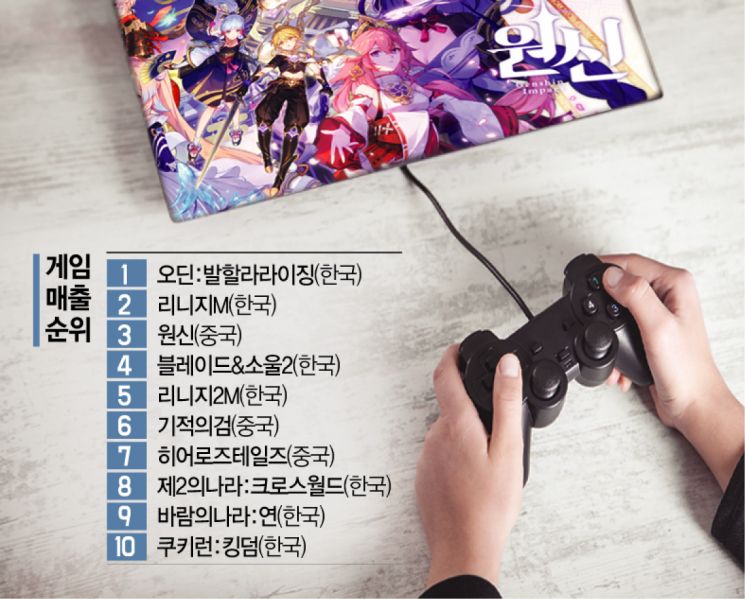

'Genshin Impact' Ranks 3rd in Google Play Revenue

High China Risk for Domestic Game Companies

Seeking New Opportunities in India and Southeast Asia

The dominance of Chinese games in the domestic gaming market has intensified. Chinese games, backed by enormous capital, are even threatening the position of Korea's leading intellectual property (IP) games. As the Chinese government tightens regulations, raising the barriers to entering the Chinese market, Korean game companies are busily seeking new markets such as India and Southeast Asia.

Onslaught of Chinese Games

According to the gaming industry on the 8th, Chinese game company miHoYo's ‘Genshin Impact’ pushed NCSoft's Lineage 2M down to 3rd place in the Google Play revenue rankings. NCSoft's Lineage 2M is currently ranked 5th. Lineage 2M, which had never fallen out of the top ranks, has been overtaken by Chinese games due to the 1st anniversary update of Genshin Impact. Chinese games, once regarded as mere 'knockoffs,' are now dominating the Korean gaming market with formidable momentum. As of that morning, Chinese games accounted for 30% of the top 10 on Google Play, including Genshin Impact, 4399's ‘Miracle Sword’ (6th), and 37Games' ‘Heroes Tales’ (7th).

As the Chinese gaming industry grows rapidly, it poses a threat to Korean game companies. According to the ‘2020 China Game Industry Report,’ last year China's overseas game revenue reached $15.45 billion (approximately 17.5 trillion KRW). Among this, Korea ranked 3rd (8.8%) in China's total overseas revenue, estimated to have earned about 1.5 trillion KRW from the Korean gaming market.

The level of Chinese mobile game development is already considered to have surpassed Korean game companies. An industry insider said, "There are many talks that Chinese developers have become more skilled than Korean developers." Chinese game companies also possess immense capital. miHoYo is known to have invested over 100 billion KRW in ‘Genshin Impact.’ Kwon Gu-min, a researcher at the Korea Creative Content Agency's Industry Policy Team, stated, "Given the pace of Chinese game development, it is uncertain how long Korean games can maintain their popularity," adding, "It is necessary to move beyond negative perceptions of Chinese games and conduct continuous monitoring."

Concerns are also rising that if Chinese game companies turn their attention to the domestic market due to stricter Chinese government regulations, it could pose a significant threat. Professor Wi Jeong-hyun of Chung-Ang University, president of the Korea Game Society, said, "Chinese game companies already know how to target the Korean market," and predicted, "Since Chinese users have similar preferences and the Korean market is relatively easy to approach, aggressive moves toward Korea will intensify."

Korean Game Companies Seeking New Paths to Avoid ‘China Risk’

While Chinese game companies are thriving domestically, Korean game companies have been struggling with risks posed by the Chinese government for years. Recently, there seemed to be some relief with Pearl Abyss’s ‘Black Desert Mobile’ receiving a game license (panho) for service in China, but the Chinese government’s successive announcements of policies restricting gaming time for minors and other regulations have caused renewed concerns.

As a result, Korean game companies are looking for new markets such as India and Southeast Asia instead of China, where business predictability is uncertain. India, in particular, is regarded as the largest market that can replace China. Krafton, which heavily depends on Chinese revenue, established an Indian subsidiary in November last year and began full-scale market entry. India’s large population of 1.4 billion and increasing smartphone penetration raise expectations for market growth. Krafton released ‘PUBG Mobile’ in India and started pre-registration for ‘PUBG: New State.’

Southeast Asia is also attracting attention as an emerging gaming market. Webzen is actively working to reduce dependence on China and secure new growth engines. Webzen launched ‘MU Archangel’ in Thailand, the Philippines, Singapore, Indonesia, and Malaysia. NCSoft established ‘NC Vietnam Visual Studio,’ a graphics development studio, in Vietnam last year. This move aims to enhance graphics for new games and secure local graphic development capabilities in Vietnam, which is emerging as a new player in the graphics development market. An industry insider said, "It is a time for swift responses to diversify overseas revenue sources," adding, "The trend of Korean game companies moving away from China to avoid China risk is expected to accelerate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.