LG Group and Market Cap Gap Around 10 Trillion

Possible Reversal if Kakao Pay Joins Next Month and Performs Well

Kakao Affiliates' Stock Prices Also Strong... LG's 'Eldest' LG Chem Underperforms

[Asia Economy Reporter Minwoo Lee] KakaoPay, which faced controversy over its IPO price being a 'bubble,' has lowered its IPO price and will enter the KOSPI market next month. Attention is focused on whether Kakao will surpass LG Group to become the 4th largest group by market capitalization depending on KakaoPay's success.

According to the Korea Exchange on the 1st, KakaoPay resubmitted its securities registration statement with an adjusted IPO price range and officially began the listing process. This was because the Financial Supervisory Service requested a revised registration statement on the 2nd of last month. Accordingly, the new IPO price range was lowered by 3,000 to 6,000 KRW from the previously proposed 63,000 to 96,000 KRW on the 2nd of last month, now set at 60,000 to 90,000 KRW. The market capitalization based on the upper limit of the IPO price was also adjusted from 12.5152 trillion KRW to 11.733 trillion KRW.

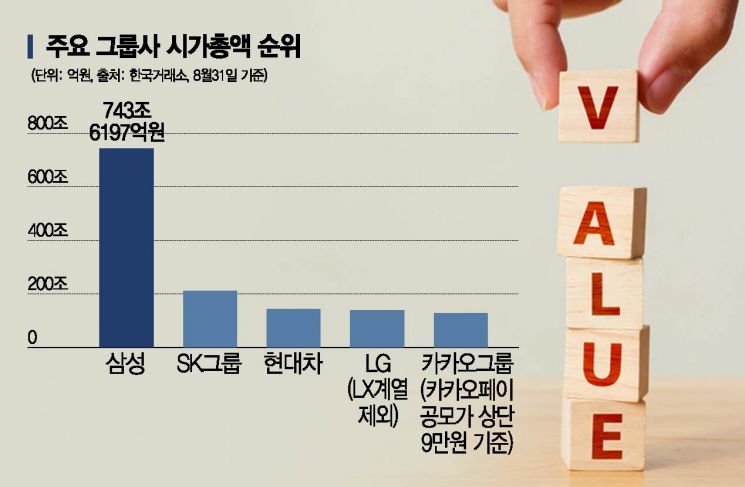

Simply adding these up, as of the previous day, the market capitalization of Kakao's listed affiliates including Kakao, KakaoBank, KakaoGames, and Neptune reaches 127.2498 trillion KRW. This ranks 5th among domestic listed groups, following Samsung Group (743.6197 trillion KRW), SK Group (210.0683 trillion KRW), Hyundai Motor Group (143.1354 trillion KRW), and LG Group (139.561 trillion KRW, excluding LX affiliates).

There is a forecast that KakaoPay could even challenge for 4th place depending on its success. As of this day, the market capitalization gap between Kakao Group and LG Group is 12.3112 trillion KRW. KakaoPay's success puts it within striking distance to surpass LG. If KakaoPay achieves a 'ttasang' (IPO price doubled at the opening price followed by hitting the upper limit), it can definitely overtake LG. KakaoBank, which entered KOSPI on the 6th of last month, recorded an all-time high of 94,400 KRW on the 18th of last month, just 7 trading days after listing, rising to 2.4 times its IPO price. As of 10 a.m. on this day, it maintained a price above twice the IPO price, in the 83,000 KRW range.

The overall stock price trends of the group companies also differ. While LG Electronics, LG Household & Health Care, including LG Chem, the largest by market cap within the LG Group, have recently been sluggish, most Kakao affiliates such as Kakao, KakaoBank, and KakaoGames continue to show an upward trend.

Moreover, the listing of LG Energy Solution, LG Chem's battery division affiliate, within this year is uncertain. LG Energy Solution submitted a preliminary review application for KOSPI listing to the Korea Exchange in June and proceeded with related procedures but recently applied for an extension of the review period. This is believed to be due to increased compensation burdens following General Motors (GM) in the U.S. deciding on June 20 to recall an additional approximately 73,000 Chevrolet Bolt EVs at a total cost of 1 billion USD (about 1.1597 trillion KRW). The Bolt EVs are equipped with batteries containing battery cells produced by LG Energy Solution. Accordingly, last month LG Energy Solution stated, "After reviewing GM's recall measures and market conditions, we will decide by October whether to continue pursuing the IPO scheduled for this year."

Meanwhile, KakaoPay plans to finalize its IPO price through institutional investor demand forecasting on the 29th and 30th of this month and conduct a general subscription on the 5th and 6th of next month. It will then enter the KOSPI on the 14th of next month. Samsung Securities, JP Morgan, Goldman Sachs Securities, and Daishin Securities are the lead underwriters. Korea Investment & Securities and Shinhan Investment Corp. are additional underwriters, allowing subscriptions through these securities firms as well. As this is the first domestic IPO to allocate 100% of the public offering shares for general subscribers equally, there is keen interest in its success.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.