SK Captures Both Cost and Quality by Internalizing Battery Materials

Battery Business Vertical Integration... Determined to Lead the Materials Market

SKC to Announce Cathode Material Business Plan at 'Story Day' in Second Week of September

SK Materials Reviews Cathode Material Business Following Anode Materials

[Asia Economy Reporter Hwang Yoon-joo] SK Group, which is promoting electric vehicle batteries and materials as next-generation core businesses, is newly entering the cathode material business. Cathode materials account for the highest cost proportion among battery materials. Although SK has previously invested in related companies, it has not directly produced cathode materials. This move is interpreted as an intention to complete vertical integration from electric vehicle batteries to core materials and to preempt the fiercely competitive battery-related industry.

According to SK Group on the 30th, SK Materials and SKC are reviewing the cathode material business. All possibilities such as joint ventures and mergers and acquisitions (M&A) are open. In addition, SK Innovation plans to pursue a joint venture for cathode materials in China with EVE, a joint venture with a Chinese battery company, and BTR, the top anode material company in China.

SKC and SK Materials are simultaneously reviewing the cathode material business because the expansion of the electric vehicle market has led to a shortage of core materials such as cathode materials. According to SNE Research, the demand for the cathode material market is expected to expand about sixfold from 456,000 tons in 2019 to 2,749,000 tons in 2025. This market has an average annual growth rate of 33.3%. The market size is also expected to grow rapidly from 39 trillion won in 2021 to 100 trillion won in 2026.

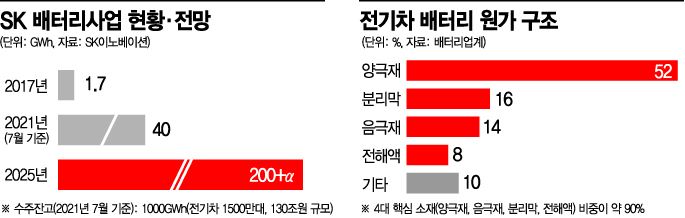

Consideration was also given to the fact that cathode materials have the highest cost proportion among the four core battery materials (cathode materials, anode materials, separators, electrolytes). Since cathode materials account for about 40-52% of battery costs, the battery industry faces pressure to reduce cathode material prices and improve performance.

Currently, the cathode material market is led by three countries: South Korea, China, and Japan. However, the market share of Korean companies is minimal. As of 2018, the top five global cathode material shipment companies were Umicore (Belgium, 10.8%), Sumitomo Metal Mining (Japan, 9.8%), Nichia (Japan, 7%), XTC (China, 6.8%), and Shanshan (China, 6.4%). Domestic companies such as EcoPro BM and POSCO Chemical are present but remain within the top 10 market share. Domestic cathode material companies must compete on price with Chinese companies and fiercely compete with Japanese companies in cathode material and precursor technology. SK's strategy is to raise competitiveness to a world-class level even in the battery materials sector.

If SK internalizes battery materials such as cathode materials, it is expected to stabilize supply and serve as an opportunity to increase SK Innovation's battery market share. According to the industry, as of June, SK Innovation's battery installation capacity, including electric buses and trucks, reached 1.38 GWh, entering the top five after CATL, LG Energy Solution, Panasonic, and BYD.

SK Innovation's annual battery production capacity is currently about 40 GWh. This is insufficient to fill the order backlog of 1 terawatt (TW). The plan is to invest 18 trillion won in the battery business by 2025 to increase annual capacity to 200 GWh, five times the current scale, and expand to 500 GWh by 2030.

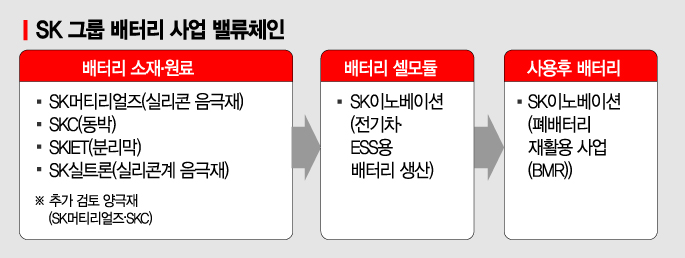

An SK Group official said, "Internalizing cathode materials is expected to determine battery cost and quality competitiveness," adding, "The four companies?SK Materials (cathode and anode materials), SKC (cathode materials and copper foil), SKIET (separator), and SK Siltron (silicon-based anode materials)?will create synergy and engage in healthy competition."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.